Download Pintu App

Bitcoin (BTC) Headed to $100K: Is It Time to Buy? (1/14/26)

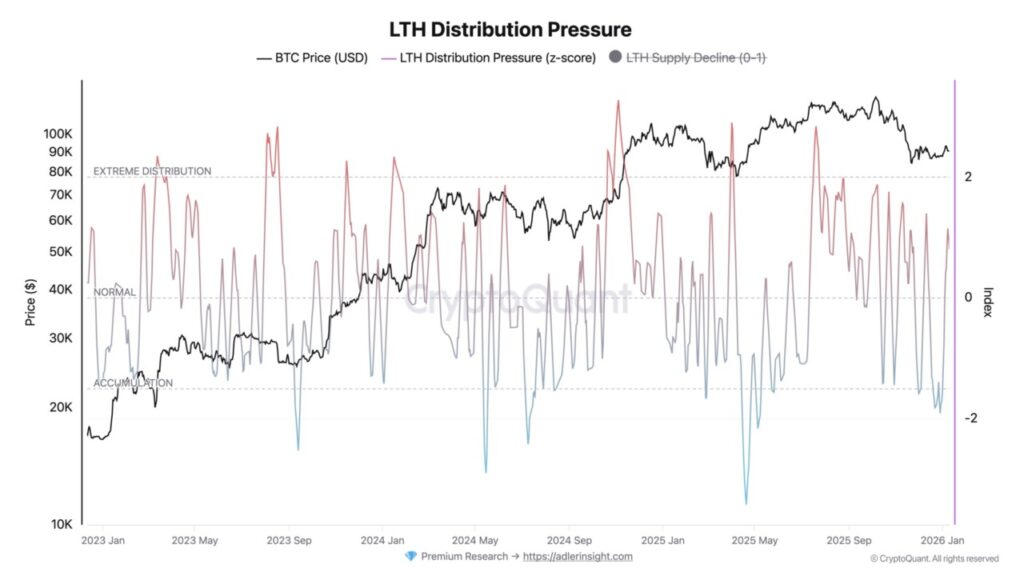

Jakarta, Pintu News – In the past ten days, Bitcoin’s (BTC) long-term holder distribution pressure has remained in the neutral distribution zone. Bitcoin (BTC) managed to break the $90,000 level after touching a low of $90,250 at the end of Sunday.

Crypto analysts point out that Monday has been the strongest trading day over the past month, although this trend has not always continued. With speculation regarding the establishment of a Bitcoin Reserve in the US by 2026, many are wondering if it’s a good time to invest in Bitcoin (BTC).

Bitcoin (BTC) Price Movement Analysis

Bitcoin (BTC) has shown significant gains, reaching above $90,000. Crypto analyst Maartunn noted that Mondays often bring strong price increases, but this pattern is not always consistent.

