Download Pintu App

5 Ways to Short Memecoins, Here’s What You Need to Know!

Jakarta, Pintu News – Shorting memecoins is increasingly attracting the attention of crypto traders as the volatility of community-based assets increases in 2026. Memecoins such as Dogecoin (DOGE) and Pepe Coin (PEPE) are known for extreme price movements, both up and down, opening up opportunities to short strategies when trends weaken. However, due to their different characteristics from mainstream crypto, shorting memecoins also comes with specific risks that need to be understood upfront.

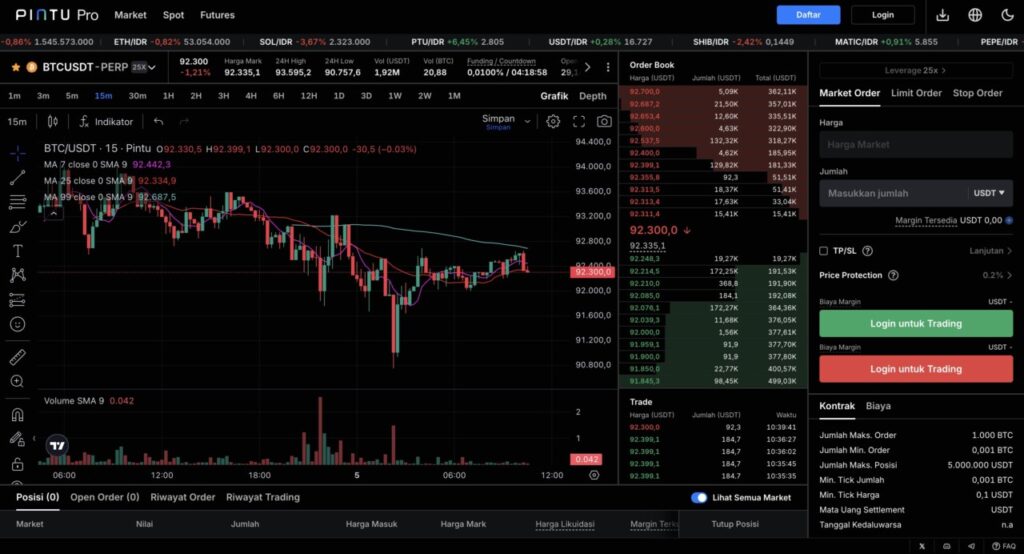

1. Choose a Platform that Provides Short Feature, One of them is Pintu Futures

The first step to shorting memecoin is to choose a platform that does feature short positions through derivative contracts. Not all exchanges support shorting, especially for highly volatile assets like memecoin. Therefore, traders need to ensure that the platform they are using has adequate liquidity and risk management systems.

One option available in Indonesia is Pintu Futures, which allows traders to open long or short positions on various crypto assets. Through futures contracts, traders can speculate on price drops without having to own the cryptocurrency directly.

Also Read: Ethereum (ETH) Keeps Going, Is 2026 the Right Time to Buy?

2. Utilize Futures Contracts to Take Short Positions

The most common way of shortingecoins is using futures or perpetual futures contracts. In this scheme, traders open a short position assuming the price of theecoin will fall within a certain period. If the price does fall, the price difference becomes a potential profit.

Futures provide flexibility as traders can take advantage of two-way price movements, unlike spot trading which is generally only profitable when prices are rising. However, since memecoins tend to move quickly, futures on these assets often have aggressive margin fluctuations. Therefore, understanding the mechanics of contracts and margins is crucial.

3. Pay attention to Leverage and Position Size

Shorting memecoins almost always involves the use of leverage, whether small or large. Leverage allows traders to open positions that are worth more than their initial capital, increasing their profit potential. But on the other hand, leverage also increases the risk of loss if the price moves against you.

With memecoins like Dogecoin or Pepe Coin, sudden price spikes can occur simply due to social media sentiment or community activity. Therefore, using too much leverage on these assets increases the risk of liquidation in a short period of time. Determining a proportionate position size is one of the key factors in shorting memecoins.

4. Understand Extreme Volatility and Liquidation Risk

One of the most important things about shorting memecoin is to understand that its volatility is much higher than that of major cryptos like Bitcoin or Ethereum. The price of memecoin can jump tens of percent in a matter of hours without any fundamental changes. This makes short positions highly vulnerable to liquidation.

Also, memecoins with relatively small trading volumes have the added risk of inefficient price movements. Just a little buying pressure can trigger a sharp price spike. Traders need to be aware that liquidation on small-volume assets can happen faster than on assets with high liquidity.

5. Manage Risk with Discipline and a Clear Strategy

Risk management is a decisive factor in shorting memecoins. The use of stop-losses, limiting leverage, and actively monitoring positions is highly recommended. These strategies help limit losses when the market moves against expectations.

Additionally, traders need to be aware that memecoin is heavily influenced by community sentiment and short-term trends. The absence of strong fundamentals makes price movements difficult to predict. Therefore, shorting memecoins should be done with a tactical approach rather than long-term assumptions.

Conclusion

Shorting memecoins like Dogecoin and Pepe Coin offers opportunities amidst the volatility of the crypto market, but also carries no small amount of risk. Using the right platform such as Pintu Futures, understanding futures contracts, and disciplined risk management are important elements of this strategy. With the extreme characteristics of memecoins, caution and thorough understanding are key before going short.

Also Read: New Strategy in the Crypto World: 680,000 BTC Acquisition by Strategy!

Follow us on Google News to get the latest information about crypto and blockchain technology. Check Bitcoin price today, Solana price today, Pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- CoinMonks (Medium). You Can Now Short Meme Coins: A Dream Come True or a Risky Bet? Accessed January 14, 2026.

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.