Download Pintu App

XRP Surges to $2, Will it Continue to Rise in 2026?

Jakarta, Pintu News – XRP (XRP) has broken through the $2 mark again and the increasing flow of institutional investors suggests that the altcoin’s price rise has only just begun.

XRP Price Stability Supported by Investment Products

At the start of 2026, Ripple (XRP) managed to return to a bullish position by breaking the 50-day simple moving average (SMA) in the first weekend of January. This move fits the classic downtrend retest structure that will lead to higher prices if buyers remain in control of the market.

However, the price movements that did occur suggested stabilization rather than acceleration. This stability seems to be reinforced by the participation of institutional investors. Although the digital asset market experienced one of its worst weekly performances since mid-2023 with outflows of approximately $454 million, the price of XRP moved in the opposite direction.

Also Read: Monero (XMR) sets new record, will it continue to surge in January 2026?

Volume Data and Trader Outlook Determine Price Range

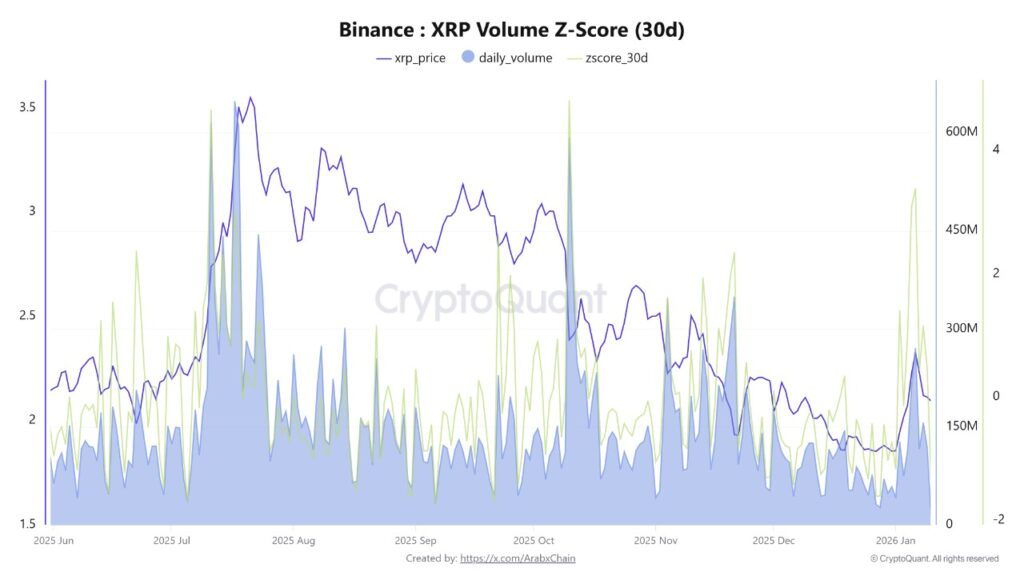

Data from CryptoQuant adds further nuance. The Z-score of trading volume on Binance stands at around 0.44, which puts activity slightly above the 30-day average but remains in the neutral range. This suggests that the price of XRP is not driven by speculation, but rather by balanced activity between buyers and sellers, a condition seen during accumulation phases.

Meanwhile, CrediBULL Crypto market analysts stated that the completion of the “triple tap” at the top of the range leaves two possibilities: a pullback to $1.77 in a larger uptrend, or a maintained base around $2 where the price drop continues to be bought. Given the current market conditions, the analyst prefers an uptrend with a higher price target of around $3.

Further Analysis and Whale Behavior

However, futures trader Dom emphasized that although $2.10 has held for several months, a move towards the mid-range of $2.40 would only provide a meaningful market shift on the daily chart. The analyst stated that strong price action is likely to begin once the altcoin stabilizes above the $2.40 level.

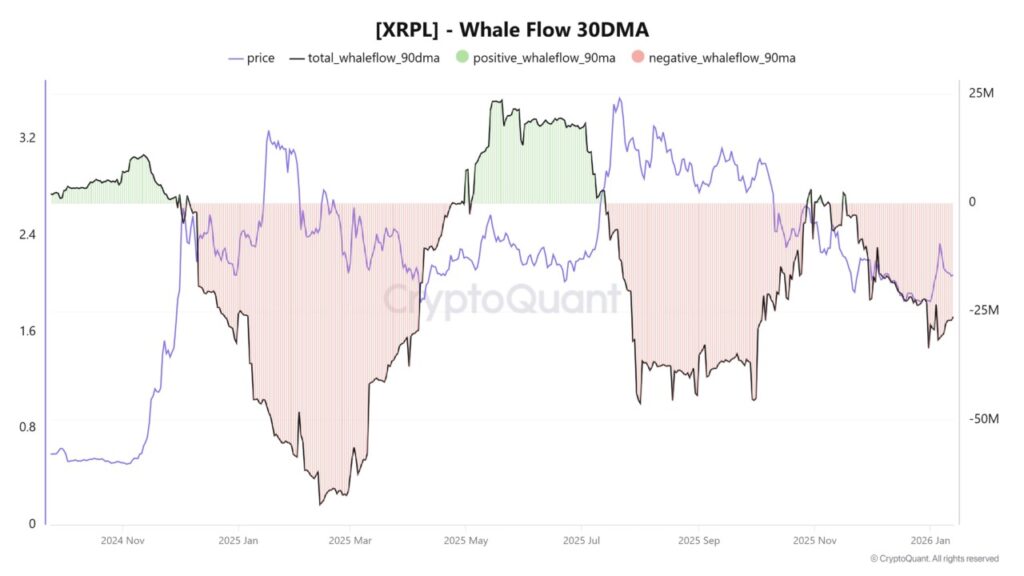

Coincidentally, last week’s XRP rally stalled just below $2.40, where the price was rejected on January 6. The price pullback was followed by over $100 million in net whale selling from January 4 to January 7. Although whale outflows remain high, a change in behavior needs to be seen if XRP is to retest the $2.40 level.

XRP Outlook in 2026

With strong support from institutional investors and favorable technical analysis, Ripple (XRP) seems to have the potential to reach higher price levels in 2026. Stability and continued interest from institutional buyers will probably be key in determining how high XRP can climb in the coming years.

Also Read: 7 Crypto Oversupply Signals Could Reset Bitcoin to $10,000 – Here Are the Indicators!

Follow us on Google News to get the latest information about crypto and blockchain technology. Check Bitcoin price today, Solana price today, Pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- Cointelegraph. XRP tops $2 as TradFi piles in, do charts predict new highs in 2026. Accessed on January 15, 2026

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.