Download Pintu App

How to Invest in Crypto Long-Term 2026: Strategies, Risks, and Assets Rated Most Solid

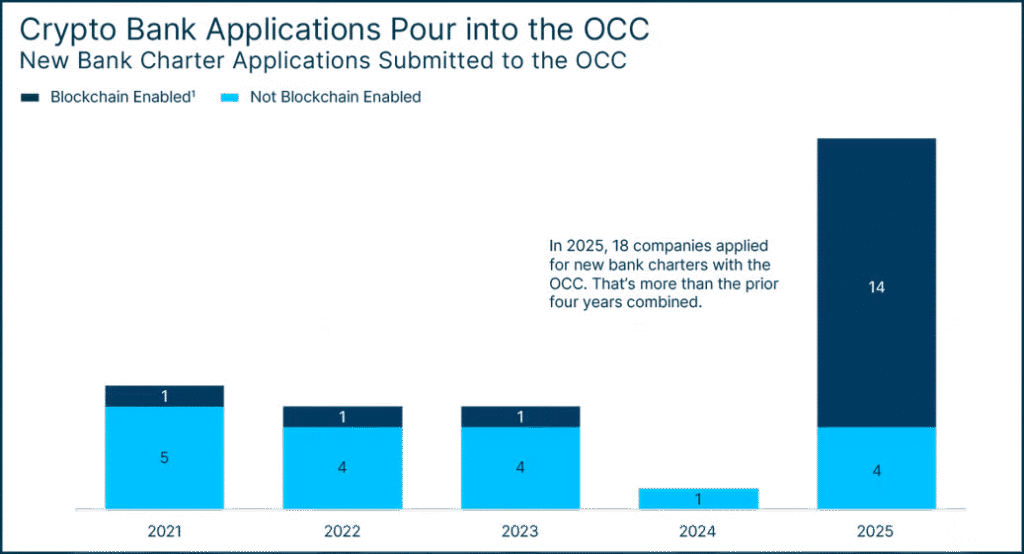

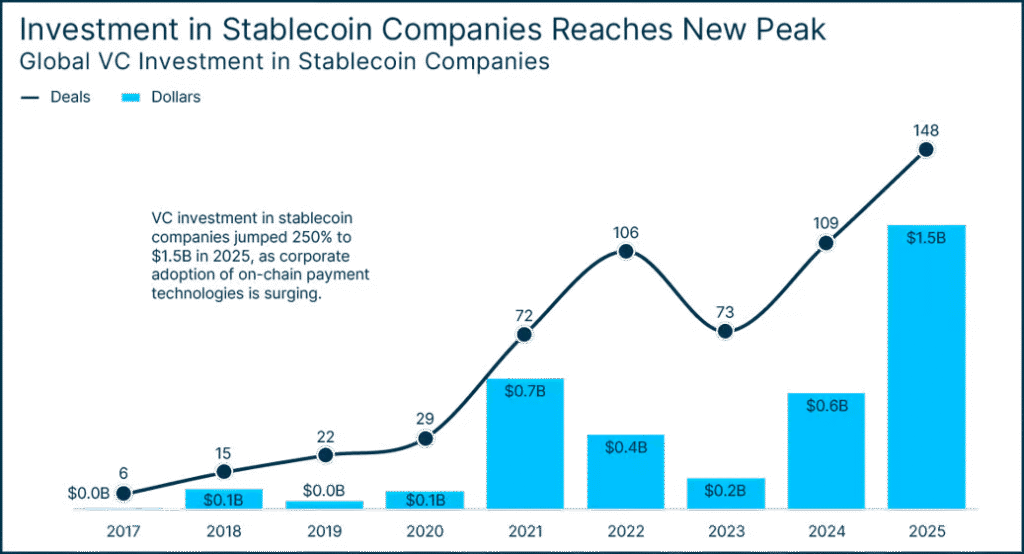

Jakarta, Pintu News – By 2026, global financial markets will increasingly show close integration between digital assets and conventional financial systems. With clearer regulation and increased institutional participation, crypto and cryptocurrencies are no longer viewed solely as speculative instruments, but rather as part of a long-term investment strategy. This development marks a paradigm shift, where crypto is beginning to be positioned as an alternative asset with structural growth potential.

