Download Pintu App

Grayscale Highlights 36 Promising Altcoins to Watch in Early 2026

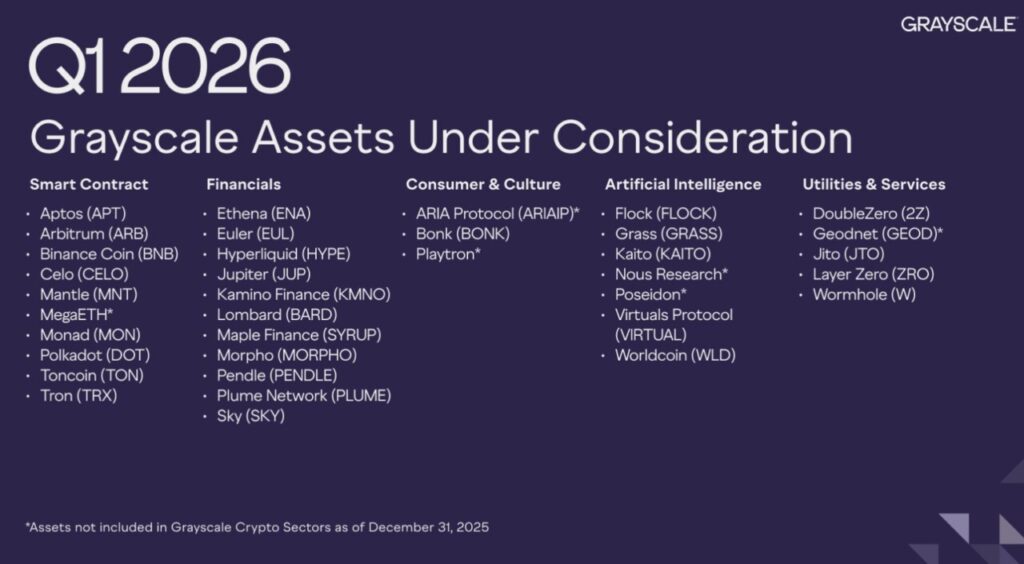

Jakarta, Pintu News – Asset manager Grayscale has revealed the latest update to its “Assets Under Consideration” list as of the first quarter of 2026.

The list includes a wide variety of altcoins that could potentially shape the company’s product offering in the future. As part of its review process, the fund manager updates its product catalog about 15 days after the end of each quarter.

Grayscale Updates Crypto Asset Watchlist for Q1 2026

In its latest update, Grayscale announced 36 altcoins that made the “Assets Under Consideration” list for the first quarter of 2026. While being on this list does not guarantee inclusion in Grayscale’s investment products, it does signify that the assets are under active evaluation.

Read also: Top 4 US Stocks that Analyst Ali Martinez Highlighted!

Candidates for Q1/2026 come from five key sectors, namely: Smart Contract, Financial, Consumer & Culture, Artificial Intelligence (AI), and Utilities & Services. Among these categories, smart contract platforms and the financial sector were the most prominent with the highest number of assets.

“The Assets Under Consideration list includes digital assets that are not currently included in Grayscale’s investment products, but have been identified by our team as potential candidates for future products,” reads the company’s official blog.

This latest list shows a slight refresh compared to the fourth quarter of 2025, which previously listed 32 assets. Grayscale added some new assets and removed one from the list.

For the smart contract category, Grayscale added Tron (TRX).

The consumer and cultural category saw an expansion with the inclusion of ARIA Protocol (ARIAIP), a platform that tokenizes intellectual property (IP) rights into liquid crypto assets.

ARIA allows investors, creators, rights owners, and fans to access, trade, and earn from these assets on-chain.

Crypto Grayscale Options

In the artificial intelligence (AI) segment, Nous Research and Poseidon were added, while Prime Intellect was removed from the list.

The utilities and services category also saw minor growth with the addition of DoubleZero (2Z) – a Decentralized Physical Infrastructure Network (DePIN) that provides high-performance, low-latency network infrastructure for blockchain and distributed systems.

Read also: Bitcoin Price Surges to $95,000 Today: Whales Continue to Accumulate BTC!

These additions show that Grayscale is now paying attention to trends such as tokenization, DePIN, and artificial intelligence. Other than these changes, other assets in the smart contracts, financials, AI, and utilities categories remained consistent from the previous quarter.

This listing update comes alongside Grayscale’s initial move to launch ETFs (Exchange-Traded Fund) for BNB Coin (BNB) and Hyperliquid (HYPE). The company has registered official trusts for both products with the Delaware Division of Corporations, as an initial procedural step towards a possible future ETF launch.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. Grayscale Asset Consideration Q1 2026. Accessed on January 14, 2026

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.