Download Pintu App

How Tesla, Meta, Microsoft, and Apple Could Shape the Market’s Next Move

Jakarta, Pintu News – 4 major companies will determine the direction of the stock market this week, where forward guidance or projections – not headline earnings – will likely be the determinant of whether the AI-driven stock rally will continue or weaken.

When Tesla (TSLAX), Meta Platforms (METAX), Microsoft (MSFTON), and Apple (AAPLX) released their earnings reports, investors focused more on statements about future prospects than past performance. The combined influence of these four companies on major indices makes this earnings week one of the most important of the year.

Crucial week for the market and the “Magnificent 7”

The market is facing volatile conditions, characterized by new record highs in Gold and Silver prices, a spike in Natural Gas prices that surpassed $6 for the first time in over three years, as well as the increasing likelihood of a US government shutdown.

Read also: Bitwise Moves Forward with Uniswap ETF Plans Despite a Sluggish Crypto Market

Under these conditions, investors’ attention is very much focused on Wednesday and Thursday. In addition to the Federal Reserve meeting, four of the seven largest companies known as the “Magnificent 7” will also release financial reports for the last quarter of last year.

Tesla, Meta, and Microsoft are scheduled to release earnings after the market close on Wednesday – right after the Fed meeting – while Apple will follow on Thursday after the market closes.

This series of reports is expected to heavily influence short-term market sentiment and could determine whether the AI-driven market rally will continue.

Tesla: Profit Pressure and the Optimus Narrative

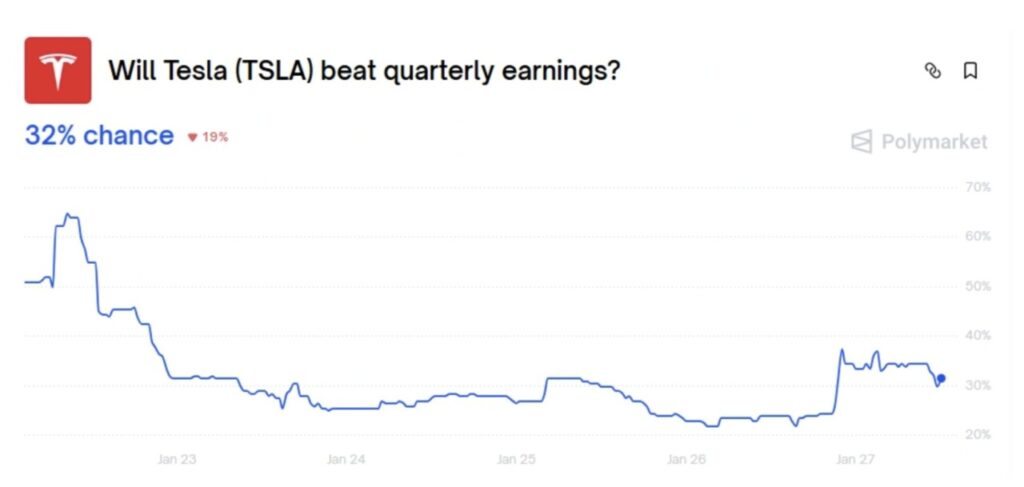

Tesla is facing high uncertainty ahead of its earnings report, which will be released after the market closes on Wednesday. In the previous quarter, Tesla failed to meet earnings per share expectations, and analyst projections this time around are mixed. Prediction platform Polymarket estimates that Tesla’s chances of exceeding profit expectations are below 30%.

Consensus estimates project that Tesla will post adjusted net income of $0.45 per share (EPS), on revenue of about $24.75 billion. This translates to a 38% drop in profit compared to last year, and a drop in revenue of about 4%.

The main focus of the market is likely to be on Austin, Texas, where Tesla is testing its Robotaxi service. Elon Musk recently stated that the Gigafactory in Austin will be the main location for Optimus humanoid robot training.

Tesla’s share price is closely tied to this Optimus project, which Musk calls “the biggest product of all time,” with sales planned to begin in late 2027.

Meta Platforms: Can AI Investments Generate Growth?

Analysts are quite optimistic ahead of Meta Platforms’ earnings report scheduled for release after market close on Wednesday. Wall Street expects adjusted earnings per share (EPS) of $8.19 on revenue of $58.41 billion.

