Download Pintu App

7 Bitcoin (BTC) Signals from Whale Action: Target $135,000 Trends in Crypto Market

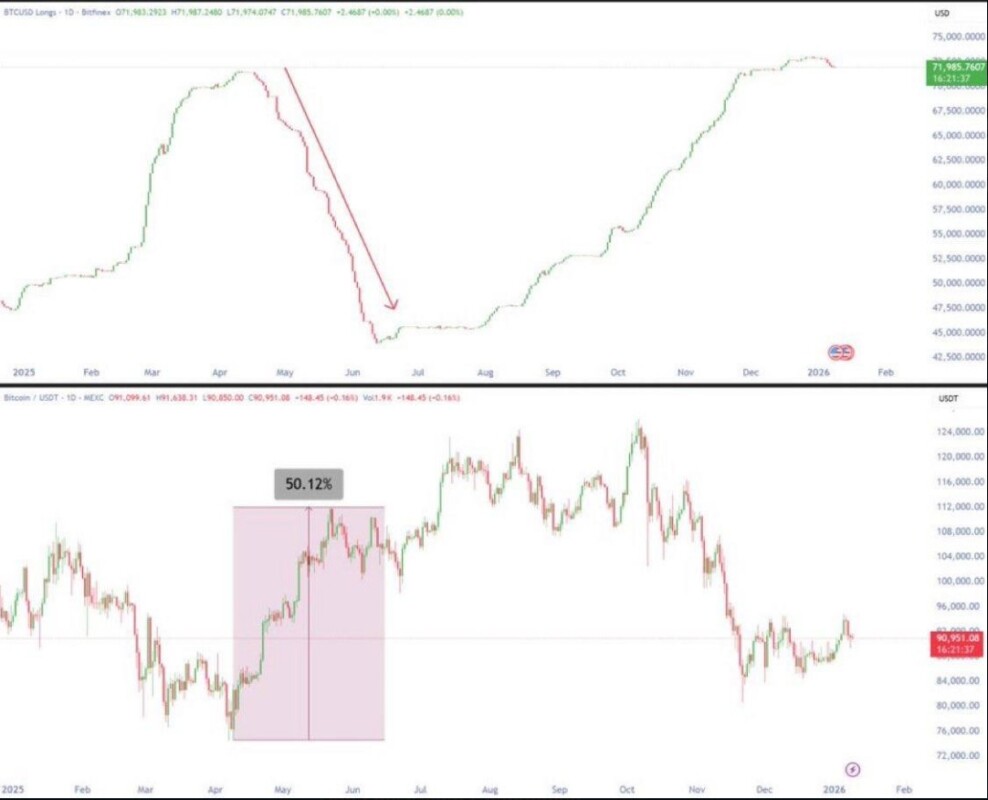

Jakarta, Pintu News – Big action from large holders of Bitcoin (BTC) is back in the spotlight as market data shows that whales are starting to trim their long positions on exchanges such as Bitfinex after reaching a peak of around 73,000 BTC in late December 2025. This action is being interpreted by analysts as a signal that may precede major volatility or a change in the price trend of the world’s largest crypto in the next few weeks.

1. Whale Sells BTC Long Positions

Data from TradingView shows that whales on Bitfinex are actively reducing leveraged long positions on Bitcoin after the peak in holdings at the end of December 2025. This decrease follows a trend of large holdings decreases – around 220,000 BTC over 2025 – that caught the attention of crypto market analysts.

This change is seen as part of a risk maneuver by large holders, which is sometimes done before strong volatility momentum. In the past, similar actions have occurred before BTC prices experienced sharp reversals and strong rallies. Some traders highlighted historical reflective patterns, where clearing long positions can clear leverage and open up new price direction opportunities.

Also Read: XRP 2026 Price Prediction: Is This Investment Still Promising?

2. Bitcoin Price Consolidation Now

Until now, Bitcoin price has been moving in a relatively narrow range around $88,000 – $92,000 with no clear trend direction. This consolidation pattern indicates that the market is looking for new catalysts before choosing the next direction.

The resistance level near $94,000 is an important checkpoint for traders. A convincing close above this level on strong volume would be a sign that buying pressure is again dominating. Conversely, failure to break this resistance could extend the consolidation range or put further selling pressure, especially if funding and liquidation costs increase.

3. Wyckoff Historical Signal

Some analysts attribute the whales ‘ current behavior to the Wyckoff Spring principle which historically suggests a possible “spring” phase before a strong uptrend. The pattern was previously seen when BTC dropped below important support and then rebounded sharply.

In the context of 2025, when the price of BTC fell below $74,000, a position change by whales was followed by a rebound to around $112,000 in a relatively short span of time.

However, it’s important to note that every market period is different, so while this analogy is interesting, there’s no guarantee prices will act similarly in future periods.

4. Ownership Shift between Whale and Small Investors

According to on-chain data from trackers like CryptoQuant, total ownership by whales decreased while small investors’ exposure increased throughout 2025. This change in ownership structure indicates a widening BTC user base.

Spreading ownership to a smaller group of investors can influence market dynamics, as risk is more distributed than relying on a handful of large entities. However, it’s not a guarantee of automatic price increases, but it could change the way price risk is spread across the crypto market.

5. Price Target of $135,000 Appears

Some technical scenarios map that the previous similar move could put Bitcoin’s potential target at around $135,000 if the break-out pattern succeeds. This target arises from a reinterpretation of historical patterns as the market makes a spring and a follow-through rally.

The target is not a definitive prediction, but one of the scenarios based on the technical dynamics being observed by some analysts. However, this outlook remains dependent on tangible confirmation of broader market prices and demand.

6. Other Indicators Observed

In addition to whale movements, market participants also pay attention to trading volume, the ratio of Bitcoin to stablecoins on exchanges, and funding conditions as important indicators of further market direction.

RSI momentum and macroeconomic data are also additional parameters monitored to get an overall picture of the current crypto market. The combination of technical and fundamental indicators gives a broader context to the possible continuation of the Bitcoin price trend.

7. Risk and Uncertainty

It’s worth noting that whale action has different motives and doesn’t necessarily reflect the same price direction for each market cycle. These large groups may close long positions for risk management or hedging, rather than simply anticipating price drops.

In the highly volatile crypto market, technical signals need to be viewed alongside the risk of sudden volatility triggered by macro or regulatory news. Therefore, scenarios such as break-outs above key resistances or high price targets remain uncertain without further confirmation from real market data.

Also Read: Raydium Price Prediction 2026: Significant Upside Potential in the Solana Ecosystem

Follow us on Google News to get the latest information about crypto and blockchain technology. Check Bitcoin price today, Solana price today, Pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

NewsBTC. Bitcoin Whales Hit The Sell Button – $135K Price Target Now Trending. Accessed January 12, 2026.

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.