Download Pintu App

7 Reasons Dogecoin (DOGE) Dropped 7% Today, Including the Whale Trail Selling Big!

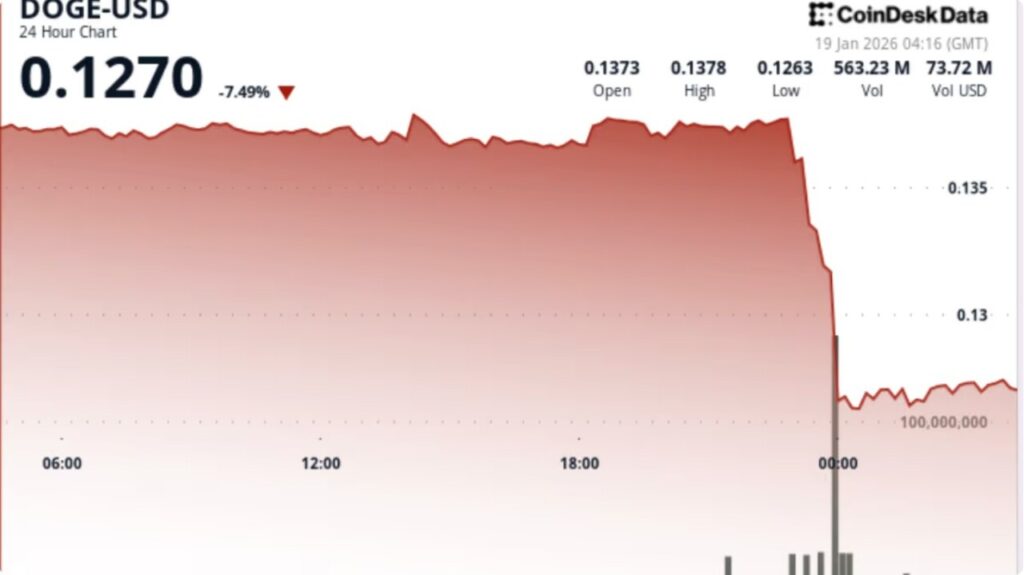

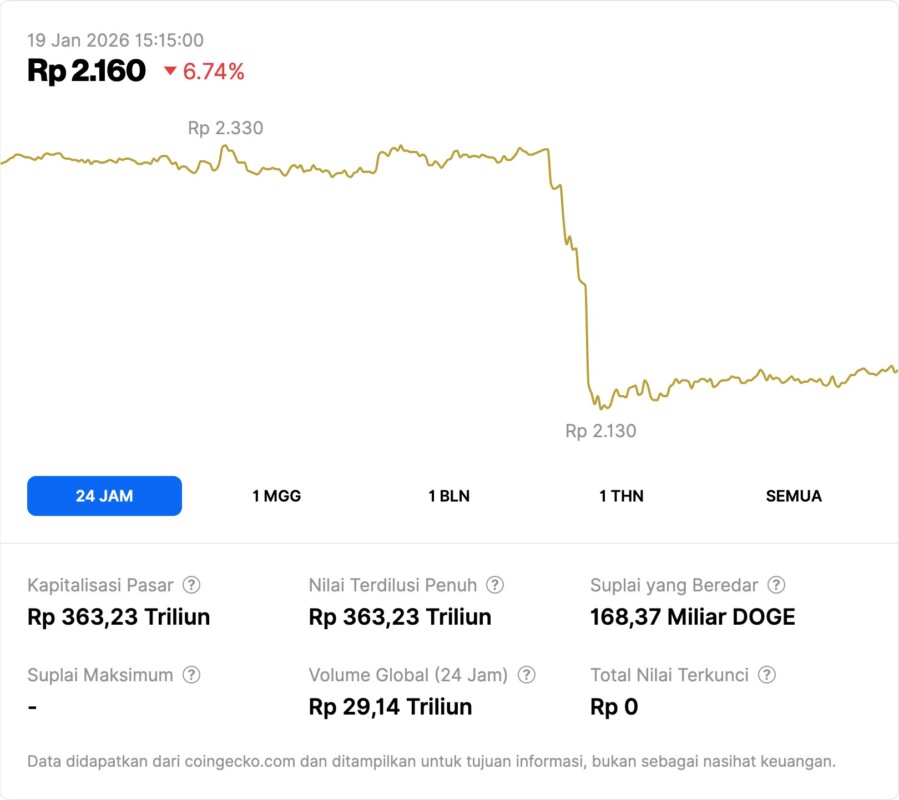

Jakarta, Pintu News – Dogecoin’s (DOGE) price drop of around 7.35 percent on January 18-19, 2026 caught the attention of the crypto market after the price broke a key technical level below USD 0.13, signaling broader selling pressure and whale activity affecting market sentiment and structure.