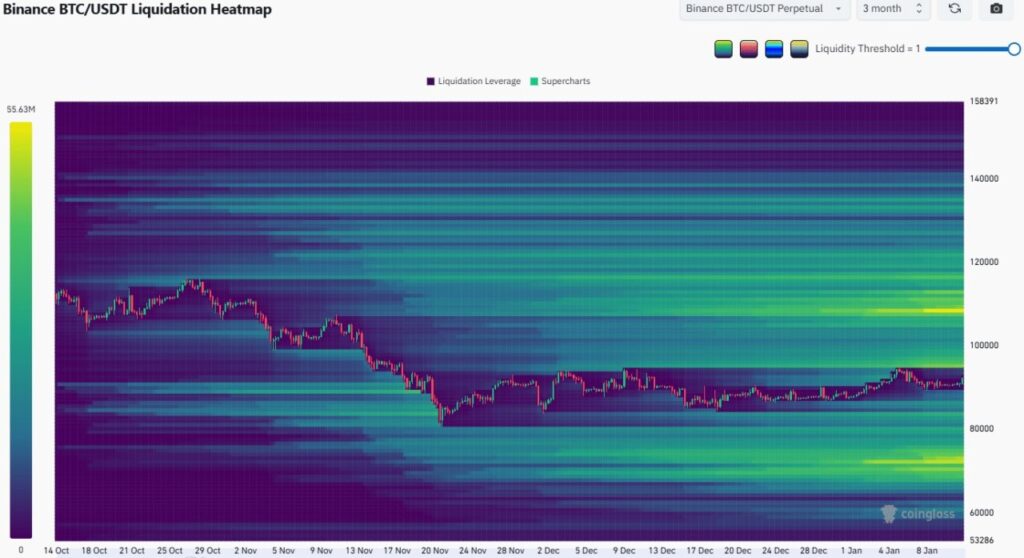

In four out of the last five Mondays, there has been a liquidity grab which was then followed by a price reversal to target liquidation accumulated below the opening price of the day. In the long term, some analysts believe that Bitcoin (BTC) may have entered a bear market. However, with the potential establishment of a Bitcoin Reserve by the US government, bullish sentiment may increase and push prices higher this year.

Holder Structure and its Impact on Price

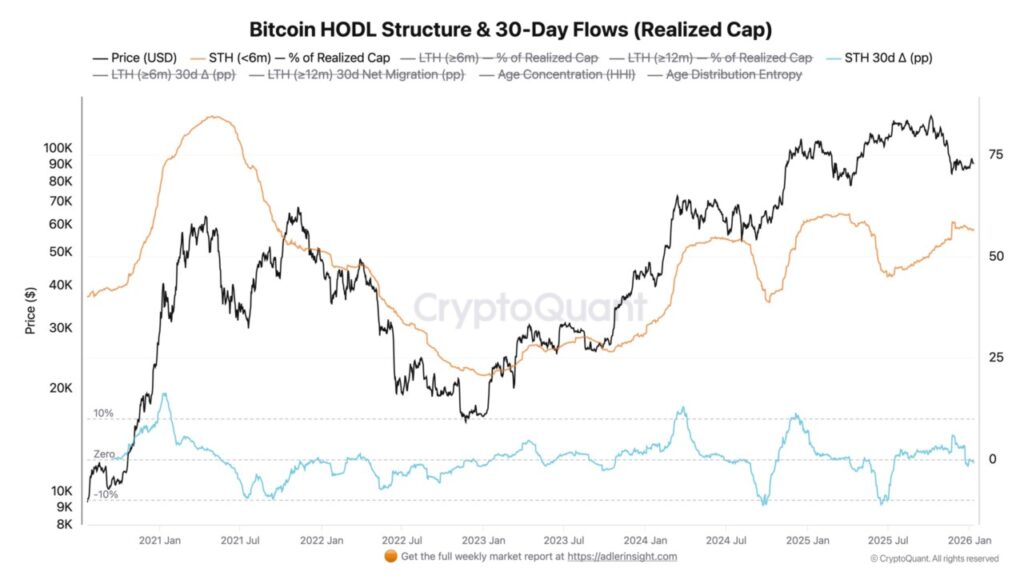

According to Adler Crypto Insight, Bitcoin’s (BTC) ownership structure has stabilized, despite showing a bearish bias. From January 5 to 11, long-term holders (more than 6 months) saw an increase in their share of the realized cap from 43.29% to 43.69%. This change indicates a shift in ownership towards long-term holders.

However, the 30-day migration to the 12-month+ long-term holders segment decreased from 2.12% to 1.81%. This suggests that the growth in the share of cap realized by 12-month+ long-term holders is more due to the transition of coins aged 6-12 months into the 12-month+ segment and not due to increased accumulation in the older category.

Bitcoin (BTC) Price Outlook and Predictions

The three-month liquidation heatmap shows that the $96,000-$100,000 area is a magnetic zone with large pockets of liquidity. Since prices tend to be attracted to liquidity, it is very likely that Bitcoin (BTC) will rally towards $100,000 in January. However, the distribution of long-term holders and a new whale exit at the breakeven point around $99,000 could threaten a breakthrough past that key psychological resistance.

Conclusion

While there is great potential for Bitcoin (BTC) to reach $100,000, investors should remain aware of market volatility and conduct in-depth research before making an investment decision. With market dynamics constantly changing, understanding the factors that affect Bitcoin (BTC) price is key to a successful investment.

Also Read: Monero Hits Record High, Investors Leave Zcash!

Follow us on Google News to get the latest information about crypto and blockchain technology. Check Bitcoin price today, Solana price today, Pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app through Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- AMB Crypto. Bitcoin price eyes $100k yet breakout signals are missing. Accessed on January 14, 2026

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.