Download Pintu App

Morgan Stanley Enters Crypto Space, Forms Specialized Unit and Appoints Digital Asset Strategist

Jakarta, Pintu News – Morgan Stanley is getting serious about strengthening its position in the global crypto and cryptocurrency industry. The giant investment bank has officially appointed Amy Oldenburg as head of digital asset strategy, marking a strategic step towards major expansion in the digital asset sector.

This appointment comes just weeks after Morgan Stanley announced plans to launch a number of crypto products, including exchange-traded funds (ETFs) and digital wallets. The move is seen as a strong signal that traditional financial institutions are aggressively entering the cryptocurrency market.

Amy Oldenburg’s Appointment and New Strategic Direction

Amy Oldenburg is a senior Morgan Stanley executive who has been with the firm since 2001 and has worked in the emerging markets equity division. Since November 2021, she has led the emerging markets team with a specific mandate to develop digital asset strategies. With his latest appointment, Oldenburg will lead the newly formed full crypto unit. This role reflects Morgan Stanley’s shift in focus from limited exploration towards strategic execution.

Oldenburg’s appointment also demonstrates an internal approach based on long-term experience. Morgan Stanley chose an internal figure who understands both global markets and the dynamics of financial technology. On several public occasions, Oldenburg has been vocal about the importance of a user-oriented crypto infrastructure. This illustrates that the bank’s strategy is not only to pursue products, but also ecosystems.

Digital Asset Team and Infrastructure Expansion

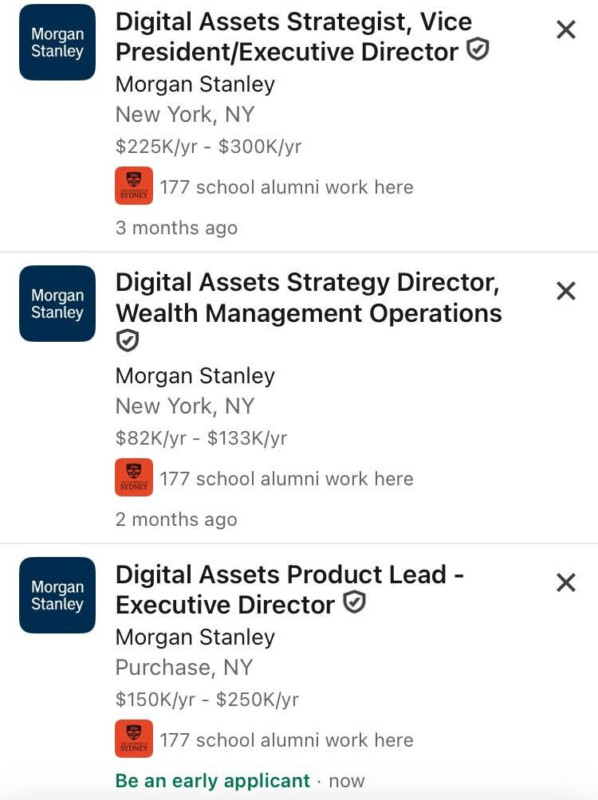

In addition to appointing new leaders, Morgan Stanley has also begun to actively expand its crypto team. A number of job vacancies related to digital asset strategy and products are listed on LinkedIn. Positions opened include director of digital asset strategy, crypto strategist, and product lead for digital assets. This move indicates a significant investment in human resources.

The expansion of the team is aimed at supporting the development of increasingly complex crypto products. Morgan Stanley is not only targeting passive investment products, but also utility-based solutions. In the context of the cryptocurrency industry, internal strengthening is often an indicator of long-term readiness. It also reflects institutional clients’ increasing demand for crypto exposure.

Bitcoin, Ethereum, and Solana ETFs in the Spotlight

In early 2025, Morgan Stanley applied to launch spot Bitcoin (BTC) and Solana (SOL) ETFs. The move was the bank’s big debut in the crypto ETF space after being relatively passive in the previous wave of institutional adoption. Not long after, Morgan Stanley also filed for an Ethereum (ETH) ETF with a staking feature. The product is designed to provide additional yield potential from staking activities.

Also read: XRP Locked at $2 Level for 14 Months, Crypto Analysts Hint at Big Breakout?

If approved by regulators, the ETF could potentially attract new fund flows from Morgan Stanley’s approximately 19 million wealth management clients. With such a broad client base, the impact on crypto market liquidity could be significant. The ETF also reflects the changing attitude of US regulators who are increasingly open to a variety of cryptocurrency products. For the market, this is an important catalyst in the institutional adoption cycle.

Crypto Wallet and Self-Custody Outlook

In addition to the ETF, Morgan Stanley is also preparing to launch a crypto wallet. This wallet is designed to support cryptocurrencies as well as tokenized real-world assets, such as stocks, bonds, and property. This initiative puts Morgan Stanley at the intersection of traditional finance and blockchain technology. The integration has the potential to expand the use cases of digital assets.

Amy Oldenburg herself is known as a strong proponent of the self-custody concept with the principle of “not your keys, not your coins.” She considers 24/7 liquidity access and full control over assets as the main values of crypto. Although he had previously criticized ETFs due to staking limitations, regulatory changes have made the product approach more flexible. This view shows that Morgan Stanley’s strategy is adaptive to market developments.

To conclude, Morgan Stanley’s move to appoint a chief digital asset strategist and expand its crypto product line confirms a major shift in the global financial sector. The investment bank is no longer just observing, but actively building a comprehensive cryptocurrency foundation. With a combination of ETFs, wallets, and a self-custody focus, Morgan Stanley has the potential to become a key player in the digital asset era. This development reinforces the narrative that crypto is increasingly integrated with the mainstream financial system.

Follow us on Google News to stay up to date with the latest in crypto and blockchain technology. Check Bitcoin price, usdt to idr and tokenized nvidia stock price through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading the Pintu crypto app via Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Cointelegraph. Morgan Stanley appoints new head of digital asset strategy. Accessed January 28, 2026

- Featured Image: X

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.