1. DOGE Tumbles 7% in Recent Session

Dogecoin dropped from around USD 0.137 to around USD 0.127 during the latest trading session. This decline indicates significant selling pressure after repeatedly failing to defend the USD 0.137 level as support. The drop past the psychological level suggests that the short-term bullish momentum has weakened.

When the price moves below USD 0.13, some technical support levels are also left behind, which opens up space for a drop to the next support level. Traders often associate a drop below levels like these with a move from buying power to dominant selling power. This activity also triggers the liquidation of leveraged positions in the derivatives market.

Also Read: 5 Realistic Ways to Earn 2 Million in a Day, Here’s the Secret!

2. Selling Pressure from Whale Action in the Market

One of the main catalysts for DOGE’s decline has been significant selling by large whales – addresses that hold large amounts of tokens. This kind of activity can increase selling pressure as the large supply coming out of such wallets is often absorbed at market prices, reducing demand. The data suggests that this selling pressure is indicative of profit realization followed by a decrease in buying pressure.

Whale action is often a signal for retail traders to adjust their positions, which then reinforces the downward momentum in the market. When whales start moving or selling their assets, the price output usually follows suit as the market maps it as an indication of negative sentiment.

3. Correlation with Broader Crypto Market Trend

DOGE’s movements do not occur in isolation from broader crypto market trends. The fall of some major assets such as Bitcoin (BTC) during the same period also put pressure on altcoins including DOGE. The correlation between the price of Bitcoin and memecoins like Dogecoin is often seen in risk-off phases, when investors reduce exposure to high-risk assets.

The overall trading volume of the crypto market that increased during the price drop reflects that market participants are making portfolio adjustments, including profit locking or risk management before important macro data is released.

4. Decline in Trader Sentiment and Technical Positioning

DOGE’s price drop below key technical levels on the daily and short-term charts could reinforce the bearish perception among technical traders. Momentum indicators such as the falling Relative Strength Index (RSI) suggest selling pressure is more dominant than buying. The support level below the current price remains an important area that market watchers are monitoring.

Falling below the USD 0.13 level also means that traders using a technical approach should be prepared for the possibility of testing the next support level before a potential bounce or consolidation occurs.

5. Short-Term Market Reaction and Potential Continuation

DOGE’s price movement today is likely to be reactive to large selling pressure and rapid changes in market structure. Pressure from whales and large market participants can lead to increased short-term volatility. Traders and investors often monitor important levels such as USD 0.125 or USD 0.12 as the next areas to test.

Historically, sharp declines over a short period are often followed by a consolidation phase where the price moves within a certain range before finding a clearer direction. This means that although DOGE is under pressure right now, a possible consolidation or bounce could also occur depending on the upcoming market sentiment.

6. How Relevant is News for Crypto Investors?

For medium- or long-term crypto investors, dynamics like whale pressure and technical dips are often seen as part of a larger price cycle. Dogecoin, as one of the most highly liquid meme coins, often reflects the overall market condition in a risk-off or risk-on phase.

More conservative investors can utilize volatile phases like this to observe the price structure and consider diversification strategies instead of emotional responses to daily price changes.

7. What’s Next for Dogecoin?

DOGE’s price perspective in the very short term remains dominated by the current selling pressure, but investors are keeping a close eye on how whale behavior and short-term technical data shape the next movement pattern. Breakouts from important levels or rebounds from support could signal a change in trend.

Further movements depend heavily on broader market sentiment, including the direction of the Bitcoin price and macro policies that affect the digital asset market as a whole.

Also Read: 10 Ways to Make Money from Games Quickly but Realistically (Online & Mobile)

Follow us on Google News to get the latest information about crypto and blockchain technology. Check Bitcoin price today, Solana price today, Pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- CoinDesk. Dogecoin slides 7% as whale-linked selling pushes price below USD 0.13. Accessed January 19, 2026.

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.