Download Pintu App

DUSK Surges 117% in a Day — Is the $1 Milestone Within Reach in 2026?

Jakarta, Pintu News – Dusk (DUSK), the native cryptocurrency of an unlicensed layer-1 blockchain called Dusk Network, has emerged as a prominent leader in the latest privacy coin rotation.

In the past 30 days, the market value of DUSK surged by about 583%, pushing its price to about $0.30, which is the highest level since January 25. The movement over the weekend also showed that DUSK outperformed other privacy coins such as Dash (DASH) and Zcash (ZEC).

So, what made the price of DUSK soar, and does DUSK still have the potential to go higher?

DUSK Price Rises 117.53% in 24 Hours

On January 19, 2026, the DUSK token price was recorded at IDR 4,640, experiencing a sharp surge of 117.53% in the last 24 hours. This increase was a big highlight in the crypto market, as it signaled a very strong bullish momentum.

Read also: Why Crypto is Down Today, January 19, 2026

Within a day, the price of DUSK jumped from a level of around IDR 2,133 and touched a peak of IDR 5,366 before experiencing a slight correction.

DUSK Breaks Year-long Downtrend

Through a weekly chart, the CCN website observed that the price of DUSK rallied after breaking out of a falling wedge pattern. As seen in the chart, the altcoin has recorded lower highs and lower lows since December 2024. However, the situation started to change when the Money Flow Index (MFI) started to rise.

A rise in the MFI indicates stronger buying pressure. This factor was instrumental as DUSK broke through resistance at $0.25, while the bulls successfully defended support at $0.15.

However, that’s not the only positive signal. As seen in the chart, the Awesome Oscillator (AO) showed positive values for the first time since July 2024.

This position reflects the bullish momentum that is starting to strengthen on this crypto asset. If this trend continues, the price of DUSK has the potential to go higher in the short term.

Why did the price of DUSK skyrocket today?

Aside from the technical side, DUSK’s sharp price surge is also the result of years of development that finally met with a favorable regulatory environment in Europe.

Fundamentally, here are some reasons why the DUSK price outperforms other privacy coins:

Mainnet launch (January 7, 2026)

After six years of development, the Dusk mainnet was officially launched one year ago. This marked the project’s transition from a mere concept to a functional Layer 1 blockchain that can produce blocks with instant finality.

DuskEVM Announcement

The development team recently unveiled DuskEVM, an Ethereum Virtual Machine (EVM) compatible solution. This allows Ethereum developers to easily port their dApps to Dusk, and utilize Dusk’s native auditable privacy features.

Breakthrough “Auditable Privacy”

CTO Hein Dauven explains that while DUSK transactions are private by default, the protocol allows for selective disclosure. Recipients can cryptographically prove where the funds came from, making the network fully compliant with the EU Travel Regulation and MiCA.

“Private by default, but accountable when needed. DUSK transactions hide the sender and amount from the public, but the recipient can still verify (and cryptographically prove!) who sent them the funds. This is the missing piece to make DUSK privacy compliant with the travel rule,” Dauven said on January 17.

Real World Asset Integration (RWA)

DUSK is now a platform for tokenized securities in collaboration with Dutch exchange NPEX. With over €300 million of assets planned to be tokenized, the Dusk network is moving from speculation to institutional utility.

History Indicates Further Upside Potential

From an on-chain perspective, data from Glassnode shows that the recent price rally has pushed DUSK close to itsrealized price.

Read also: Top Crypto to Watch this Weekend: BTC, ETH, and SOL as Open Interest Skyrockets

The realized price reflects the average purchase price of the entire outstanding supply. If the market price falls below this point, most DUSK holders incur losses, so price increases often trigger sell-offs from investors looking to “make a return.”

However, when the market price breaks above the realized price, the dynamics start to change. More investors start making profits, selling pressure diminishes, and the market can move from the distribution phase to the continuation of the uptrend.

This is why this level is so important for DUSK right now. Historically, when DUSK manages to break and hold the price realization, a follow-up rally usually occurs.

In previous cycles, similar scenarios preceded major surges, including:

- Rally towards $0.44 in 2021

- Increase to $0.95 by 2022

- Movement to around $0.62 in 2024

Thus, if DUSK is able to break and hold above the realized price, this could be a strong signal for buyers who were previously still waiting on the sidelines.

Given the current enthusiasm for privacy coins, the price of DUSK has the potential to continue its uptrend and even approach $1, provided it can maintain these important levels.

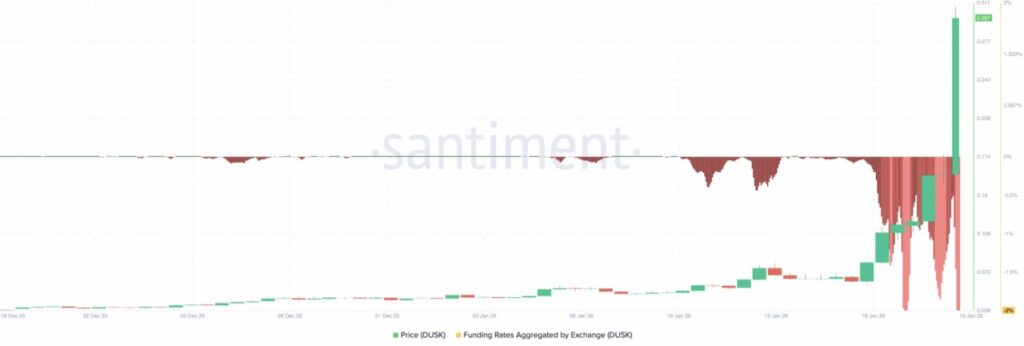

Short positions in DUSK are at risk of being pinched

Supporting this upside potential, DUSK’s funding rate remains strongly negative.

This is important because a negative funding rate indicates that market participants who take short positions (betting the price will fall) will have to pay additional fees to maintain their positions, even though the price continues to rise.

This condition usually favors the continuation of the uptrend. When too many traders are on the short side while prices are not falling, their positions become vulnerable. If the price continues to rise, they could be forced to cover their short positions (short covering), which would add buying pressure and accelerate the rally through forced liquidation.

At the same time, the funding rate remaining negative shows that market skepticism is still high. This means that the market has not yet entered the euphoric phase, and the rally is likely to continue in a healthier manner.

DUSK Price Prediction: Potential to Rise 70% Again?

Looking at the daily chart, DUSK’s upward trend still appears strong. As this article is being written, the DUSK token has broken the upper trendline of the symmetrical triangle pattern, which is usually a signal of trend continuation, not a sign of market exhaustion.

Several fund flow and trend indicators support this move:

- The Chaikin Money Flow (CMF) rose above the zero line again after falling, signaling capital flows back into the DUSK market.

- The Supertrend indicator has also turned bullish, with the green line now below the price and serving as dynamic support.

If this structure is maintained, the price of DUSK could potentially rise by another 70%, which would bring the price target to around $0.50.

More Bullish Scenario: $1 Target?

In a more aggressive and optimistic scenario-especially if the privacy narrative continues to attract market interest and trading volumes remain high-the price increase could continue further, even approaching the $1 zone.

Risk: Momentum Fatigue

However, risks remain. If this rally heats up too quickly and selling pressure starts to mount, then the breakout could lose steam. In this scenario, DUSK may experience a temporary correction and retest support at around $0.21 before attempting to climb back up.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- CCN. DUSK Outperforms Other Privacy Coins, Breaks out to 12-Month High: Is $1 Possible in 2026? Accessed on January 19, 2026

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.