Download Pintu App

Bitcoin strengthens, but $105,000 target is still far away, what’s going on? (1/15/26)

Jakarta, Pintu News – Bitcoin (BTC) is showing its strength again with increased fund flows into the spot Bitcoin (BTC) ETF, but data analysis shows doubts that the price can reach $105,000 in the near future.

Bitcoin’s strength is constrained by derivatives market

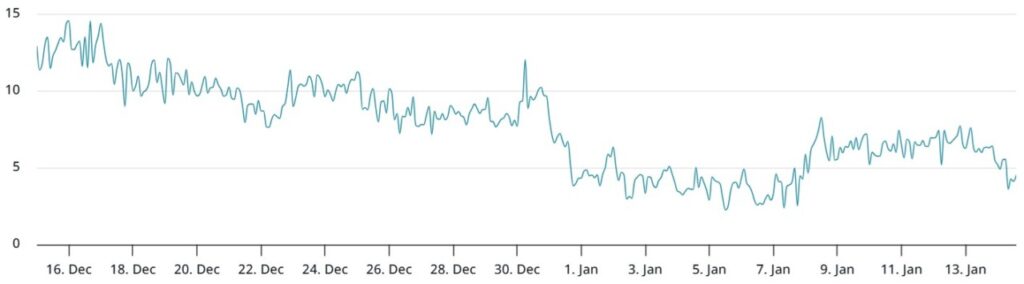

Although Bitcoin (BTC) managed to break through the $97,000 mark, the derivatives market is yet to provide strong confirmation of the continuation of this trend. The options skew shows that traders are still cautious about the potential for a sustained rally. BTC’s delta options skew indicator is still showing 4%, which is unchanged from the previous week, signaling a stable risk perception despite the price having surged above $96,000 on Wednesday.

This rise in Bitcoin (BTC) price comes amid continued weakness from the Nasdaq index, which is still struggling to return to the 26,000 level last seen in early November 2025. Investor sentiment is divided, with Bitcoin (BTC) still trading 23% below its record high, while gold and silver prices hit new record highs in 2026, indicating stronger demand for traditional safe-haven assets.

Also Read: Monero (XMR) sets new record, will it continue to surge in January 2026?

Geopolitical concerns limit Bitcoin’s upside potential

The market’s unoptimism was also influenced by geopolitical tensions, such as the protests in Iran that triggered military threats from US President Donald Trump. These threats included an additional 25% import tariff on countries doing business with the Islamic Republic of Iran. These concerns are heightened as US relations with China and India could deteriorate if the proposal moves forward.

In addition, investor confidence has also been hit by the Trump administration’s intention to take control of Greenland, which is considered critical to US national security. Germany’s Defense Minister, Boris Pistorius, reportedly offered assistance to Denmark in the event of a hostile takeover. This situation adds to the uncertainty in the market, which also affects sentiment towards cryptocurrencies such as Bitcoin (BTC).

Market Response to Economic and Political Uncertainty

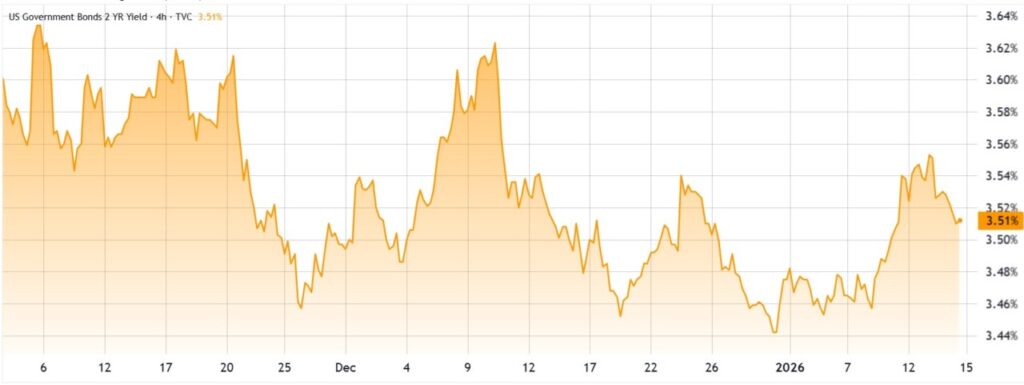

The two-year US Treasury yield fell to 3.51% on Wednesday, indicating that traders prefer the safety of government bonds despite US consumer inflation being above the Federal Reserve’s target of 2.7% per year. Warren Buffett, chairman and former CEO of Berkshire Hathaway, expressed his concerns about the unclear future direction of artificial intelligence, which was reflected in Berkshire’s cash position increasing to a record $381.7 billion.

The Nasdaq index fell 1.6%, while Oracle (ORCL US) shares tumbled 5% after bondholders filed a class action lawsuit alleging the company failed to disclose the need for significant additional debt to expand its artificial intelligence infrastructure. This uncertainty led traders to reduce their exposure to equities, which also curbed their appetite for riskier assets like crypto.

Bitcoin’s Outlook Amid Uncertainty

Although Bitcoin (BTC) has shown signs of recovery from a two-month bear market, derivatives data shows that traders are still highly skeptical of the possibility of a quick rally towards $105,000. Investor focus currently remains on broader geopolitical risks and whether the US Federal Reserve can support economic growth without reigniting inflation.

Also Read: 7 Crypto Oversupply Signals Could Reset Bitcoin to $10,000 – Here Are the Indicators!

Follow us on Google News to get the latest information about crypto and blockchain technology. Check Bitcoin price today, Solana price today, Pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- Cointelegraph. Bitcoin rallies as spot ETF inflows soar, but $105K looks out of reach. Accessed on January 15, 2026

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.