Download Pintu App

Bitcoin (BTC) Price Towards $100,000: Is This a Bullish Phase or a Bulltrap?

Jakarta, Pintu News – Bitcoin (BTC) is now entering a phase that many analysts consider bullish, but the debate among traders about whether the $100,000 price will be a point of expansion or market exhaustion is heating up.

Bitcoin Indicator Shows Bullish Signal

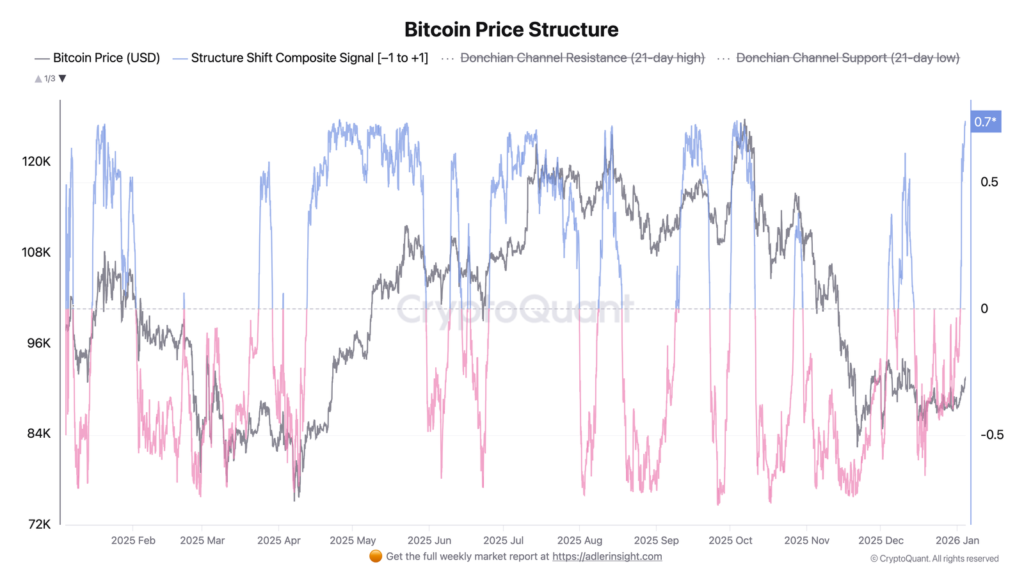

According to Bitcoin researcher Axel Adler Jr, the Bitcoin (BTC) movement structure indicator has shown significant changes. At the end of December, the indicator was still below -0.3, indicating downward pressure. However, the situation changed drastically on Friday when the indicator surged past 0 and reached +0.73 on Sunday.

During this period, the price of Bitcoin (BTC) rose from around $87,500 to $91,400, signaling a shift to a positive regime. Adler Jr. added that when the indicator moves above +0.5, this usually indicates an uptrend.

The key test now is whether the indicator can hold above 0 while the price tries to break the resistance at $96,000. If the indicator falls back below zero, this could increase the risk of a false breakout or bull trap.

Also read: Bitcoin Breaks $94,000, While Crypto Volume Plummets to Lowest Level Since 2023

