Download Pintu App

7 Facts XRP Longs Liquidated $5 Million: Impact Analysis and Crypto Market Direction

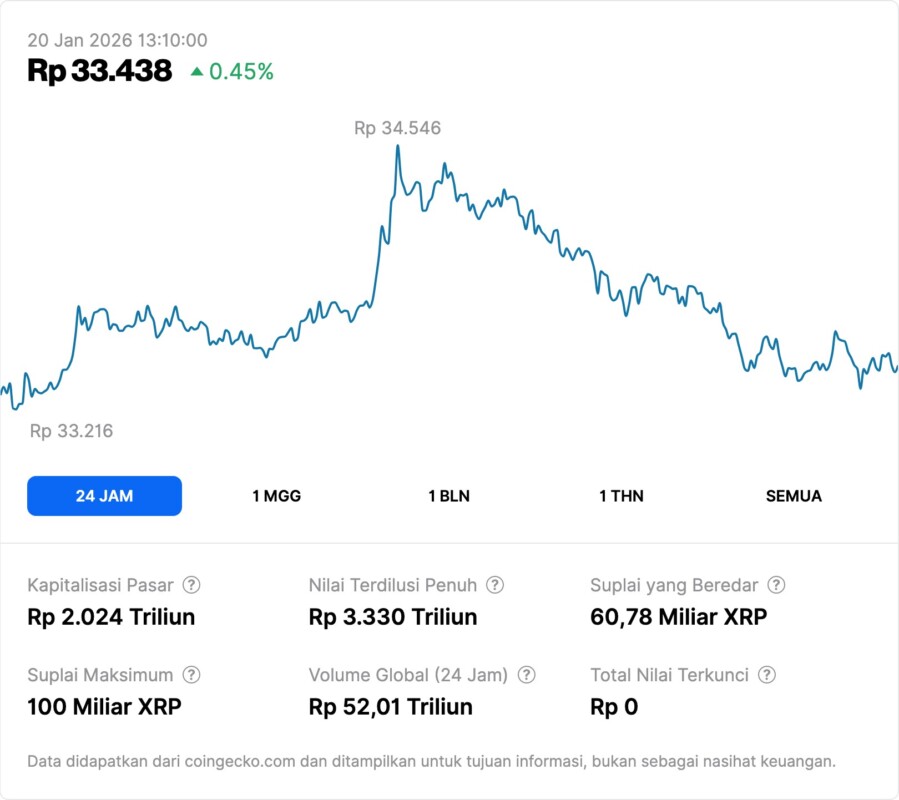

Jakarta, Pintu News – The price of Ripple (XRP) has come under sharp pressure following a massive wave of liquidations in the derivatives market, with tens of thousands of long positions automatically closed and Binance leading the sell-off triggering collective losses of around US$5 million. These events serve as a reminder of the inherent volatility of the cryptocurrency market as well as the importance of risk management for traders and investors.

