Download Pintu App

SKR Crypto Explodes 200%: Smart Money Accumulation vs Airdrop Selling Pressure!

Jakarta, Pintu News – The price of Seeker crypto experienced a sharp surge after its launch. The SKR token rose more than 200% in the last 24 hours and is now trading at around $0.041, after previously hitting a high near $0.059.

This rise came after a massive airdrop from the Solana ecosystem – a situation that usually triggers high selling pressure.

What makes this rally interesting is not the magnitude of the price increase, but rather who is absorbing the token supply. While airdrop recipients are likely sending large amounts of SKR to exchanges, wallet data shows that savvy investors and whales are entering aggressively.

The result is a price rally that looks speculative at first glance, but is actually supported by a strong market structure.

Airdrop Sales Hit Exchanges but Fail to Change Market Structure

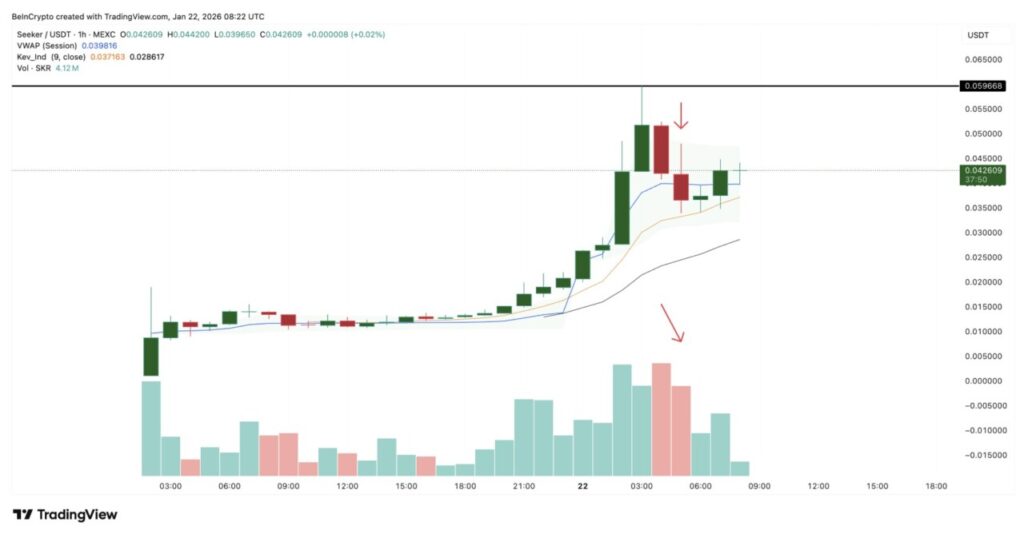

The first wave of sales was aggressive. In the last 24 hours, the SKR token balance on exchanges increased by about 51%, bringing the total SKR held on exchanges to about 380.9 million tokens. This suggests around 129 million SKR were likely sent to exchanges by airdrop recipients looking to make a quick profit. This selling pressure briefly pushed the price down below the VWAP on the one-hour chart.

Read also: Solana Mobile Launches SKR Crypto Airdrop for Seeker Users! Here’s How to Claim

VWAP (Volume Weighted Average Price) is the average price traders pay, calculated based on volume. VWAP is often considered a short-term “fair” price level. When the price drops below the VWAP, it usually signals a strong selling pressure.

However, in the case of SKR, this decline did not last long.

The price quickly rose back above the VWAP, and the 9-period exponential moving average (EMA) line successfully served as support.

EMA is a trend indicator that gives more weight to recent price movements, making it useful for detecting short-term changes in momentum. The 9-period EMA reflects trader behavior in the very near term and is often the initial support in fast and strong trends.

Interestingly, the 21-period EMA (black line), which reflects a deeper short-term trend, was not even touched. This shows that sellers failed to push prices lower. Instead, the decline was absorbed, signaling controlled profit-taking rather than a sign of trend reversal.

The next question arises: who is buying?

Big Investors and Smart Money Absorb More than the Amount Sold to Exchanges

Data from crypto wallets provides a clear answer.

Although the crypto’s SKR balance on exchanges increased by about 129 million tokens, non-exchange wallets accumulated more. The top 100 addresses (called mega whales) added about 144 million SKR, increasing their total holdings to about 8.3 billion tokens. This group alone absorbed more supply than went to exchanges.