Continuity of Bitcoin Accumulation

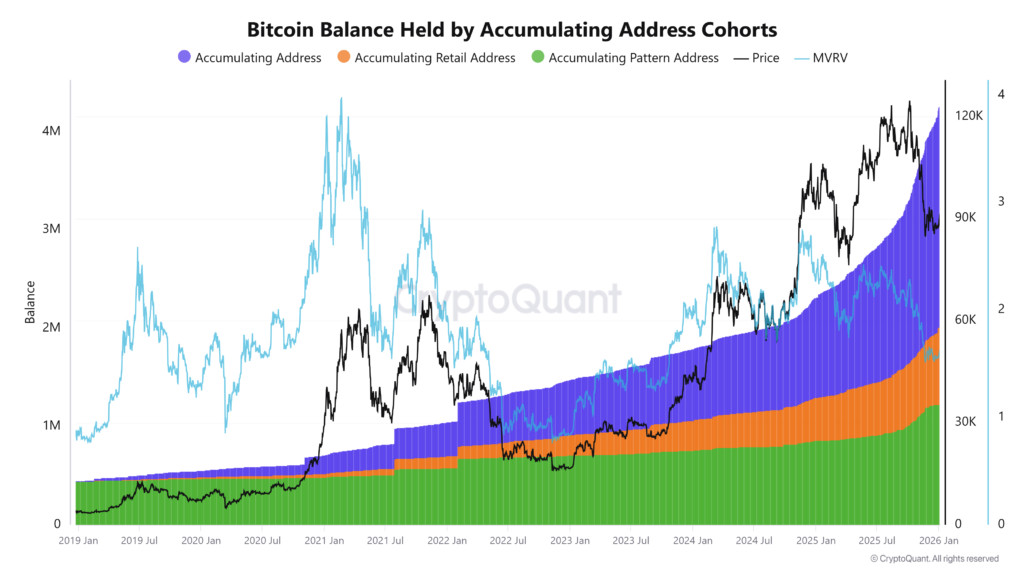

Data from CryptoQuant shows that the absorption of Bitcoin (BTC) supply continues. Bitcoin (BTC) balances held by accumulating address groups have reached a new record high of 2.28 million BTC ($211 billion at the time of writing), extending a trend that has been increasing throughout 2024-2025. Retail accumulation increased more slowly, showing growing participation with no signs of late-cycle euphoria, while the pattern of systematic accumulation remains intact.

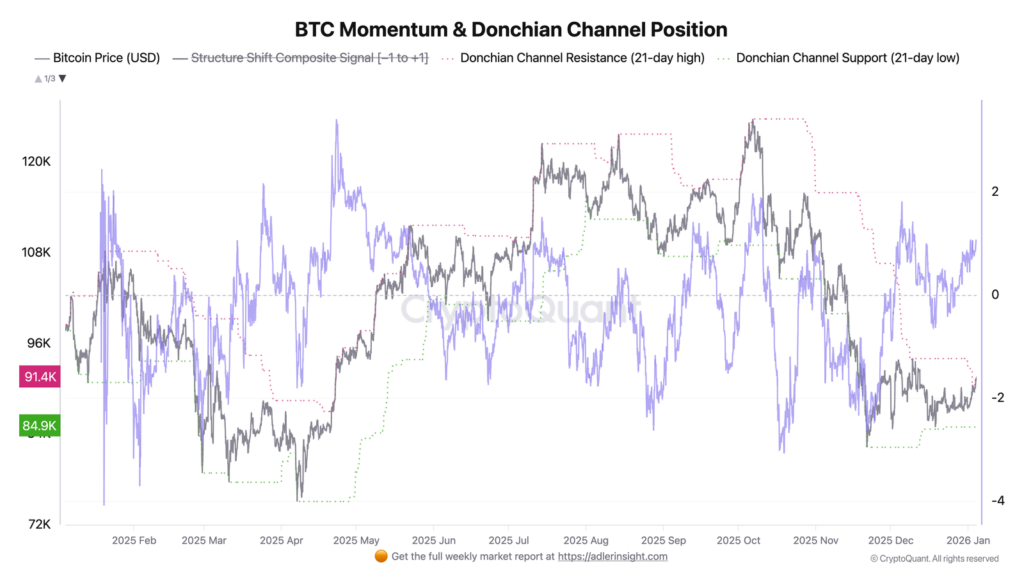

Amidst this, traders’ opinions are divided. The creator of the Bitcoin Quantile Model, Plan C, argues that Bitcoin (BTC) is no longer in a downward trend, referring to almost six weeks of sideways trading in a channel that resembles accumulation. According to him, the time spent consolidating increases the likelihood that a durable bottom has formed. A break above $94,500 could trigger a quick move towards the $100,000 level.

Also read: Will Bitcoin (BTC) Reach $100,000 This Week?

Bull Trap Warning Amid Rally

Meanwhile, trader Peter DiCarlo warns that the current rally may be a trap. He described the potential surge towards $100,000 not as a confirmation of a new bull leg, but as a setup to attract late buyers before a deeper correction to $70,000. Short-term overbought conditions that remain high also add to concerns about the sustainability of the current rally.

With market conditions constantly changing, it is important for investors to remain vigilant and consider all factors before making investment decisions. In-depth analysis and understanding of market indicators can help in identifying potential pitfalls or confirmation of trends.

Conclusion

With Bitcoin (BTC) now on the verge of $100,000, the crypto market is exhibiting complex dynamics. Investors and traders should pay attention to key indicators and move with caution amid potential bull traps or expansion opportunities that may occur.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app through Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- Cointelegraph. Bitcoin Enters Strength Phase, $100K Debate Heats Up. Accessed on January 7, 2026

- Featured Image: Generated by AI

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.