Long-term Crypto Investment Trends in 2026

Long-term crypto investment trends in 2026 show a more mature tendency compared to previous periods. Based on various industry reports, investors are now more focused on accumulating digital assets with a medium to long time horizon. This approach is driven by the stability of market infrastructure and growing confidence in blockchain technology.

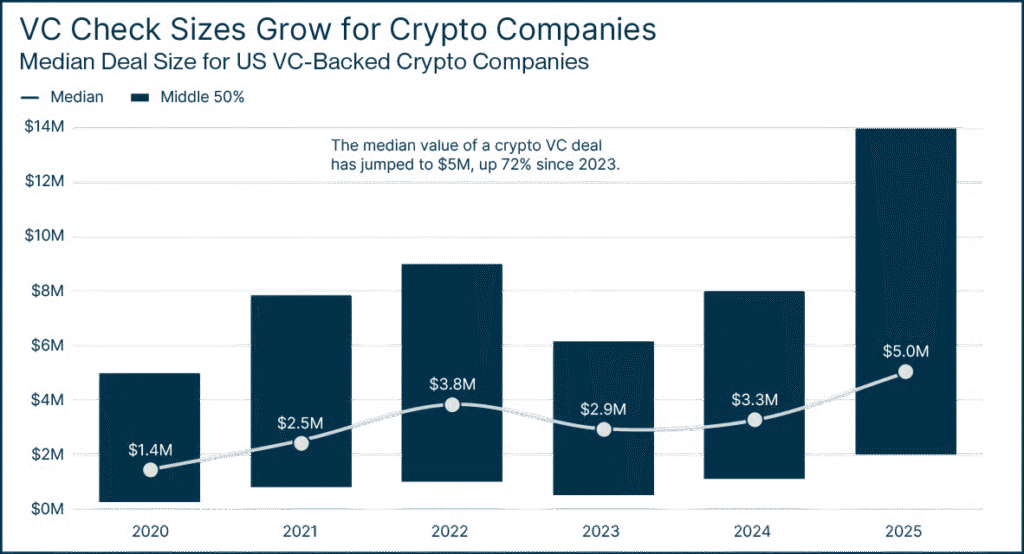

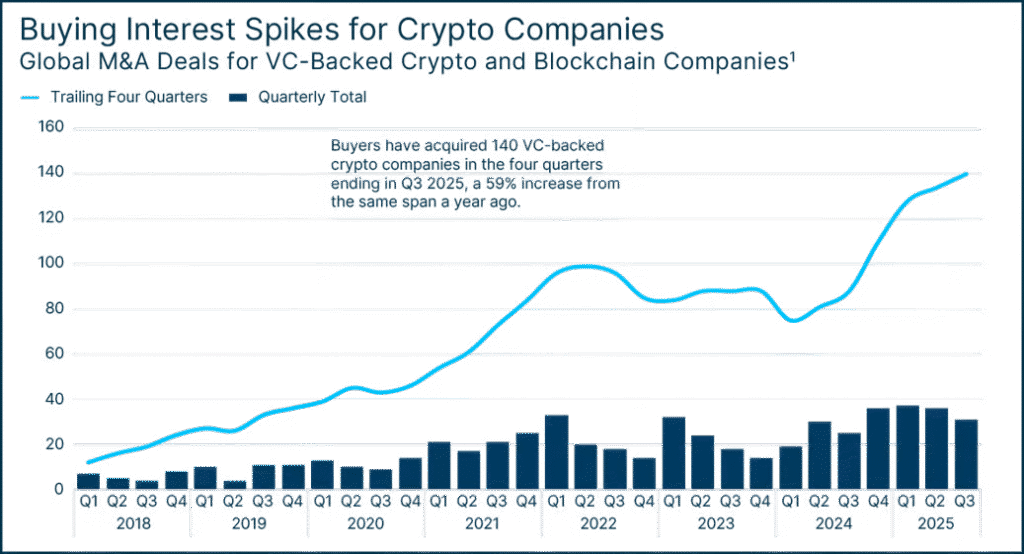

Institutional adoption is the main factor driving this trend. Many global companies are beginning to incorporate digital assets into their balance sheets, while crypto-based financial products are increasingly diversifying. Industry data shows that major assets such as Bitcoin and Ethereum remain front and center in long-term strategies.

