Download Pintu App

3 Altcoins with High Liquidation Risk this Week!

Jakarta, Pintu News – The “extreme fear” sentiment hit the market again in the last week of January. This atmosphere made short positions dominate. However, some data suggests that some altcoins could trigger massive liquidation due to their specific factors.

This week, altcoins such as Ethereum (ETH), Chainlink (LINK), and River (RIVER) are expected to cause nearly $5 billion in liquidation. Here’s why.

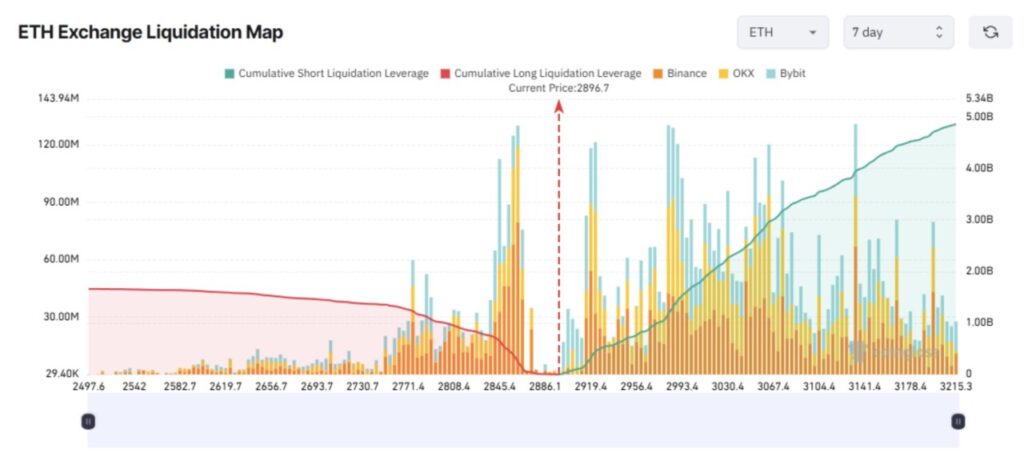

Ethereum (ETH)

The 7-day liquidation map for Ethereum shows a significant imbalance between the cumulative liquidation potential of short and long positions. Specifically, if ETH recovers to the $3,200 mark this week, short sellers could experience liquidation losses that exceed $4.8 billion.

Read also: Ethereum Price Prediction: Network Growth Promises $4,800 Target?

There is a clear reason for traders to be cautious. CW analysts, using Ethereum Whale vs. Retail Delta data, show that the whales have regained control of ETH in the past week. The method has gone from negative to positive and continues to rise sharply.

“Retail investors are liquidating, while whales are increasing their long positions. The ones suffering from this downturn are retail investors. Whales will continue to sow fear until retail investors give up,” said CW analysts.

A recent report from the BeInCrypto website also revealed that when the ETH price fell below $3,000, many whales increased their accumulation. This behavior could trigger a price recovery and cause huge losses for short positions.

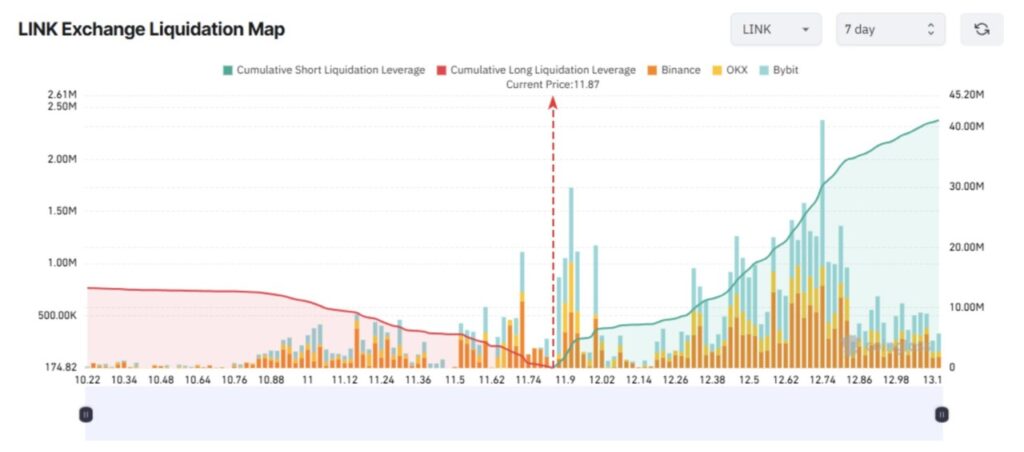

Chainlink (LINK)

Like ETH, LINK is also showing an imbalance on its liquidity map. The negative sentiment that hit the altcoin market in late January has prompted derivatives traders to allocate more capital and leverage to LINK’s short positions.

