Download Pintu App

7 Important Facts about Record High Leverage on Ethereum (ETH) and its Impacts

Jakarta, Pintu News – Ethereum (ETH) is the second largest cryptocurrency after Bitcoin (BTC) and is often a barometer of crypto market sentiment at large. Recently, on-chain data showed leverage ratios on ETH derivatives contracts hitting record highs on several major exchanges, implying that traders are increasingly taking on borrowed positions to magnify their exposure. This situation creates an environment of high volatility that is important for both young and novice investors to understand.

1. What is Leverage Ratio and Why is it Important

The leverage ratio is a measure that shows how much borrowed capital is used in derivatives trading compared to actual capital. High leverage means that many traders use borrowed funds to enlarge their positions, which can accelerate profits but also increase the risk of loss.

In the context of ETH, a high leverage ratio means there are many open positions that depend on small price movements. This makes the market more sensitive to price fluctuations and can trigger large liquidations in a short period of time. Extreme leverage levels are often an indicator of systemic risk in crypto derivatives markets such as futures and perpetual swaps.

Read More: 5 Key Gold Price Predictions for 2026-2030 in the Context of Global Asset Markets

2. Ethereum (ETH) and the Record High Leverage

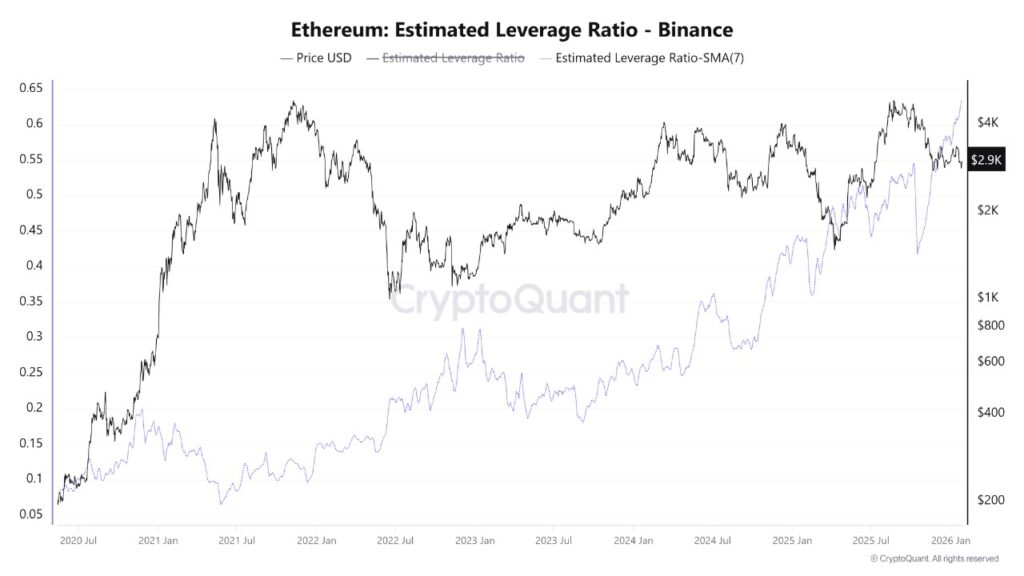

The latest market analysis notes that the Estimated Leverage Ratio (ELR) for ETH across several major exchanges remains at what are considered record levels, with the 7-day moving average touching around 0.63. The data shows a high concentration of leveraged positions on ETH, which means that many traders are betting heavily on Ethereum’s price movements.

This leveraged condition coincides with relatively stable but fragile price action, where ETH is trying to defend the psychologically important level around US$3,000.

