Download Pintu App

Polygon Soars 50% as On-Chain Activity Heats Up — But Can the Rally Hold?

Jakarta, Pintu News – POL, the native token of the Polygon (POL) network, has surged more than 50% in the past week. This increase in the price of POL is not due to a momentary sharp spike or some sensational news, but rather supported by steady on-chain demand.

As prices began to stall and approach their recent highs, attention shifted. Now, it’s no longer just about the upward push of prices. The main question that arises is: will POL enter a healthy consolidation phase or will it experience a deeper correction?

On-Chain Demand Remains Steady as Momentum Begins to Weaken

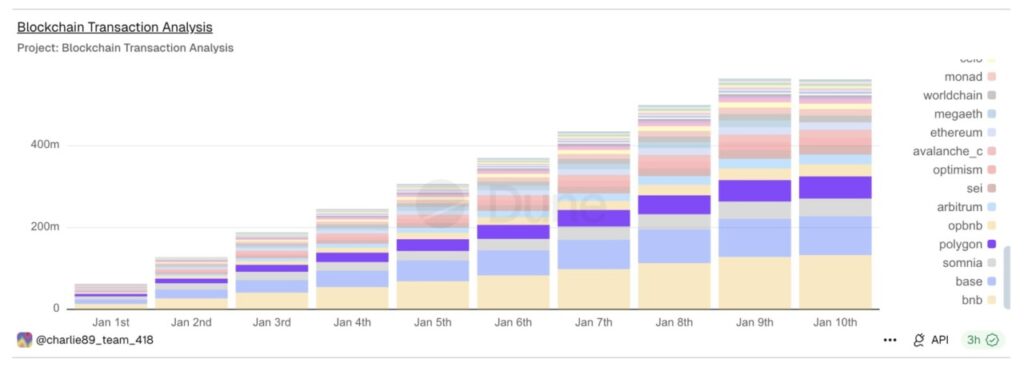

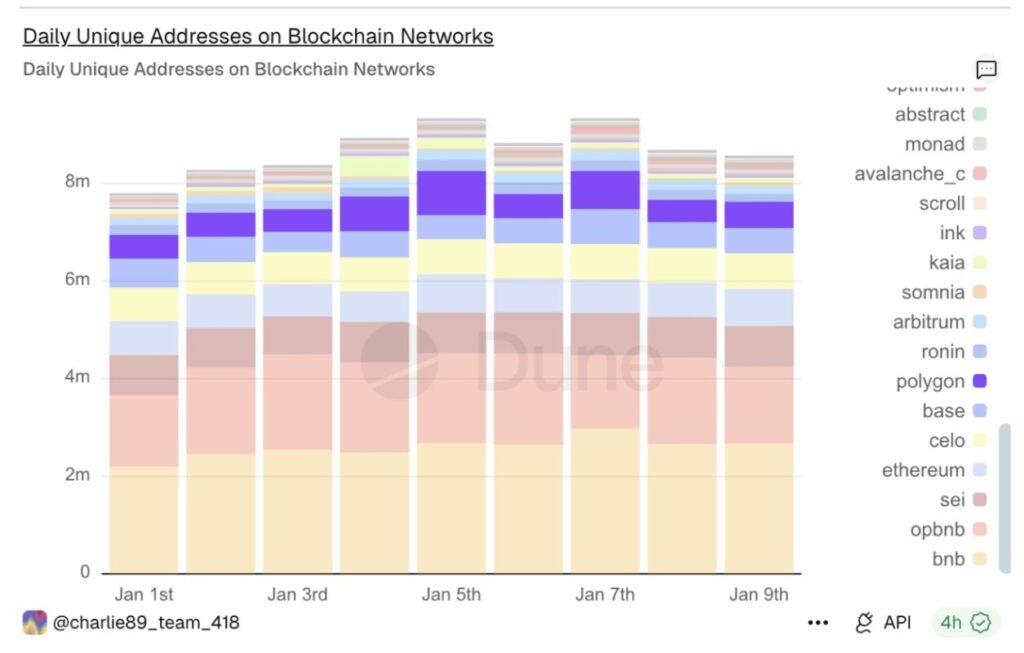

On-chain data shows that the Polygon network has continued to show stable usage levels throughout early January. Daily unique address counts remained strong, and transaction activity continued to increase, in line with trends on other large EVM networks. This indicates consistent network demand, rather than short-term speculation.

Read also: Dogecoin Price Gains Slightly Today: DOGE Under Significant Selling Pressure?