As a result, these traders will incur greater losses if LINK experiences a recovery. If LINK rises back to the $13 mark this week, the total cumulative liquidation potential of short positions could exceed $40 million.

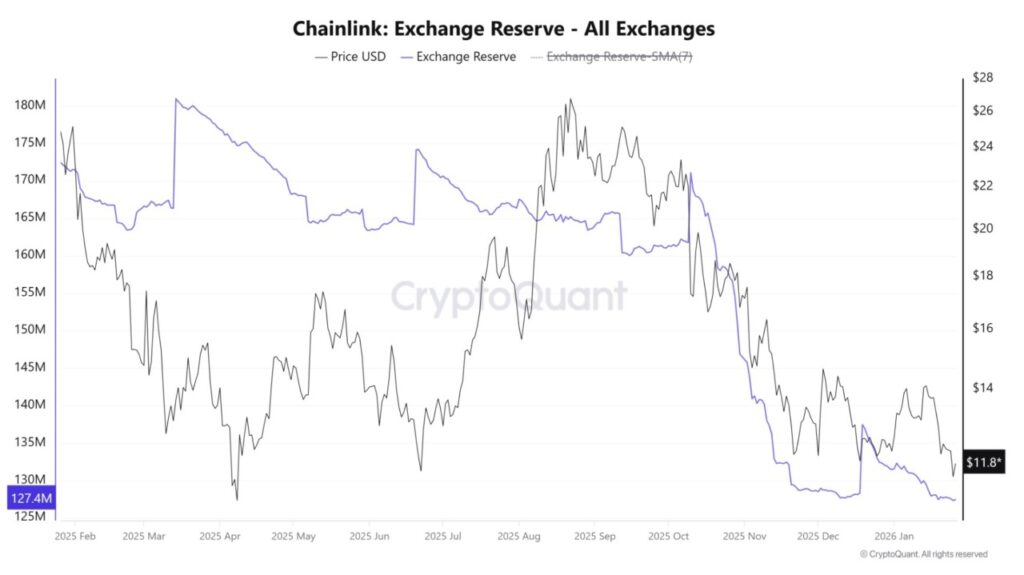

Meanwhile, data from exchanges showed that LINK reserves hit a new monthly low in January, according to CryptoQuant. The chart shows that despite the price decline, investors continue to accumulate LINK and withdraw it from exchanges. This behavior reflects long-term confidence in the asset.

Additionally, data from on-chain analytics platform Santiment identified LINK as one of the undervalued altcoins after the recent market correction.

If accumulation pressure increases amid the price decline, a sudden recovery could occur. Such a move would increase the risk of liquidation for LINK short sellers this week.

Read also: After Hitting a Local Low, XRP Builds Momentum for a Potential 11% Rally

