Download Pintu App

Grayscale Moves Closer to Sui ETF Approval with Official Filing Update to U.S. SEC

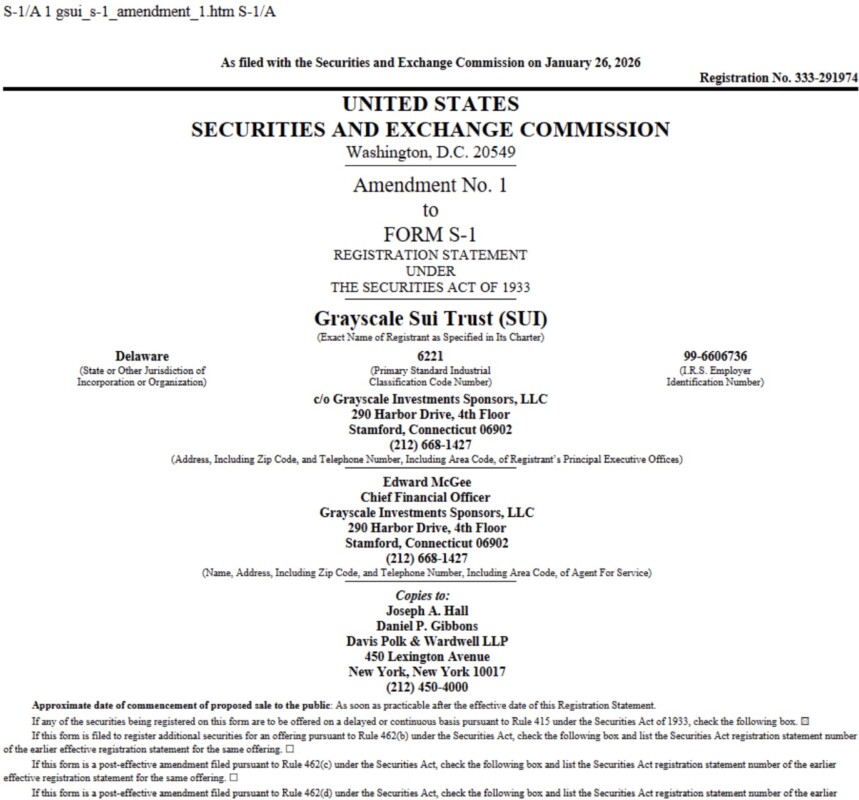

Jakarta, Pintu News – The launch of the spot Sui (SUI) ETF is getting closer after Grayscale amended its Spot Sui Staking ETF filing with the US Securities and Exchange Commission (SEC).

Several other issuers, including Bitwise and Canary Capital, are also applying for regulatory approval, which could trigger an increase in SUI prices.

Grayscale Updates Sui ETF Filing with US SEC

According to recent documents from the US Securities and Exchange Commission (SEC), crypto asset manager Grayscale has filed the first amendment to the S-1 form for its Sui ETF. If approved, the fund will provide exposure to the price of SUI while generating returns through a staking mechanism.

Read also: VanEck Launches First Spot Avalanche ETF in the US: Time for AVAX to Rise?

In the latest filing, Grayscale added more information regarding staking, risk factors, and regulatory events. However, they have not disclosed the amount of management fees, staking service providers, or potential fee write-offs.

Grayscale also plans to rename the fund as the Grayscale Sui Staking ETF and apply for permission to list and trade its shares on NYSE Arca under the ticker GSUI. Currently, Grayscale Sui Trust shares are still traded on the OTCQB market.

Bank of New York Mellon will act as the transfer agent and administrator of this ETF. Meanwhile, Coinbase was appointed as the prime broker and Coinbase Custody Trust Company as the custodian of the fund.

As CoinGape has previously reported, Bitwise also filed for a Sui ETF with the US SEC. This move comes after the SEC approved several ETFs that follow altcoins such as XRP, DOGE, and SOL.

Will the SUI Price Increase?

As of January 27, SUI was trading at $1.44 with a market capitalization of $5.46 billion. Although down from its high, SUI’s price is recovering as activity on the network increases, such as 616,000 daily active users and 4.3 million transactions per day.

Read also: Hip-3 Hyperliquid Sets a New Record, Can HYPE Price Break $50 in February 2026?

On February 27, SUI’s lowest price was recorded at $1.43 and the highest at $1.46. However, trading volume declined by 32%, indicating reduced interest from traders. In addition, the unlocking of 54 million tokens worth nearly $80 million next week could increase selling pressure.

On the other hand, the derivatives market showed massive buying activity in the last few hours according to data from CoinGlass. Open interest (OI) for SUI futures rose 7.30% to $728.66 million in the last 24 hours. On Tuesday (Jan 27), XRP 4-hour futures open interest also rose by 2.60%, with nearly 1% gains on platforms such as Binance, OKX, and Bybit.

Follow us on Google News to stay up to date with the latest in crypto and blockchain technology. Check Bitcoin price, usdt to idr and tokenized nvidia stock price through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading the Pintu crypto app via Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Coingape. SUI ETF Nears Approval as Grayscale Amends S-1 with US SEC. Accessed on January 28, 2026

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.