Download Pintu App

The Fate of Dogecoin and Shiba Inu in Q1 2026: Are the Meme Legends Losing Momentum?

Jakarta, Pintu News – Meme coins are back in the spotlight as traders look for early signs of a market shift. Dogecoin (DOGE) and Shiba Inu (SHIB) are showing contrasting signals, with whale behavior and on-chain data drawing attention.

While prices are still under pressure, deeper metrics are hinting at a potential turning point. The question now is, are these signals strong enough to trigger a significant recovery?

Dogecoin (DOGE)

Mega whale activity remains a major support factor for Dogecoin. Since the beginning of October 2025, wallets holding between 100 million and 1 billion DOGE have accumulated more than 9 billion tokens.

Read also: Dogecoin Price Crashes 6% Today: What Happened?

At current prices, the position is worth nearly $1.8 billion. This consistent accumulation indicates long-term conviction despite poor short-term performance.

However, their strategy has not resulted in a sustained price recovery. The DOGE price is still trading well below its previous highs. The positive signal is that these whales have not sold their holdings. This holding action has helped limit volatility and created a basis for price stability during the recent decline.

Dogecoin’s past could determine its future

In general, Dogecoin’s performance is still facing challenges. During the fourth quarter of 2025, DOGE lost almost 50% of its value. This decline wiped out most of investors’ gains and weakened market confidence. Selling pressure dominated as speculative interest in the meme coin dimmed.

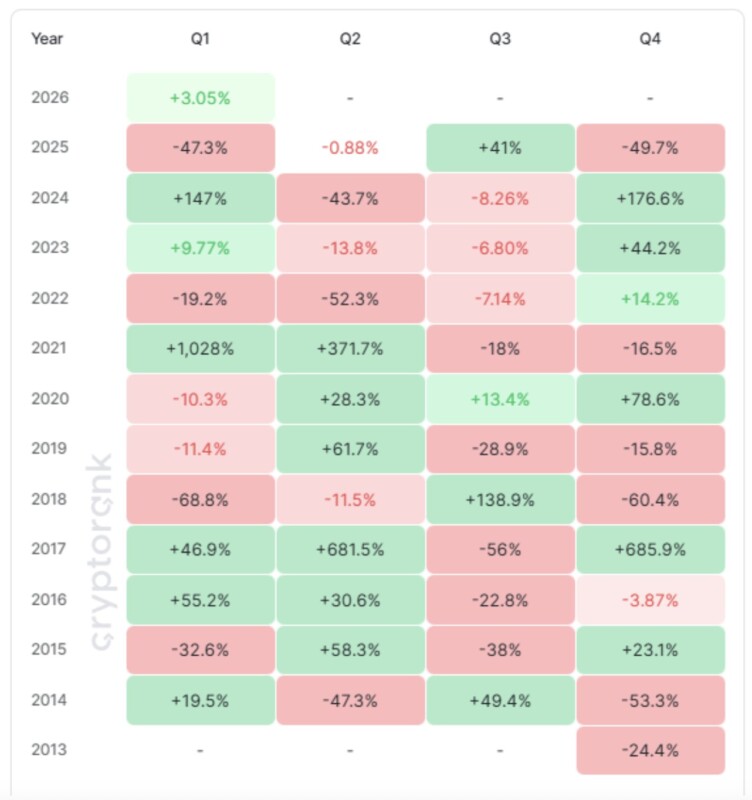

However, seasonal data offers a different perspective. Over the past 11 years, DOGE recorded an average return of around 93% every first quarter. While a surge of that magnitude is difficult to repeat, this historical trend supports a more optimistic view. Seasonal strength often coincides with increased appetite for risky assets.

Another supporting factor is DOGE’s involvement in discussions around ETFs. While spot products have not met expectations, exposure through regulated channels provides greater visibility. Increased institutional access could bring long-term benefits to DOGE, although the impact in the near term is limited.

DOGE price awaits strong bullish signal

The Dogecoin price has dropped by almost 20% in the last three weeks. Currently, DOGE is trading around $0.121. The meme coin is still holding above the $0.117 support level-a zone that managed to preserve most of the gains made earlier in the year.

Looking ahead, the price outlook is likely to be bullish as long as market conditions remain stable. A recovery towards $0.152 is the most realistic upside target, as this level previously served as important support in several market cycles.

A stronger rally that recovers losses by the fourth quarter of 2025 could potentially push DOGE prices to around $0.273, although this scenario would require support from broader market forces.

Downside risks remain if market sentiment deteriorates. Continued disappointment from spot ETF performance could put additional pressure on prices.

If DOGE breaks below $0.117, the price risks dropping to $0.113 or even $0.108. Missing this range will invalidate the bullish outlook and extend the correction phase.

Shiba Inu (SHIB)

Historically, Shiba Inu has performed strongly during the first quarter of each year. Data shows that the average return of SHIBs in Q1 stands at 35.8%. This seasonal trend provides a positive backdrop for SHIB’s price movement in early 2026.

Read also: Shiba Inu Price Prediction 2026: SHIB Suppressed in Bearish Trend Despite Burn Rate Surging 1,200%

However, this rise will most likely only make up for the losses incurred last November, rather than forming a new uptrend.

A stronger recovery requires consistent investor participation-and right now SHIB is getting it. The wallet activity shows that holders are still holding their positions, not exiting the market.

This behavior reflects increased confidence compared to the end of 2025. While market enthusiasm remains limited, existing support makes SHIBs more resilient amid broader market uncertainty.

SHIB Holders Begin to Change Attitudes

Macro momentum for Shiba Inu is starting to show signs of improvement. The Chaikin Money Flow (CMF) indicator continued to decline during the fourth quarter of 2025, signaling continued capital outflows. The trend depressed price performance and limited upside opportunities. However, from the beginning of 2026, the CMF began to reverse in an upward direction.

This increase suggests that selling pressure is starting to ease as outflows decrease. CMF measures capital movements based on price and volume data.

In the case of SHIB, reduced outflows indicate that investors are starting to be less aggressive in selling. If the CMF continues to rise and surpasses the zero line, it will confirm the presence of capital inflows. This shift usually favors a more sustained price increase.

SHIB prices likely to recover

The price of SHIB has dropped by 18.66% in the last three weeks. Currently, the token is trading around $0.00000754. The meme coin is still holding above the crucial support level of $0.00000751-a zone that managed to keep almost all the gains achieved in early January and continues to serve as a short-term floor.

Current conditions point to a potential reversal. The recent price drop, combined with increasing capital inflows, has formed a bullish divergence-a formation that often precedes short-term price bounces.

In case of recovery, SHIB has the potential to rise towards $0.00000836. If it manages to break through that level, the next target is in the range of $0.00000898 or higher. In a broader perspective, the medium-term target is around $0.00001285.

However, downside risks remain if investor support weakens. Failing to maintain support at $0.00000751 could signal a return of selling pressure. In that scenario, SHIB risks dropping towards $0.00000691 or even lower.

Such a move would invalidate the bullish outlook and prolong the correction phase. SHIB’s price stability is largely dependent on continued capital inflows and improving market sentiment throughout the quarter.

Follow us on Google News to stay up to date with the latest in crypto and blockchain technology. Check Bitcoin price, usdt to idr and tokenized nvidia stock price via Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading the Pintu crypto app via Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. Dogecoin and Shiba Inu Price Outlook for Q1: Are the OG Meme Coins Dying? Accessed on January 30, 2026

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.