Download Pintu App

Dogecoin Slips to $0.12 — Is a Deeper Pullback Ahead?

Jakarta, Pintu News – The price movement of Dogecoin (DOGE) is showing more and more signs of vulnerability, as the market is still moving in a larger bearish pattern. Macro-wise, DOGE is still in a downward trend with a pattern of lower peaks and lower bottoms, indicating that downward pressure still dominates.

Although the price has stabilized near the long-term support of $0.12, the lack of participation from the buyers’ side raises concerns that this level may not hold for long. With trading volumes continuing to decline, the likelihood of a sharper price drop-even to the point of capitulation-is increasing.

Dogecoin Price Drops 1.30% in 24 Hours

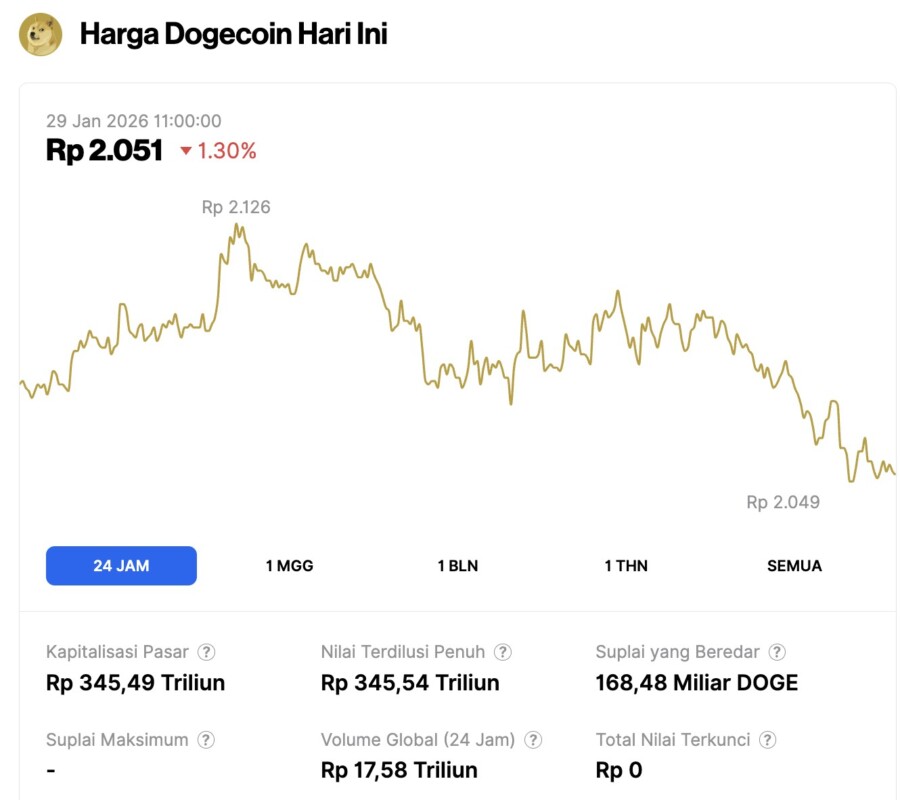

On January 29, 2026, Dogecoin saw a 1.30% decline over the past 24 hours, trading at $0.1220 — roughly IDR 2,051. During this period, DOGE fluctuated between IDR 2,126 and IDR 2,049.

At the time of writing, Dogecoin holds a market capitalization of approximately IDR 345.49 trillion, with a 24-hour trading volume of around IDR 17.58 trillion.

Read also: Ethereum Slips to $2,900 as Whales Scoop Up $1.3 Billion in ETH Amid ERC-8004 Buzz

Key technical points of the Dogecoin price:

- The bearish market structure persists: The pattern of lower tops and lower bottoms still dominates.

- Long-term support of $0.12 is under pressure: Buying volume continues to decline.

- Stored liquidity is below support; in case of a breakdown, the downward momentum could accelerate.

Dogecoin’s recent attempts to climb higher continue to be held back at the upper resistance area of the channel, which has been respected with precision. This resistance area coincides with a retest of the lowest value area, forming a strong technical rejection zone. Any rejection from this area triggers renewed selling pressure, which pushes the price back to the bottom of the moving range.

Instead of showing signs of accumulation, the rallies appear to be corrective in nature – indicating a distribution rather than a continuation of the strong uptrend. This pattern further reinforces the overall bearish bias and highlights the lack of conviction from buyers at higher price levels.

Support $0.12 becomes critical point

The latest price drop has brought Dogecoin back to the $0.12 level, an area that has historically often attracted buying interest. However, this time the context is different. Unlike previous reactions, buying volume has continued to decline as the price consolidates around this zone.

This discrepancy between price stability and volume weakness is often the first signal of a sharp decline, not a price bounce.

In previous cycles, retests at the bottom of the channel often resulted in a strong bullish engulfing candlestick pattern-a sign of aggressive demand. But this time, no such signal appeared. Instead, prices are moving around the midpoint of the channel, reflecting uncertainty rather than accumulation.

Liquidity Buildup Increases Risk of Capitulation

Prolonged consolidation near support levels often leads to a buildup of liquidity, especially if prices fail to bounce convincingly. Stop-loss orders and retained liquidity tend to pile up just below levels that get a lot of attention, such as $0.12. If this level is broken, it could trigger a quick sell-off due to the triggering of many stop-losses.

This kind of movement is often referred to as a capitulation, which is when the price falls sharply in a short period of time. In the case of Dogecoin, if there is a clear breakdown below $0.12, then it is likely that the price will move quickly towards the bottom support of the channel, where there is a deeper pool of liquidity.

Volume Weakening Strengthens Bearish Scenario

Volume analysis continues to favor the bearish scenario. Buying volume failed to increase during the consolidation phase, signaling buyers did not enter the market with conviction. Without the absorption of selling pressure, even a small selling pressure can have a big impact on the price.

Read also: Bitcoin Holds Near $88,000 as Traders Set Their Sights on $93,500 Liquidation Zone

Technically, weakening volume near support is a warning signal. It indicates that the market is not forming a solid base, but rather preparing for a further decline. The lack of demand significantly increases the likelihood that the price drop will be impulsive, rather than gradual.

Market Structure Still Leading Downward

In terms of market structure, Dogecoin hasn’t shown any significant signs of change that could undo the bearish trend. There are no higher price peaks yet, and momentum is still skewed towards the downside. Until this structure improves, any rally is likely to be resold, not continued.

Although painful in the short term, a capitulation move can be the beginning of a cleaner reset process and the establishment of stronger support. However, the process is usually preceded by sharp selling pressure.

Forecast of Further Price Movement

Dogecoin is approaching an important decision point. As long as the price stays around $0.12 and buying volume continues to decline, the risk of capitulation remains high. In the event of a confirmed breakdown below this level, the price will likely test the liquidity hold and move faster to the channel’s lower support.

Conversely, to invalidate this bearish scenario, a sudden surge in buying volume and a takeover of higher price levels is required. In the short term, price behavior around $0.12 will determine whether Dogecoin can stabilize or enter a deeper correction phase.

Follow us on Google News to stay up to date with the latest in crypto and blockchain technology. Check Bitcoin price, usdt to idr and tokenized nvidia stock price through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading the Pintu crypto app via Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- CryptoNews. Dogecoin price risks capitulation as bullish volume fades at $0.12. Accessed on January 29, 2026

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.