Seeker crypto’s standard whale wallet also added around 25.6 million SKR, bringing their total holdings to around 133.8 million tokens. Meanwhile, smart money wallets added another 2.4 million SKR – up 32.5% within the group. Even the (publicly known) public wallets also showed accumulation albeit from small starting figures.

Overall, non-stock wallets absorbed around 182 million SKR – exceeding inflows to exchanges by more than 50 million tokens. This imbalance explains why the price briefly dropped below VWAP but quickly recovered, and why the SKR price stabilized so quickly.

Simply put, airdrop sellers sell when the market is strong, and it’s the big players who buy from them.

Read also: Meme Coin Outlook: Dogecoin, Shiba Inu, and Pepe Struggle Under Bitcoin’s Shadow

SKR Price Levels that Determine Whether the Rally Will Continue

From this point on, the Seeker price structure is more important than the headlines.

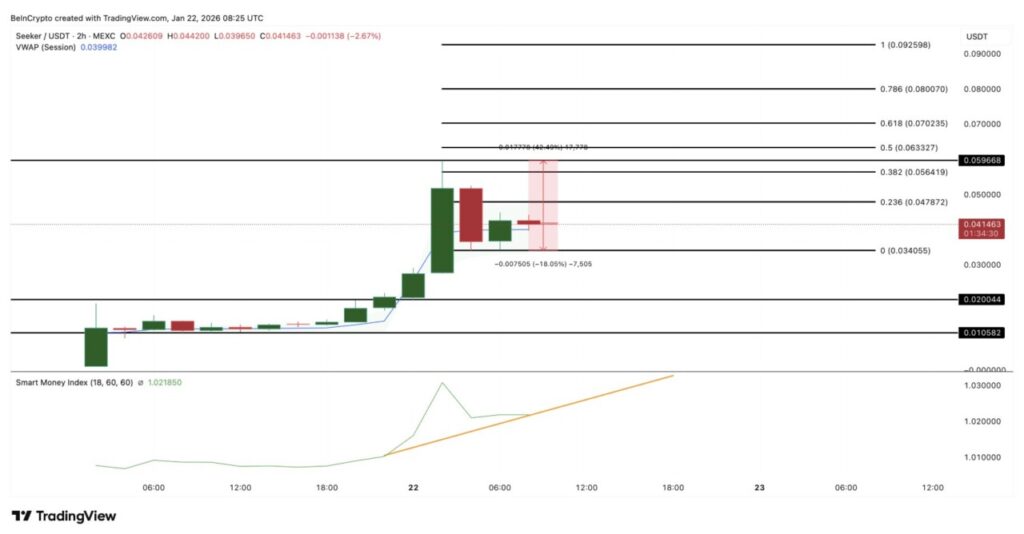

On the two-hour chart, the most important level is the VWAP (same as on the one-hour chart). As long as the SKR price remains above this level when the candle closes, the short-term trend is still considered positive.

This is also reflected in the Smart Money Index, which tracks institutional investor movements through price behavior. The index spiked during the rebound and is now flat instead of declining. Typically, a flat index after a spike signals a consolidation phase, not selling pressure.

This means that smart money buyers are likely waiting for better prices or the next trigger signal.

If the VWAP holds and the Smart Money Index remains stable or starts to rise again, then the price of SKR has the opportunity to retest the recent highs around $0.059. If the price breaks this level cleanly, it will enter a price discovery phase, with the next upside targets being around $0.080 and $0.092.

However, risks remain. If the VWAP breaks on the two-hour chart and the Smart Money Index drops from its current structure, then selling pressure could return quickly. In this scenario, $0.034 becomes the first lower level to watch.

If market confidence declines further, then the price could fall to $0.020 – the area where the initial consolidation had formed.

For now, SKR prices are still holding up. The selling pressure from the exchanges was great, but it was successfully absorbed by the market. As long as smart money behavior remains positive and VWAP continues to be maintained, this rally does not appear to be just a one-day spike due to the airdrop, but could be the start of an even higher move.

Follow us on Google News to stay up to date with the latest in crypto and blockchain technology. Check Bitcoin price, usdt to idr and tokenized nvidia stock price through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading the Pintu crypto app via Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. SKR Delivers The 200% Rally Smart Money Was ‘Seek’ing – Yet Airdrop Sellers Lurk. Accessed on January 22, 2026

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.