Download Pintu App

5 Reasons Many Traders Are Switching from Spot to Futures in 2026

Jakarta, Pintu News – As the crypto market expands in 2026, more and more traders are choosing to switch from spot trading to futures trading in order to take advantage of more diverse opportunities in the futures market.

This shift is fueled not only by the desire for greater profit potential, but also by advanced features not available with traditional spot trading. Here are five key reasons why this trend is gaining strength, including how platforms like Pintu Futures support the needs of modern traders.

1. Profit Opportunities from Up and Down Price Direction

One of the main reasons traders turn to futures is because of the ability to profit both when asset prices rise and fall. With spot trading, profits are generally only made when the price rises, as traders buy the asset and expect it to increase in value. With futures, traders can go long when prices rise or short when prices are expected to fall.

This feature gives greater flexibility to trading strategies especially in volatile markets like crypto. Traders who predict a drop in the price of an asset like Bitcoin (BTC) or Ethereum (ETH) can still profit without having to physically own the asset. This is a strong reason many traders are considering a move to futures in 2026.

Also Read: Ethereum (ETH) Keeps Going, Is 2026 the Right Time to Buy?

2. Enhanced Leverage for Potential Yield Amplification

Futures feature leverage, which allows traders to open positions with less capital than the value of the contract being controlled. This leverage allows traders to control positions that are much larger than their initial capital, which can dramatically increase their profit potential.

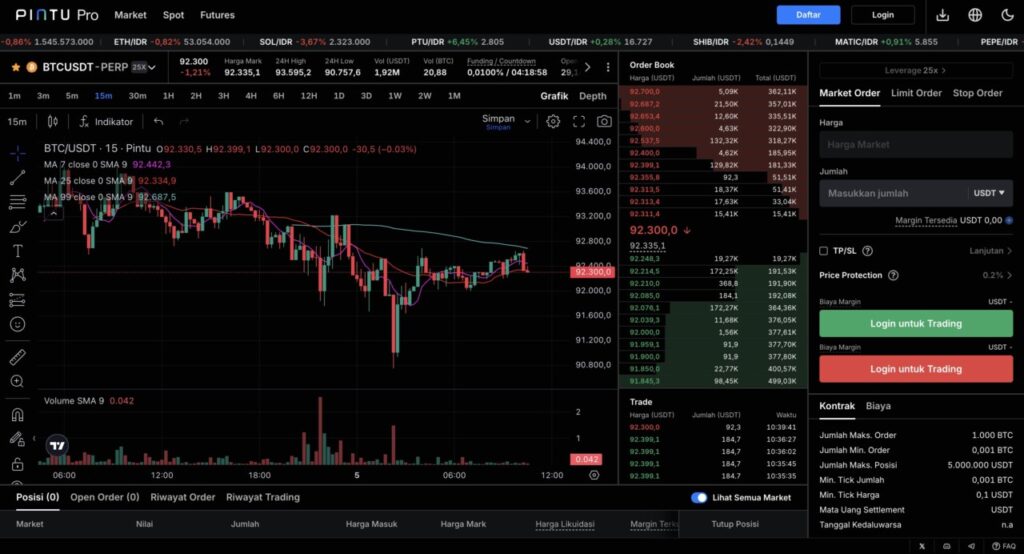

Crypto futures platforms like Pintu Futures offer various levels of leverage that can be used according to a trader’s risk tolerance. For example, with 75x leverage, small amounts of capital can control positions that are hundreds of times larger. However, traders should also understand that leverage also increases the risk of loss, making risk management an important part of any futures strategy.

3. Risk Management and Hedging Tools

Many traders turn to futures not just for profit, but also to protect their positions from adverse price movements. Futures can be used as a hedging tool to cover the risks of assets held in spot trading.

For example, an investor holding a certain amount of Bitcoin on the spot market can open a short position on Bitcoin futures to reduce the impact if the price suddenly drops. This approach provides protection not available in the regular spot market, and is one of the reasons behind the popularity of futures among more experienced traders.

4. No Basic Asset Ownership Required

Unlike spot trading, which requires traders to buy and hold crypto assets directly, futures allow price speculation without the need for physical ownership of the asset. Investors simply enter into a contract that represents the future price of the asset.

This advantage makes futures trading simpler logistically, as traders do not need to think about the storage or security of digital assets such as private wallets or custodian fees. This feature appeals to traders who focus on price movements and short to medium-term strategies without holding long-term assets.

5. Platform Innovation and Easier Integration

Modern trading platforms such as Pintu Futures have made it easier for traders to enter the futures market with a more intuitive interface and support for advanced features such as flexible margin, stop-loss and take-profit. Many exchanges now provide futures access integrated with spot wallets, allowing capital to be allocated between market types quickly.

Additionally, some platforms also offer direct margin trading using local currencies such as INR, reducing the need to convert to stablecoins first. This adds convenience especially for traders in certain markets who want to start futures trading without the additional conversion hurdle.

Conclusion

Switching from spot to futures trading is not just a trend, but a reflection of traders’ need to optimize opportunities in a more complex and dynamic cryptocurrency market. With features such as two-way profitability, leverage, hedging, and the convenience of platforms like Pintu Futures, futures are an attractive option in 2026 for those who want more flexibility and variety in their trading strategies.

Also Read: New Strategy in the Crypto World: 680,000 BTC Acquisition by Strategy!

Follow us on Google News to get the latest information about crypto and blockchain technology. Check Bitcoin price today, Solana price today, Pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- SunCrypto Academy. Crypto Futures: Why Should You Switch To It In 2026? Accessed January 9, 2026.

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.