Download Pintu App

Antam Gold Price Chart Today January 13, 2025: Down Thinly Amid Consolidation

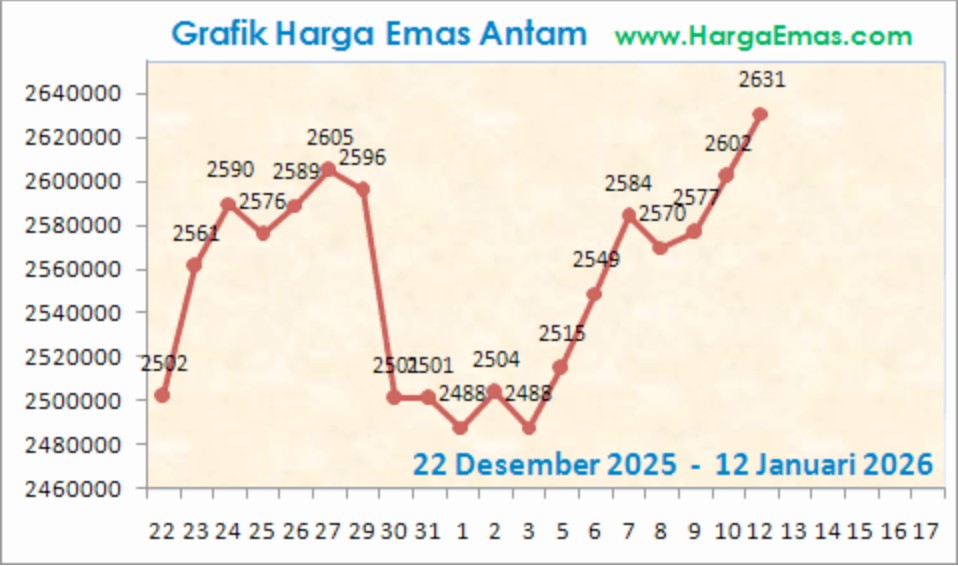

Jakarta, Pintu News – Antam’s gold price today, Tuesday, January 13, 2025, shows a relatively stable movement with a slight correction compared to the previous session. This movement occurs in line with the weakening of world spot gold prices in US dollars, although the rupiah exchange rate against the dollar is still fluctuating. Today’s Antam gold price chart is an important indicator to read the direction of the domestic gold market.

Antam Gold Price Movement Today

Based on the latest data, Antam gold prices moved in the range of IDR 2.49 million per gram in today’s trading. This figure reflects a mild decline compared to the previous close, in line with the correction in world spot gold prices which fell to the area of USD 4,596 per troy ounce. This correction is relatively limited and does not change the big trend of Antam gold movement in the short term.

The intraday chart shows that the price of Antam gold briefly touched a daily high of around IDR 2.499 million per gram before correcting to the area of IDR 2.494 million per gram. This narrow range of movement indicates that the market is in a consolidation phase, where selling and buying pressures are relatively balanced.

Also Read: Shocking Prediction: XRP Poised for a Surge Post Last Drop!

Analysis of the Latest Antam Gold Chart

When viewed from the Antam gold price chart in recent weeks, the general trend still shows an upward trend. After being corrected at the end of December, Antam gold prices rallied again in early January and approached monthly highs. This pattern indicates that today’s correction is more technical than a change in trend.

The historical chart also shows that every decline in Antam gold prices in recent days tends to be followed by a bounce phase. This shows that buying interest is still quite strong in the domestic physical gold market, especially from investors who take advantage of short-term price weakness.

Effect of World Gold Price and Rupiah Exchange Rate

Antam’s gold price is strongly influenced by two main factors, namely the world spot gold price and the rupiah exchange rate against the US dollar. On January 13, 2025, global gold prices recorded a slight weakening, while USD/IDR actually strengthened. This combination makes the decline in Antam gold prices relatively limited.

Under these conditions, the Antam gold price chart tends to move more stable than world spot gold. The effect of the rupiah exchange rate often curbs volatility, so Antam gold price fluctuations are not as deep as international gold movements.

Antam Gold Price Outlook

Looking at the current chart structure, Antam gold prices are still in a healthy consolidation zone. As long as the price stays above the psychological support area of IDR 2.47 million-Rp2.48 million per gram, the short-term trend still tends to be neutral to positive. Further movement will depend heavily on the direction of world gold prices and global sentiment.

For investors, today’s Antam gold price chart can be used as a reference to understand the price position within the broader trend. Short-term fluctuations like today are generally more relevant as technical signals, not fundamental changes in the domestic gold market.

Also Read: US Dollar Predicted to Plummet in Early 2026 Before Reversing Direction

Follow us on Google News to get the latest information about crypto and blockchain technology. Check Bitcoin price today, Solana price today, Pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- HargaEmas.com. Antam Gold Price Chart Today. Accessed January 13, 2025.

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.