Also Read: Bitcoin (BTC) Prepares for a Surge: Potential Rise to $104,000 in the Near Future?

Difference between Short-Term Trading and Long-Term Investment

Short-term crypto trading focuses on daily price movements and capitalizes on market volatility. This strategy demands time, discipline, and a high risk tolerance. Extreme price fluctuations are often the source of both significant gains and losses.

In contrast, long-term investments emphasize the fundamental value and growth prospects of assets. Long-term investors tend to ignore short-term volatility and pay more attention to ecosystem development, adoption, and technological innovation. This approach is considered more stable for investors who do not want to be actively involved in day trading activities.

The Importance of Choosing Assets with Strong Fundamentals

The selection of assets with strong fundamentals is the key to long-term crypto investment. Fundamentals include network security, consistency of development, and real utility in the digital ecosystem. Assets with solid fundamentals tend to be more resistant to market turmoil.

In addition, community and developer support play a big role in keeping crypto projects sustainable. Projects with a clear roadmap and growing adoption have a better chance of surviving in the long run. This is a key differentiator between speculative-oriented assets and sustainable investments.

Important Factors in Choosing Crypto for the Long Term

Several key factors need to be considered when choosing a crypto for the long term. First is the security and decentralization of the network, which determines the asset’s resistance to attacks and manipulation. Secondly, the scalability of the technology is important to ensure the network is able to handle user growth.

Another factor is regulatory certainty and institutional adoption. Assets that are already widely used in the global financial system generally have more measurable risks. This combination of technical and non-technical factors helps investors assess the long-term viability of a cryptocurrency.

List of Crypto that are Good for Long Term in 2026

Several digital assets are considered to be strongly positioned for long-term investment in 2026. Bitcoin remains seen as the leading asset with the highest adoption rate and limited supply. Ethereum stands out thanks to its role as the foundation of decentralized applications and smart contracts.

In addition, Solana is known for its transaction speed and low fees, while Ripple is widely used in cross-border transactions. Each asset has different characteristics, so the selection needs to be tailored to the investor’s goals and risk profile.

Risks of Long-Term Investment in the Crypto World

Despite offering growth potential, long-term crypto investments carry risks. Price volatility, regulatory changes and technological risks can significantly affect the value of an asset. These risks demand in-depth understanding before making an investment decision.

Also, not all crypto projects are capable of surviving in the long run. Some assets may lose relevance as technology and competition evolve. Therefore, diversification and periodic evaluation are important parts of risk management.

Effective Long-Term Investment Strategy

A widely used strategy in long-term investing is Dollar Cost Averaging (DCA), which involves buying assets periodically at a fixed amount. This approach helps reduce the risk of buying at peak prices and maintain investment consistency. This strategy is relevant for investors who want to build their portfolio gradually.

In Indonesia, the DCA approach can be facilitated through the Auto DCA Explore Plans feature on Pintu. This feature enables automatic and scheduled crypto purchases, thus supporting a disciplined long-term strategy. This systematic approach is considered effective in dealing with crypto market volatility.

Also Read: New Record! Ethereum Records $8 Trillion Worth of Stablecoin Transactions

Follow us on Google News to get the latest information about crypto and blockchain technology. Check Bitcoin price today, Solana price today, Pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

FAQ

Is crypto safe for long-term investment?

Crypto has long-term growth potential, but still carries high risks. Safety depends on asset selection, platform, and risk management strategies.

How long should crypto be held for in the long term?

Long-term investments generally have a horizon of several years, depending on your financial goals and confidence in the chosen asset.

Which crypto is the most stable for the long term?

Assets with large capitalization and wide adoption tend to be more stable than small-cap assets.

Are altcoins also suitable for long-term investment?

Some altcoins have long-term potential, but the risks are relatively higher than the main asset.

How to minimize the risk of long-term investment in crypto?

Portfolio diversification, the use of DCA strategies, and understanding asset fundamentals are key steps in minimizing risk.

Reference

- SVB. 2026 Crypto Outlook. Accessed January 6, 2026.

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.