Download Pintu App

7 Key Facts: Bitcoin Holds at USD 88K as Dollar Plummets 12 Months and Gold Sets Records

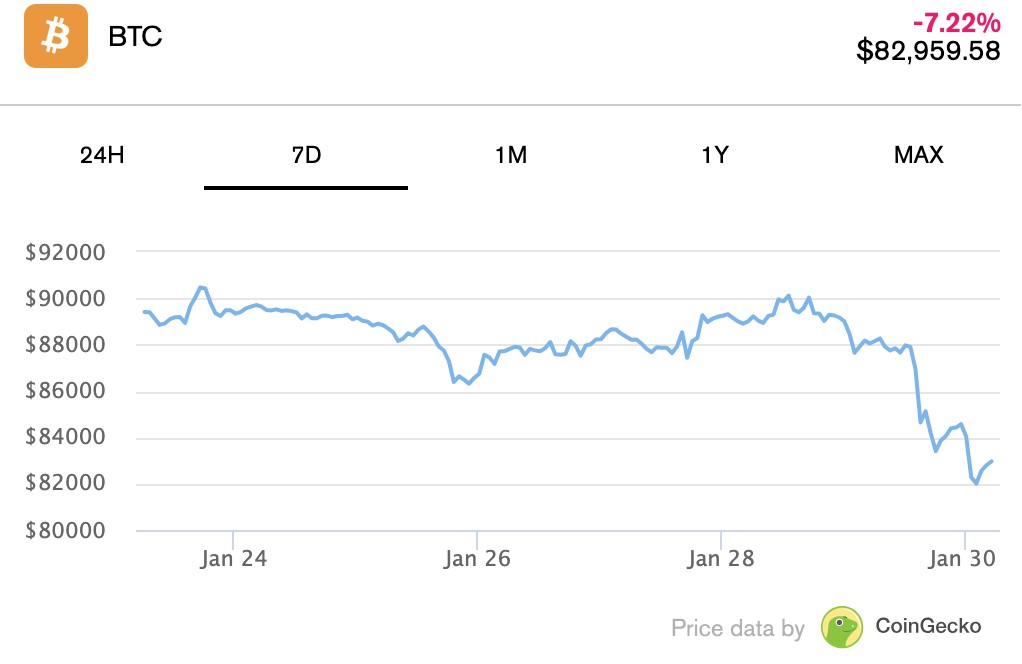

Jakarta, Pintu News – Bitcoin (BTC) price has remained relatively stable at around USD 88,000 despite the US dollar index falling to a 12-month low, while gold prices (XAU/USD) continue to print new highs in early 2026. These movements show the different responses between risky assets such as crypto and traditional safe-haven assets to macro market conditions.

1. Bitcoin Stabilizes Around USD 88,000

Bitcoin has shown strong price consolidation in the zone around USD 88,000 in recent sessions. This stability comes despite a significant drop in the value of the US dollar, which typically impacts global assets. The market seems to be in a relatively balanced phase between selling pressure and buying demand although volatility remains high.

Also Read: 7 Important Facts: Impact of Whale Sale on XRP Price

2. US Dollar Drops to 12-Month Low

The USD index fell to its lowest level in a year, reflecting a decline in sentiment towards the safe-haven currency. A falling dollar often pushes up the price of commodities pegged in dollars, such as gold. However, Bitcoin’s response to a falling dollar is more limited than other traditional assets such as precious metals.

3. Gold Reaches New Highs

Global gold prices recorded new highs in recent days, reinforcing the precious metal’s position as a safe-haven asset as market risk sentiment increases.

These highs are an expansion of a rally that has been ongoing since early 2026.

Global demand for gold is increasing as investors seek hedges against macroeconomic uncertainty.

4. Asset Response Divergence

The different responses to the dollar’s decline between Bitcoin and gold suggest differences in investors’ risk perception. Gold, as a traditional safe-haven asset, attracted capital flows while Bitcoin did not experience a balanced response. This reflects more complex market dynamics where digital assets are not yet fully treated as classic hedges by most market participants.

5. Macroeconomic Pressures and Risk Sentiment

The dollar’s decline in value and gold’s rally came amid market concerns about global economic growth. Investors tend to seek assets that offer long-term stability of value in times of uncertainty. This global risk sentiment also affected capital allocation between asset classes including stocks, bonds, commodities, and crypto.

6. Bitcoin Doesn’t Always Correlate with the Dollar

While Bitcoin is often viewed as an asset independent of traditional monetary policy, recent price movements highlight that the correlation with the dollar index is not always consistent.

BTC showed relative stability while the dollar plummeted, signaling that other factors such as internal crypto market dynamics and derivatives selling pressure played an important role.

Investors need to understand that Bitcoin may react differently to macro variables than traditional assets.

7. Implications for Crypto Investor Strategy

For crypto investors – especially new and young ones – this points to the need for a wise risk management approach, as Bitcoin does not always react to the same macro signals as traditional assets.

Portfolio diversification and understanding market dynamics across asset classes can help navigate short-term volatility. The correlation between crypto and traditional assets like gold or the dollar often changes with dynamic market sentiment.

Also Read: 5 Important Insights Predicted SHIB Will Drop First Before Reaching New ATH

Follow us on Google News to stay up to date with the latest crypto and blockchain technology. Check Bitcoin price, USDT to IDR and Nvidia stock price tokenized via Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading the Pintu crypto app via Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

– Nikhilesh De/Decrypt. Bitcoin Flat at $88K Despite Dollar’s 12-Month Slump, Gold’s New High. Accessed January 30, 2026.

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.