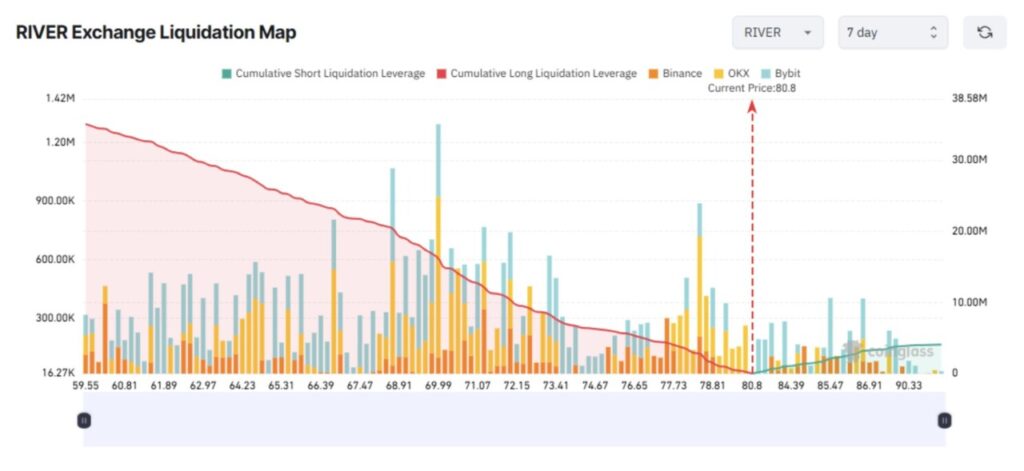

River (RIVER)

River is a decentralized finance (DeFi) protocol that delivers a chain-abstraction-based stablecoin system. It allows users to store collateral on one blockchain and access liquidity on another without the use of bridges or wrapped assets.

RIVER’s market capitalization is moving against the general market trend and has reached a new high of over $1.6 billion. Just a month ago, its market capitalization was still below $100 million.

This rapid spike triggered FOMO behavior among traders. As a result, long positions now dominate, potentially creating a large liquidation value on the long side.

If RIVER prices move beyond expectations and fall below $60 this week, long positions could suffer liquidation losses of up to $35 million.

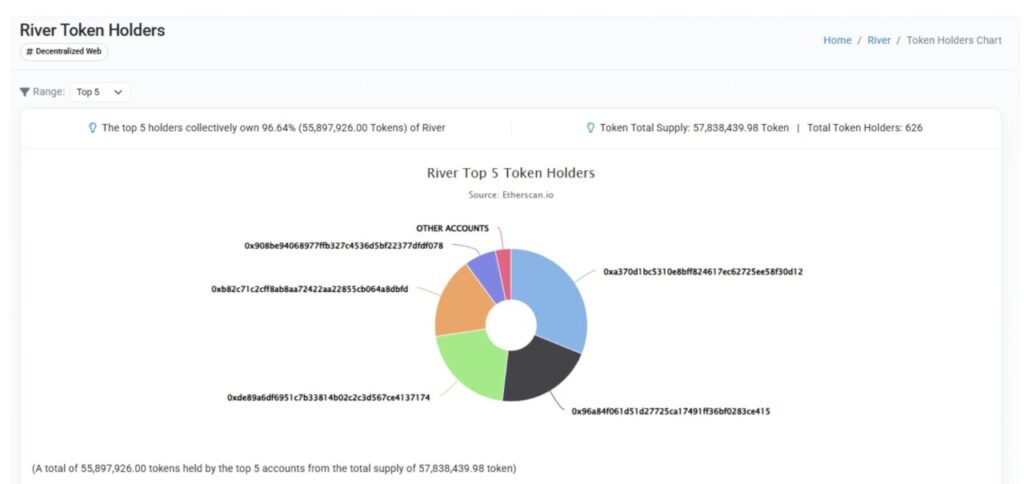

Is this scenario likely? On-chain data provides some warning signals. Data from Etherscan shows that RIVER’s top five wallets control more than 96.6% of the total supply, signaling a very high concentration of ownership.

“It’s controlled by the inside, that’s all. Please continue to manipulate. It used to start from MYX, COAI, AIA and ended up almost zero. Be careful,” said an investor named Honey.

While some investors remain confident that RIVER will break $100 soon, there are also those who are starting to doubt and fear a price reversal. If that reversal occurs, the risk of a large liquidation of RIVER’s long positions could materialize.

These three altcoins showed different market dynamics in the altcoin space at the end of January. In general, analysts agree that the altcoin market is becoming more selective. Only assets that attract institutional interest are likely to be able to sustain capital inflows and long-term growth.

Follow us on Google News to stay up to date with the latest in crypto and blockchain technology. Check Bitcoin price, usdt to idr and tokenized nvidia stock price via Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading the Pintu crypto app via Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. Altcoins Face Liquidation Risk in Final Week of Jan. Accessed on January 31, 2026

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.