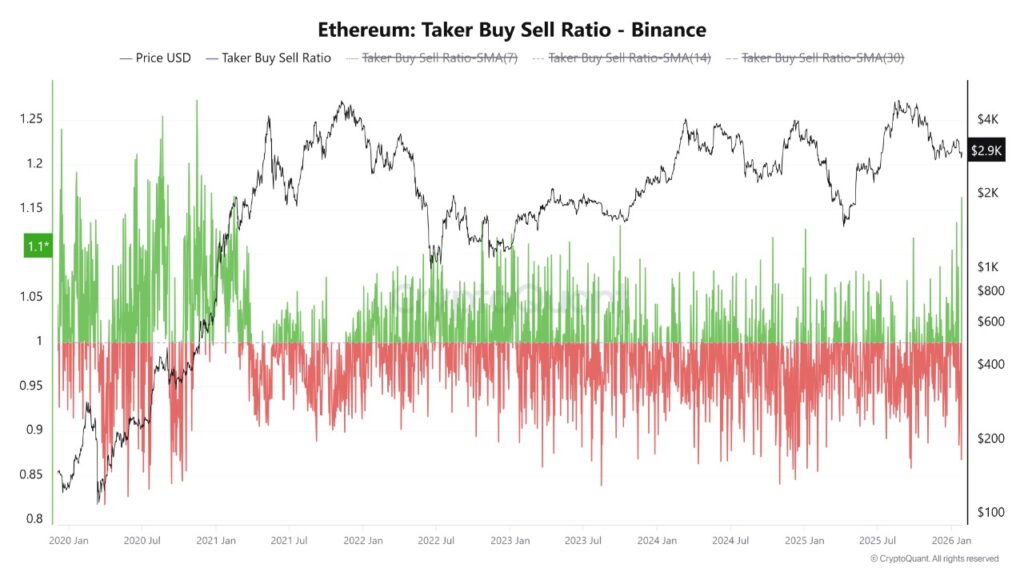

This weakness in market structure is further reinforced by instability in order flow data, which shows traders’ behavior reversing sharply in a short period of time.

Rapid changes in buy-sell taker ratios and exchange data suggest the market is moving more due to short-term positioning than sustainable trends.

3. Risk of Increased Volatility

Highly leveraged conditions increase market sensitivity to small price changes. Even seemingly moderate price movements can trigger large liquidations when margins are dragged across the threshold of leveraged positions. This means ETH volatility can increase suddenly, creating wider price ranges and sharper market movements.

Traders and investors who only hold spot ETH positions also feel the impact when prices move quickly due to leveraged behavior in the derivatives market. Highly leveraged markets tend to accelerate the expansion of volatility rather than creating stable price trends.

4. Price Consolidation and Derivative Pressure

After failing to break the highs around US$4,800 in recent times, ETH is entering a consolidation phase with a narrower price range. This puts extra pressure on leveraged positions, as the support level in the US$2,800-US$3,300 range becomes an important zone for traders.

Failure to maintain this support can drive liquidity down and trigger further selling by leveraged positions that are forced to close. With many traders depending on borrowing to maintain their positions, the interaction between price compression and high leverage magnifies the risk of unexpected price changes. Consequently, any macro sentiment or external trigger can set off a chain reaction in the derivatives market.

5. Influence of Market Sentiment and External Factors

Overall crypto market sentiment, including macro factors such as interest rate policy, global economic data, or statements from major regulators, influence the behavior of leverage in the market. When high leverage meets periods of market uncertainty, volatility can spike without warning.

For example, statements from central banks or changes in key economic data can instantly affect these leveraged positions, triggering large sells or buys in a short period of time. Because leverage magnifies exposure, market reactions to fundamental news or data are sharper than under low leverage conditions.

6. Implications for Beginner Investors

For young or novice investors, understanding the concept of leverage is key to navigating the complex cryptocurrency market. Leverage isn’t just an opportunity for greater profits-the risks involved can mean automatic liquidation when prices move against expectations.

Traders who don’t fully understand the consequences of leverage often lose money faster than experienced traders who practice strict risk management. Limiting exposure in the derivatives market or using hedging strategies can be ways to manage this risk.

7. Conclusion: Balance of Risks and Opportunities

The record high leverage in the Ethereum market reflects a vulnerable yet opportunity-filled phase of the market. For long-term investors, it is important to distinguish between leverage-driven short-term volatility and the long-term fundamental value of ETH as an underlying asset.

Understanding leverage dynamics as well as technical factors and market sentiment is an important part of a sound investment strategy. The crypto market is always dynamic; with the right knowledge, risks can be anticipated and opportunities explored wisely.

Also Read: 5 Important Insights Predicted SHIB Will Drop First Before Reaching New ATH

Follow us on Google News to stay up to date with the latest crypto and blockchain technology. Check Bitcoin price, USDT to IDR and Nvidia stock price tokenized via Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading the Pintu crypto app via Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

– NewsBTC. Ethereum Leverage Remains At Record High: What Happens Next? Accessed January 29, 2026.

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.