Download Pintu App

Bitcoin Price Outlook: Exploring BTC’s Potential in February 2026

Jakarta, Pintu News – Bitcoin (BTC) price action has subsided after failing to break and hold above the $100,000 level in January. This rejection triggered short-term profit-taking and pushed BTC into a consolidation phase.

Since then, price movements have tended to stabilize compared to aggressive selling pressure. On-chain and macro indicators are now showing improved conditions. Investor positioning points to a cautious yet optimistic outlook for February.

Bitcoin Profit Bookkeeping Highlights Certain Patterns

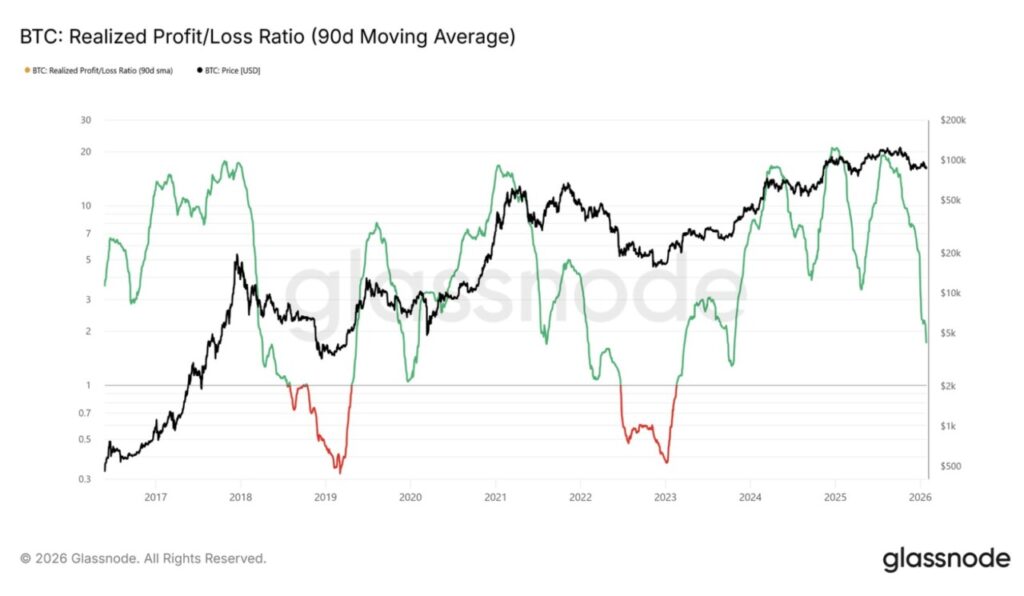

A meaningful transition towards a sustained Bitcoin rally should be reflected in liquidity-sensitive indicators. One of the most important metrics is the Realized Profit/Loss Ratio based on a 90-day simple moving average. Historically, a strong up phase has only occurred after this ratio has risen above the 5.0 threshold.

Read also: Bitcoin Price Plunges Sharply to $82,000 Today: 50-Day EMA Stagnates, Gold & Dollar Dominate!

The mid-cycle recovery in the past two years followed the same pattern. When the ratio fails to hold above the level, the price rally tends to lose momentum quickly.

A rise back above the 5.0 mark would indicate an influx of new capital into the market. It also indicates that profit-taking is being absorbed by new demand, rather than depressing prices.

Fed’s decision could affect prices

Macro conditions remain favorable after the latest policy decision from the Federal Reserve. The Fed kept interest rates on hold at its first meeting of the year. Chairman Jerome Powell described current interest rates as being in a “neutral range.” This statement signaled a potential longer pause, rather than continued tightening.

Market psychology also reinforces this background. According to data from Santiment, extreme sentiments often appear at market turning points. Optimistic and greedy sentiments tend to appear at market tops, while pessimistic and fearful sentiments usually precede a recovery. The current sentiment remains cautious, which often favors a gradual continuation of the rise.

The spot Bitcoin ETF could be the deciding factor in February. Over the past three months, the product has consistently recorded net outflows. In November 2025, the ETF recorded outflows of $3.48 billion. December followed with an additional outflow of $1.09 billion.