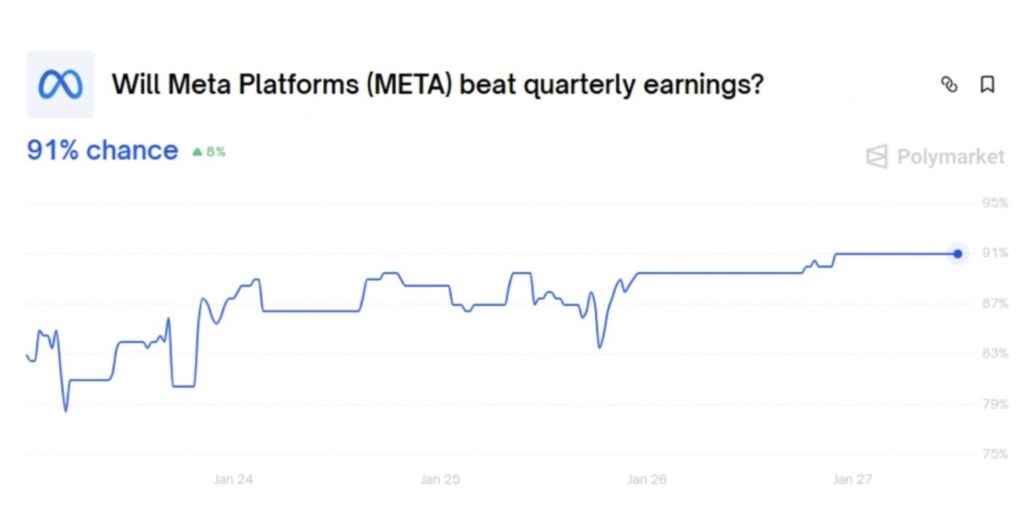

The revenue projection reflects growth of 21% over the previous year – a figure that may be difficult to achieve given the company’s increased spending on AI data centers. Meanwhile, profit growth is expected to be only around 2%. Polymarket currently predicts Meta’s chances of exceeding earnings expectations at 90%.

Investors are closely monitoring whether the massive capital expenditure is starting to yield tangible results in the form of improved profit guidance. Meta executives are also expected to highlight the progress of the company’s artificial intelligence lab, which reportedly just completed its first flagship AI model earlier this month.

However, the company has not announced when the model will be released to the public.

Microsoft: Profit Win Record Extension

Microsoft is aiming for a ninth consecutive earnings win, continuing a positive trend in which the company has exceeded consensus expectations for the past eight quarters. Analysts showed high levels of confidence ahead of the report this time, with most Wall Street firms raising their projections.

The consensus estimate currently forecasts adjusted earnings per share (EPS) of $3.92 on revenue of $80.28 billion. Polymarket gives a 94% chance that Microsoft will again exceed expectations.

Read also: Jerome Powell’s Speech Today: Bitcoin & Altcoins Prepare for Fed Rate Cut!

UBS analysts highlighted the progress of Microsoft’s Fairwater AI data center project in Wisconsin, which is on schedule and expected to reach full capacity of 500 megawatts by next summer. The flagship site reportedly cost up to $4 billion and houses hundreds of thousands of GB200 and GB300-class Nvidia GPUs.

According to UBS, the launch of similar data centers could significantly increase the growth rate of Microsoft Azure cloud services revenue, even as early as this quarter.

Apple: iPhone 17 Demand and Focus on China Market

Apple’s financial report to be released after market close on Thursday is expected to center on demand for the iPhone 17. Initial pre-orders are reportedly up 25% over the iPhone 16, with strong demand appearing consistent across early industry reports.

Particular attention is likely to be on the Pro Max model, which is more popular than the standard iPhone 16 version. Investors will also be keeping an eye on developments in China, where Apple is expected to see an increase in market share. Historically, demand from China has had a major influence on Apple’s profit performance.

With global smartphone sales growth slowing, maintaining and expanding market share is crucial for Apple. Wall Street expects earnings per share (EPS) to grow 10% to $2.68 on revenue of $138.47 billion.

This target is widely considered realistic, but the guidance for the next quarter is considered a major risk factor. Polymarket currently estimates Apple’s chances of exceeding expectations at 92%.

Why These Four Companies’ Financial Reports Matter to the Whole Market

For the overall stock index, the strong performance of these four companies is seen as crucial to maintaining the momentum of the AI-driven market rally. If all four show weakness simultaneously, it could trigger a broader market decline.

The NASDAQ 100 – where these four stocks have a large weighting – briefly broke out of its six-month price channel in November last year. Since then, the index’s momentum weakened and its movement began to flatten. Over the past two months, the 25,800 level emerged as a key resistance point.

Meta, Microsoft, Tesla, and Apple collectively represent more than 16% of the S&P 500 index. With such a large weighting, the movements of these stocks have a huge influence. If their performance weakens, the impact will almost certainly be felt across the index. This makes earnings week one of the most crucial for the US stock market so far this year.

Trading US Stock Tokens on the Door

Imagine being able to buy shares of big companies like Nvidia (NVDAX), Amazon (AMZNX), Meta (METAX) in tokenized form for just a few thousand dollars. The good news is that you can now buy/sell tokenized US stocks from xStocks and Ondo at Pintu.

By leveraging blockchain technology, you can now enjoy a faster settlement process for tokenized US stocks, more affordable start-up capital, and a more global investment experience.

Trade on the Door Now!

Follow us on Google News to stay up to date with the latest in crypto and blockchain technology. Check Bitcoin price, usdt to idr and tokenized nvidia stock price through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading the Pintu crypto app via Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- FX Street. Big Tech Earnings: Tesla, Meta, Microsoft, Apple to steer market trajectory. Accessed on January 29, 2026

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.