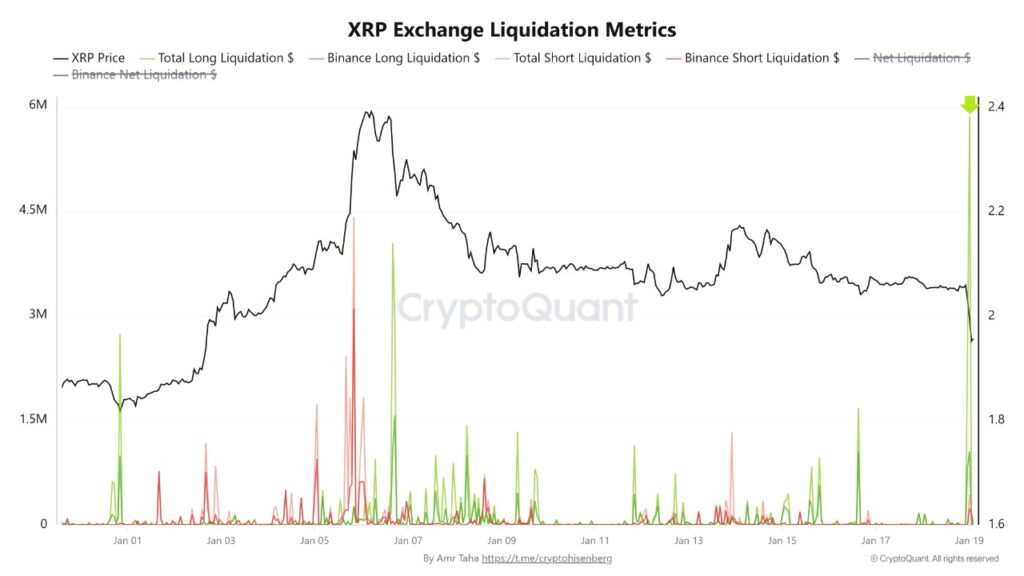

1. Binance Leads Wave of XRP Liquidations

In a wave of liquidations that occurred during the recent trading session, Binance emerged as the largest platform to execute a forced closure of long XRP positions in light of downward price pressure. The liquidation occurred when automatic stop-losses were executed as the price of XRP moved sharply below critical levels. The accumulated losses are estimated to be around USD 5 million, reflecting the large volume of leveraged positions affected.

These liquidation actions usually accelerate selling pressure, as closed positions are automatically converted into spot transactions that affect supply and prices in the market. Binance, as one of the largest crypto exchanges in the world, is often a barometer of market reaction when there is high volatility in assets like XRP.

Also Read: Gold and Silver Set New Record Highs, Bitcoin (BTC) Plummets!

2. Selling Pressure Triggers XRP Price Drop

The mass closing of long positions brings further selling pressure on XRP in the spot market. When many long traders are forced to close positions, the selling volume increases sharply and puts additional pressure on prices that are already moving down. This could lead to a series of technical reactions, including a breakdown below key support levels.

This price drop had an impact on market sentiment, given that XRP is one of the largest cryptocurrency assets by market capitalization. Price volatility often affects retail and institutional investor behavior across crypto asset classes.

3. What is Liquidation in Crypto Trading

Liquidation occurs when a leveraged trading position no longer has enough margin to withstand losses, so the exchange automatically closes the position. Traders who use high leverage are at greater risk of liquidation when prices move sharply against the direction of their position.

In the context of XRP, this liquidation wave indicates that many long positions are too tightly squeezed against the stop-loss level, so that when the price declines rapidly, there is insufficient margin and they are automatically closed. This phenomenon often accelerates the strengthening of the downtrend in the short term.

4. Technical Implications on the XRP Price Chart

Technically, large liquidations tend to leave their mark on the price chart in the form of volume spikes and breaks in key support structures. For XRP, the sharp drop placed the price below an important support level, which could trigger further selling pressure. Technical traders are watching for further support levels to determine potential areas of recovery.

In addition, indicators such as the Relative Strength Index (RSI) and Moving Averages showed dominant bearish pressure after the liquidation, reinforcing the view that the downward momentum is still valid in the short term.

5. Crypto Market Volatility and Risks

The cryptocurrency market is known for its high volatility, and this liquidation wave is a clear example of how prices can move sharply in a short period of time. Assets like Ripple (XRP) often experience large price fluctuations when there is a coordinated sell-off due to technical factors or market sentiment.

Traders and investors involved in leveraged trading need to understand this risk, because while volatility can provide profit opportunities, the risk of automatic liquidation can also lead to significant losses in a short period of time.

6. Trader Responses and Risk Management Strategies

Some market participants are responding to this pressure by adjusting their strategies by using more conservative stop-losses, reducing position sizes, or switching to spot trading over futures. Good risk management is often the main line of defense for investors looking to survive in the highly dynamic crypto market.

Strategies such as portfolio diversification, the use of risk-adjusted allocation, and monitoring key technical levels become part of a balanced trading practice to deal with large liquidations like this.

7. What’s Next for XRP

With the downward pressure in place, the market’s attention is now on the continued support levels and whether XRP is able to find areas of price stabilization. A break below key support opens the door to further pressure, while a rebound above psychologically important levels could signal the beginning of a recovery.

Investors and traders who monitor the markets need to constantly update their analysis based on the latest price data, trading volumes and technical indicators to determine the direction of the next trend in the context of ever-changing volatility.

Also Read: Ripple (XRP) likely to reach US$5? This is the price and risk analysis!

Follow us on Google News to get the latest information about crypto and blockchain technology. Check Bitcoin price today, Solana price today, Pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- NewsBTC. XRP Longs Get Wiped as Binance Leads $5M Liquidation Wave. Accessed January 24, 2026.

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.