Download Pintu App

Gold and Silver Set New Record Highs, Bitcoin (BTC) Plummets!

Jakarta, Pintu News – Global financial markets have recently experienced significant turmoil, with gold and silver reaching new highs, while Bitcoin (BTC) has experienced a sharp decline. This rise in gold and silver prices comes amid global economic uncertainty and increased geopolitical tensions.

Gold and Silver Prices Surge

Gold has just recorded a new record high of $4,660 per ounce, a dramatic surge that reflects the growing uncertainty in global markets. The rise came after Trump’s announcement of new tariffs against eight European Union countries, prompting investors to turn to assets perceived as safer. Silver was not left out either, with prices surging to $94 per ounce, breaking the previous record.

Both precious metals have become a top choice for investors seeking safety amid market uncertainty. These price increases reflect not only geopolitical tensions, but also the potential inflation that may occur due to loose monetary policies of various central banks. Investors tend to choose gold and silver as a hedge against inflation and as a safe store of value.

Also Read: 5 Realistic Ways to Earn 2 Million in a Day, Here’s the Secret!

The Bitcoin (BTC) Crisis and Its Impact

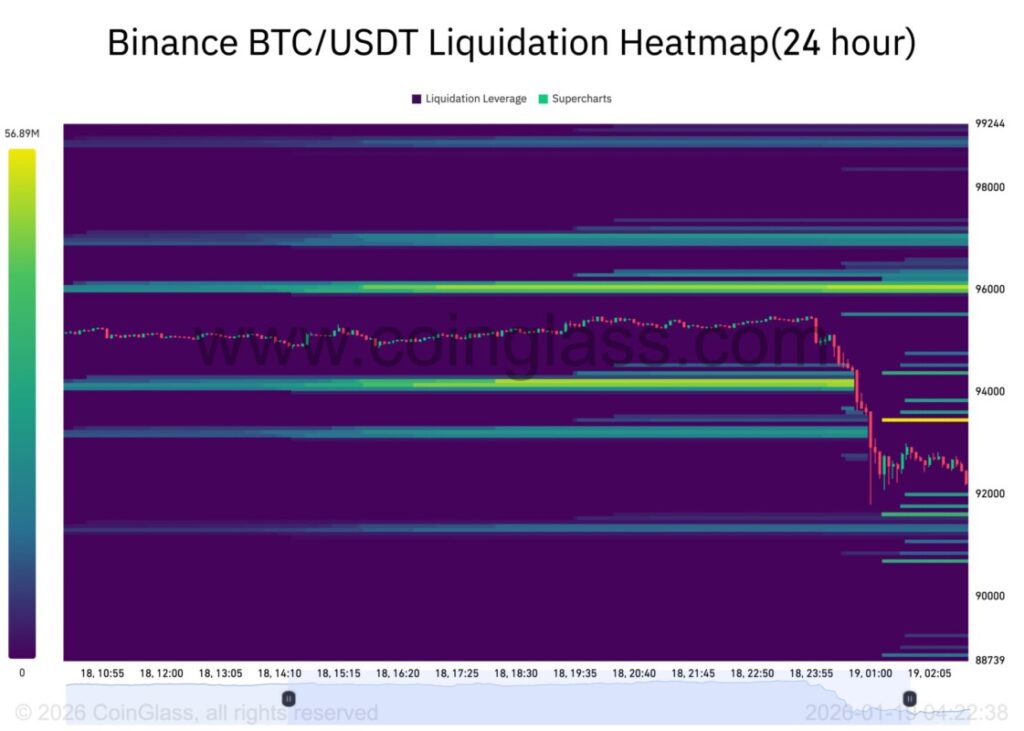

On the other hand, Bitcoin (BTC) experienced a sharp decline, with the price plummeting by around $4,000 in an hour, down to $92,000. This drop came after the liquidation of $500 million worth of leveraged long positions. This incident highlights the high volatility in the cryptocurrency market and the risks associated with using large leverage in trading.

This decline also marks a shift in sentiment in the cryptocurrency market, which many previously saw as a promising investment alternative. However, with high instability and great risk, many investors have started to reconsider their asset allocation in cryptocurrencies.

Japanese Bond Market Reaction

The Japanese bond market also saw significant movement, with yields on Japanese government bonds spiking following reports that the government is considering a sales tax cut ahead of a snap election scheduled for next month. The 30-year bond yield jumped 10 basis points to 3.58%, the highest level since the bond was first issued.

Yields on 10-year and 20-year bonds also rose, reaching their highest levels since 1999. The report raises fiscal concerns amid rising government debt and limited room for deficit financing. The Japanese government, under the leadership of Prime Minister Sanae Takaichi, seems to be looking for ways to stimulate the economy ahead of the election, but must still be careful to maintain fiscal discipline.

Conclusion

The current dynamics of financial markets demonstrate how complex and interconnected global economic and political factors are. Investors and analysts need to be constantly aware of the changes taking place and be ready to adjust their strategies according to changing market conditions. Gold and silver are likely to continue to be favorite choices amidst this uncertainty, while the cryptocurrency market may still have to find a more stable footing.

Also Read: 10 Ways to Make Money from Games Quickly but Realistically (Online & Mobile)

Follow us on Google News to get the latest information about crypto and blockchain technology. Check Bitcoin price today, Solana price today, Pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- Cryptopolitan. Gold makes new all-time high of $4660 as Bitcoin crashes by $4000 after US markets open. Accessed on January 19, 2026

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.