Download Pintu App

Check it out! 3 main reasons for Bitcoin’s price drop today

Jakarta, Pintu News – Bitcoin (BTC) experienced a sharp decline today, triggered by various global factors affecting financial markets. From tariff tensions between the US and EU to the Bank of Japan’s (BOJ) monetary policy, here is an in-depth analysis of the causes of Bitcoin’s price decline.

US-EU tariff tensions trigger market concerns

The price of Bitcoin (BTC) fell 3% after US President Donald Trump announced new tariffs of 10% against Denmark and seven other European countries over a dispute over Greenland. These tariffs could potentially increase to 25% on June 1, which raised concerns across financial markets.

As a result, over $850 million worth of crypto assets were liquidated in the last 24 hours, with Bitcoin (BTC) recording nearly $250 million in liquidations. Meanwhile, gold prices surged, reaching a new record above $4,670, and silver rose by more than $3, trading above $93. Trump’s new tariff policy and threatened invasion of Greenland have triggered a global reaction that could threaten the US dollar’s dominance.

Also Read: Gold and Silver Set New Record Highs, Bitcoin (BTC) Plummets!

Bitcoin Rally Driven by Derivatives, Not Sustainable Demand

Bitcoin’s (BTC) price rally towards $98,000 has been driven more by derivative flows and liquidation of short positions, rather than sustained demand from large investors or “whales”. Reports from Onchain Lens show that whales, including the “255 BTC Sol” whale, have closed their long positions on Ethereum (ETH), Bitcoin (BTC), and Solana (SOL).

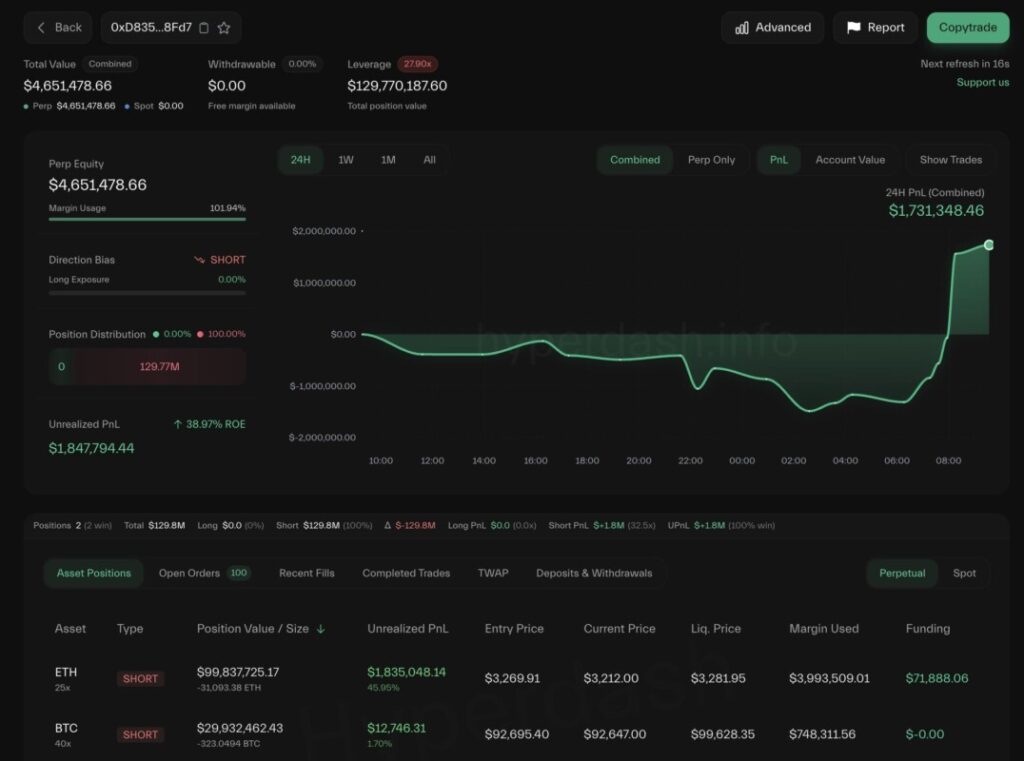

In addition, Lookonchain notes that whales are starting to open short positions on Bitcoin. CryptoQuant judges that Bitcoin’s recent price rebound is a clear bear market rally. Their weekly report shows that Bitcoin is still below its 365-day moving average of $101,000, which historically acts as a regime limit. Weak demand, increased inflows to exchanges, and an options market that reflects uncertainty over a trend reversal towards $100,000 add to the caution in the market.

Bank of Japan Rate Hike Potentially Triggers Bitcoin Price Crash

Investors have become more cautious and started liquidating their Bitcoin (BTC) holdings ahead of the Bank of Japan’s (BOJ) upcoming interest rate decision. BOJ Governor, Kazuo Ueda, has reiterated that the central bank may raise interest rates if economic and price trends match projections. Japan’s 30-year government bond yield hit a historic high of 3.58% today, while the 10-year bond yield hit 2.24%, the highest level since 1999.

An anticipated rate hike and expectations of increased fiscal spending under Prime Minister Sanae Takaichi added to speculation in the market. MacroEdge notes that the BOJ will need to raise rates again as bond yields continue to rise, potentially causing a carry trade reversal and triggering a Bitcoin price crash.

Global Factors Putting Pressure on Bitcoin Price

From geopolitical tensions to tight monetary policies, various global factors are currently contributing to Bitcoin price volatility. Investors and market participants should stay alert for further developments that could affect these market dynamics.

Also Read: Ripple (XRP) likely to reach US$5? This is the price and risk analysis!

Follow us on Google News to get the latest information about crypto and blockchain technology. Check Bitcoin price today, Solana price today, Pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- Coingape. 3 Reasons Why Bitcoin Price Is Falling Today. Accessed on January 20, 2026

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.