By January 2026, however, outflows slowed significantly to only $278 million. This slowdown suggests that selling pressure from institutions is starting to weaken. If flows start to turn positive in February, demand for ETFs could strengthen market stability. The new inflows will provide structural support and increase the chances of price increases.

Read also: 5 Reasons Why Bitcoin Price Could Plummet This Week

BTC price has an ambitious target

From a technical point of view, Bitcoin price is still moving within an ascending broadening wedge pattern. Recently, the price bounced off the lower boundary of the pattern. Currently, Bitcoin is trading at around $88,321.

To resume the uptrend, the buyers should be able to break the $89,241 level and reclaim the $90,000 psychological level. Acceptance of the price above $90,000 will confirm the strengthening momentum.

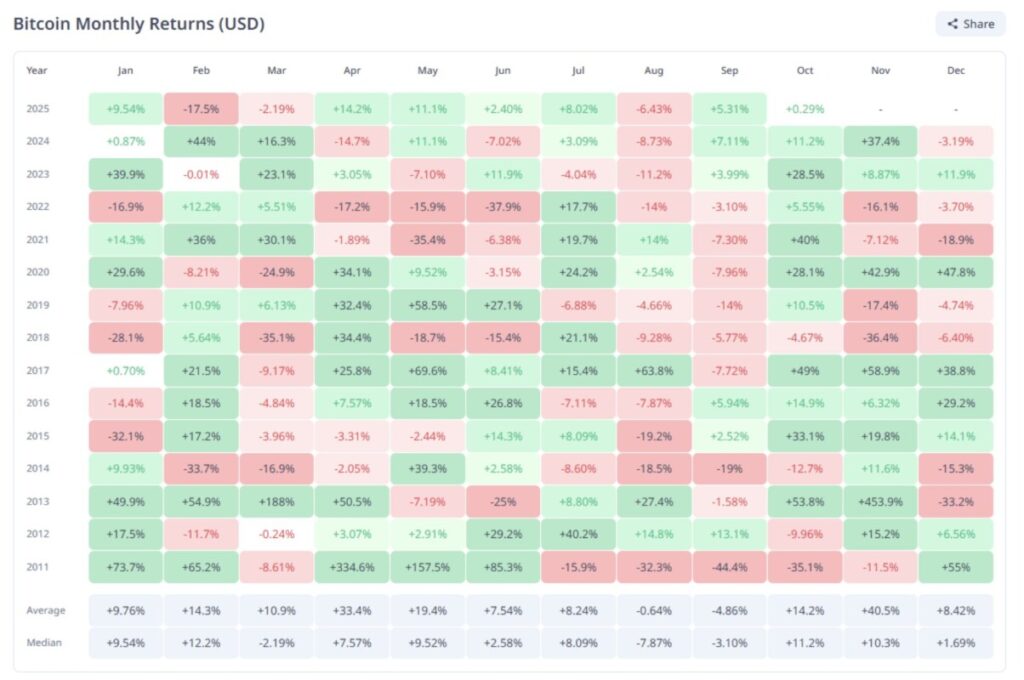

Historically, February tends to be a positive month for Bitcoin price, with an average gain of 14.3%. The factors already mentioned favor a similar bullish outlook for BTC, meaning a 14% gain would push the price towards $101,000.

If there is a confirmed breakout from the wedge pattern, then the door is open for higher targets. The first major target is around $98,000. After reaching it, there will likely be a controlled correction towards $95,000. This consolidation zone is important for forming strong long-term support. Such structures often precede larger follow-on moves.

However, downside risks should still be noted. If selling pressure reappears or macroeconomic conditions worsen, Bitcoin could fail to maintain current levels. A drop below $87,210 would increase the risk of further correction.

In that scenario, a drop towards $84,698 becomes a strong possibility. Such a move would invalidate the bullish pattern and delay the potential breakout.

Follow us on Google News to stay up to date with the latest in crypto and blockchain technology. Check Bitcoin price, usdt to idr and tokenized nvidia stock price via Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading the Pintu crypto app via Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. Bitcoin Price Prediction: What To Expect From BTC In February 2026? Accessed on January 30, 2026

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.