Download Pintu App

Gold Hits Record Highs While Bitcoin Slumps: What’s Driving the Divergence?

Jakarta, Pintu News – The price of Bitcoin (BTC) fell below $88,000 on Monday (26/1), reflecting continued weakness in the crypto market. The drop is part of a broader weakening trend in the crypto market as a whole, where the entire crypto market has declined nearly 1% in the past 24 hours.

Ethereum (ETH) price also dropped to $2,880, while Solana (SOL), XRP (XRP), and Cardano (ADA) also recorded losses. Over $154 million worth of Bitcoin price positions were liquidated, mostly from traders with long positions.

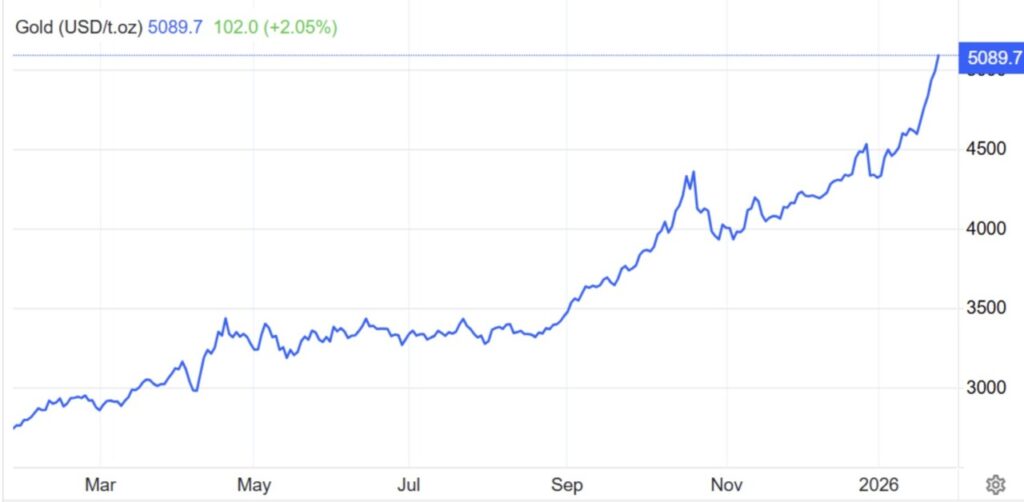

Meanwhile, gold prices surged sharply and set an all-time record high above $5,000. The crypto market’s loss of 6.64% over the past week shows the increasingly risk-averse attitude of investors due to increased volatility.

Gold prices skyrocket to $5,045, setting a new record amid global uncertainty

Gold prices jumped sharply to reach a new record high of $5,089 in early Asian trading on Monday (26/1). This increase reflects the trend of increased investor interest in safe haven assets amid heightened geopolitical tensions and global economic instability.

Read also: Antam Gold Price Today, January 27, 2026

This historical spike also reflects growing doubts over the independence of the US Federal Reserve and the future direction of their monetary policy.

Demand for gold is increasing rapidly, while market sentiment is shifting away from high-risk financial assets. According to analysts, this positive trend has the potential to continue, and gold prices could break $5,100 if the bullish momentum remains strong.

The rise in gold prices reflects investors’ anxiety over uncertain global conditions. In contrast, Bitcoin prices are experiencing a downward trend, reflecting bearish market sentiment. Gold’s continued strong performance is in line with the current rising global risks.

Bitcoin Price Weakens Amid ETF Outflows, Political Tensions, and Legislation Delays

Bitcoin price has been under pressure lately due to various economic and political developments. The main factor that triggered this decline was Coinbase’s decision to withdraw support for the CLARITY Bill, an important crypto-related regulation being discussed in the US Congress. The move has shaken investor confidence and cast doubt on regulatory certainty in the United States.

Meanwhile, institutional investors seem to be pulling out. The spot Bitcoin ETF in the US recorded net outflows of $1.33 billion between January 19 and 23. Other ETFs were also affected, with losses of $611 million over the same period. Notably, BlackRock’s ETHA ETF saw redemptions of $432 million.

Adding to market uncertainty, former President Donald Trump threatened to impose 100% tariffs on goods from Canada. He accused Canada of engaging in a backroom deal with China, which sparked geopolitical tensions. As a result, nearly $100 million exited the crypto market.

The CLARITY bill itself is still pending in Congress, and uncertainty is growing amid fears of a possible US government shutdown.

Read also: Bitcoin Price Recovers to $88,000 Today: What’s Next for BTC?

Traders are now looking forward to a busy economic schedule this week, including the GDP report from the Fed, liquidity injections, interest rate decisions, as well as a number of important speeches. These events are expected to heavily influence crypto market sentiment.

Will BTC Price Recover This Week?

The price of BTC recently experienced a sharp decline, dropping below the key level of $90,000, which raises concerns about the dominance of the bearish trend in the short term.

Currently, Bitcoin price is at $87,911, after a sustained decline from its recent peak of around $95,500.

Technical indicators show that selling pressure is still dominant:

- The Relative Strength Index (RSI) recovered slightly to 40.75, but is still below the neutral zone (50), signaling weak momentum.

- TheMACD also remains in a bearish trend, where the MACD line is below the signal line.

If the BTC price drops further below $86,000, then the next support is expected to be around $84,000. On the other hand, to break this downward trend:

- The nearest resistance is at $90,000.

- Stronger resistance is around $92,000.

To avoid further declines, buyers (bulls) need to push prices back above these key levels. Without such a recovery, selling pressure could continue to dominate this week.

Follow us on Google News to stay up to date with the latest in crypto and blockchain technology. Check Bitcoin price, usdt to idr and tokenized nvidia stock price through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading the Pintu crypto app via Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Coingape. Bitcoin Price Prediction as Gold Breaks All-Time High. Accessed on January 27, 2026

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.