Download Pintu App

Bitcoin (BTC) breaks a new record, ready to reach $100,000!

Jakarta, Pintu News – Bitcoin (BTC) recently reached its highest peak since 2026, with the exchange rate breaking $97,500. Various data suggests that there is potential for even higher price increases, possibly crossing the $100,000 threshold. Does this signal the return of a bull market for Bitcoin (BTC)?

Technical Analysis and Transaction Volume

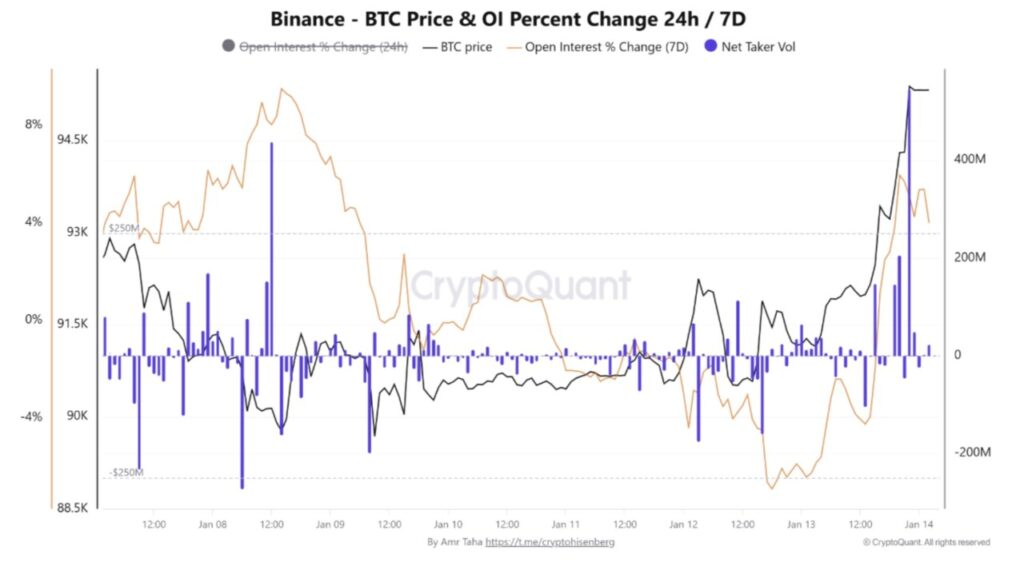

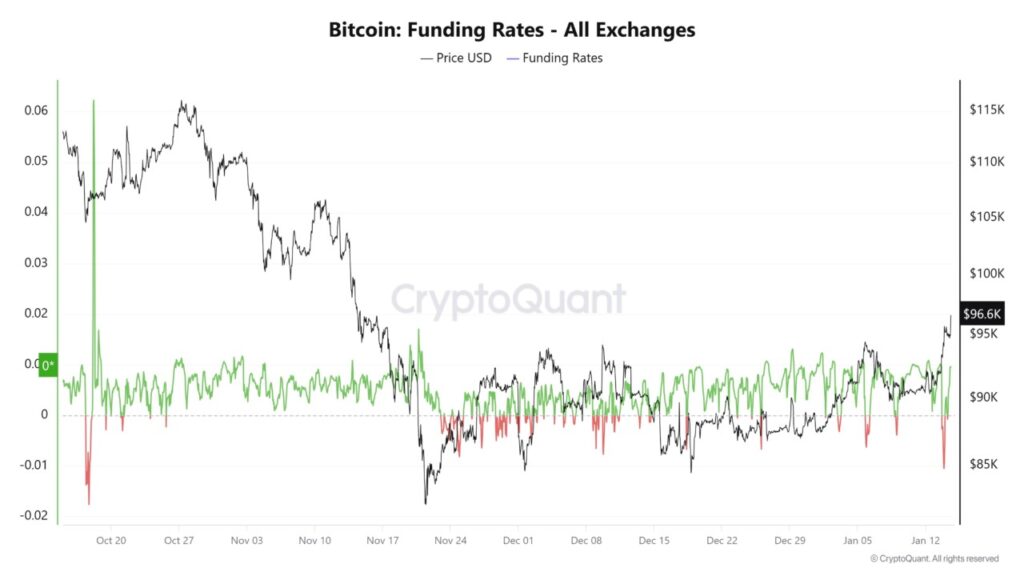

Bitcoin (BTC) managed to close the day with a price above $95,000, a signal that confirmed the uptrend and weakened short-term resistance. Net taker volume on Binance reached over $500 million, a phenomenon that coincided with an increase in open interest and the lowest hourly funding rate since October 2025.

This suggests that there is a strong push from buyers that could push the price even higher. With limited resistance above $95,000, there is a technical possibility for a rally up to $103,500. If this momentum continues, there’s not much stopping the Bitcoin (BTC) price from rising in the near future.

Also Read: Monero (XMR) sets new record, will it continue to surge in January 2026?

Onchain Data and Coinbase Premium Index

Onchain data shows the strengthening of the Bitcoin (BTC) rally. The Coinbase Premium Index has stabilized after a sustained period of selling from January 6 to the end of last week. Although the index still shows negative values, the decline in selling pressure has clearly slowed down, indicating that panic from US-based investors has diminished.

In addition, the average Bitcoin (BTC) inflow into Coinbase Advanced in the past seven days was about 2.5 times higher than the baseline. Similar inflow spikes in the past have often preceded price appreciation, which is attributed to spot accumulation, OTC settlement, or ETF positions, rather than outright sales.

Key Price Levels for Bitcoin (BTC)

In the short term, all eyes are on $100,000 as the next target. However, from a technical point of view, the next major supply zone is higher, between $103,300 and $107,500. From $95,000 to $103,300, the resistance is quite thin, giving enough room for price expansion if this momentum continues.

Broader market liquidity remains relatively low in the spot and futures markets, which leaves Bitcoin (BTC) vulnerable to sharp price movements. The latest rally above $95,300 has liquidated $270 million worth of short positions, moving the next cluster of liquidity to the long side.

Conclusion

With a range of supportive data and strong technical potential, Bitcoin (BTC) seems poised to continue its upward climb. Investors and market watchers should keep a close eye on these indicators to make the right decision on investing in these volatile times.

Also Read: 7 Crypto Oversupply Signals Could Reset Bitcoin to $10,000 – Here Are the Indicators!

Follow us on Google News to get the latest information about crypto and blockchain technology. Check Bitcoin price today, Solana price today, Pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- Cointelegraph. Bitcoin hits 2026 high above $97K, data shows sufficient fuel for higher prices. Accessed on January 15, 2026

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.