This stable on-chain demand is one of the main reasons behind the strong rise in POL prices. Users did not abandon the network, and activity remained high despite the price spike. This created a solid foundation for the price movement.

However, momentum signals are starting to show a difference in direction. The Relative Strength Index (RSI) indicator, which measures the strength of price momentum by comparing recent rises and falls, shows that when the RSI rises but the price doesn’t follow suit, it’s possible that the momentum isn’t really driving the price’s continued rise.

Between mid-October and early January, the POL price formed lower peaks, while the RSI printed higher peaks. This pattern is known as a hidden bearish divergence. It is not a signal of panic or a sign of an immediate sharp decline, but rather an indication of weakening trend strength and increased risk of correction after a strong rally.

This divergence will only be confirmed if the next price candle drops below $0.174. For now, this is just a warning that the price rally may take longer to continue.

Whales begin to reduce holdings, while retail continues to buy

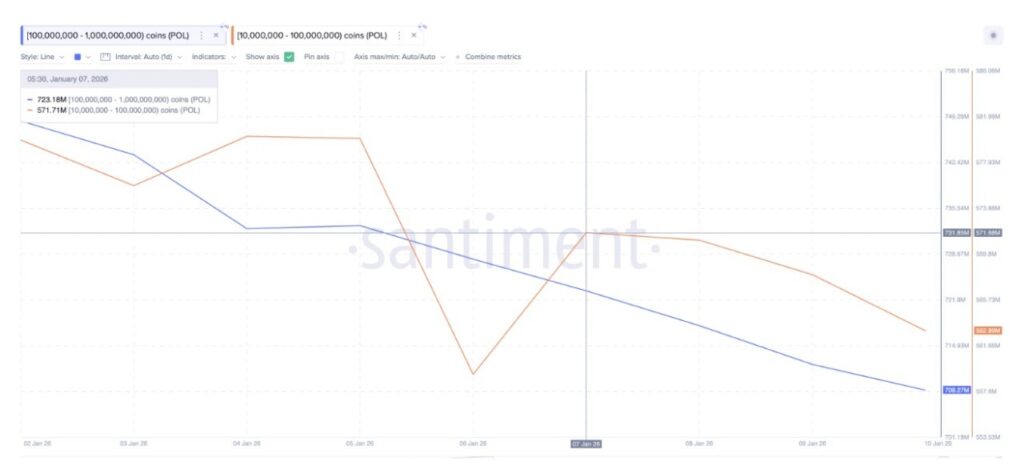

The behavior of token holders provides clues as to how this correction phase may develop.

Whales started reducing their exposure ahead of the recent price pause. Wallets holding between 100 million and 1 billion POL started reducing their holdings around January 3. Since then, the number of tokens they held dropped from around 743.6 million POL to around 708.3 million POL.

The next group of whales, holding between 10 million and 100 million POL, followed suit a few days later. They started reducing their balances around January 7, from around 571.7 million POL to around 563 million POL.

Meanwhile, small holders are moving in the opposite direction. The retail group, which typically holds between 10 to 10,000 POL, has consistently added to their balances throughout the price rally, right up to the current pause phase.

This difference in behavior is very important. Whales seem to respond to weakening momentum and technical signals on the charts, while retail investors may be more affected by visible on-chain demand and increased network activity.

Read also: Ethereum Price Hovers at $3,100 Today: ETH Technical Chart Shows Pressure?

Combinations like this often lead to a consolidation phase. However, if retail sentiment-driven buying is not matched by momentum strength, the risk of a deeper correction could also increase.

Decisive POL Price Level: Consolidation or Deeper Correction

The current price movement of POL will determine the next direction. If the price is able to hold above $0.155, then it is likely that this movement is only a consolidation phase.

This level has previously been an important support zone in early November, and maintaining it will give the market room to absorb selling pressure without damaging the technical structure.

If the price rises back past $0.188, the bearish momentum signal will start to subside. Meanwhile, a strong close above $0.213 will clear the bearish divergence signal and pave the way towards the next target around $0.253.

Conversely, if the price breaks and holds below $0.155, then the price structure will lead to a reset scenario. Under these conditions, the price could potentially drop to the $0.142 area, and could even widen to around $0.098 if the selling pressure increases sharply.

For now, POL is still supported by stable on-chain demand.

The rally hasn’t broken yet, but momentum is starting to weaken and whales are starting to reduce positions. Whether this ends up as a mild consolidation or a deeper correction depends largely on how the price reacts around that key support area.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. Polygon Price Rally Analysis January 2026. Accessed on January 12, 2026

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.