Download Pintu App

Hang Seng launches tokenized physical gold ETF, what’s the potential?

Jakarta, Pintu News – Hang Seng Investment Management officially launched a new physical gold ETF product in Hong Kong that paves the way for the integration of traditional assets with crypto technology and cryptocurrencies. The product comes amid growing investor interest in gold as a safe haven asset and blockchain as the financial infrastructure of the future.

With the support of physical gold storage and tokenization plans, this ETF reflects a shift in the global financial industry. This move by Hang Seng also confirms that tokenization is no longer just an experimental concept.

Hang Seng Physical Gold ETF Officially Listed on Hong Kong Exchange

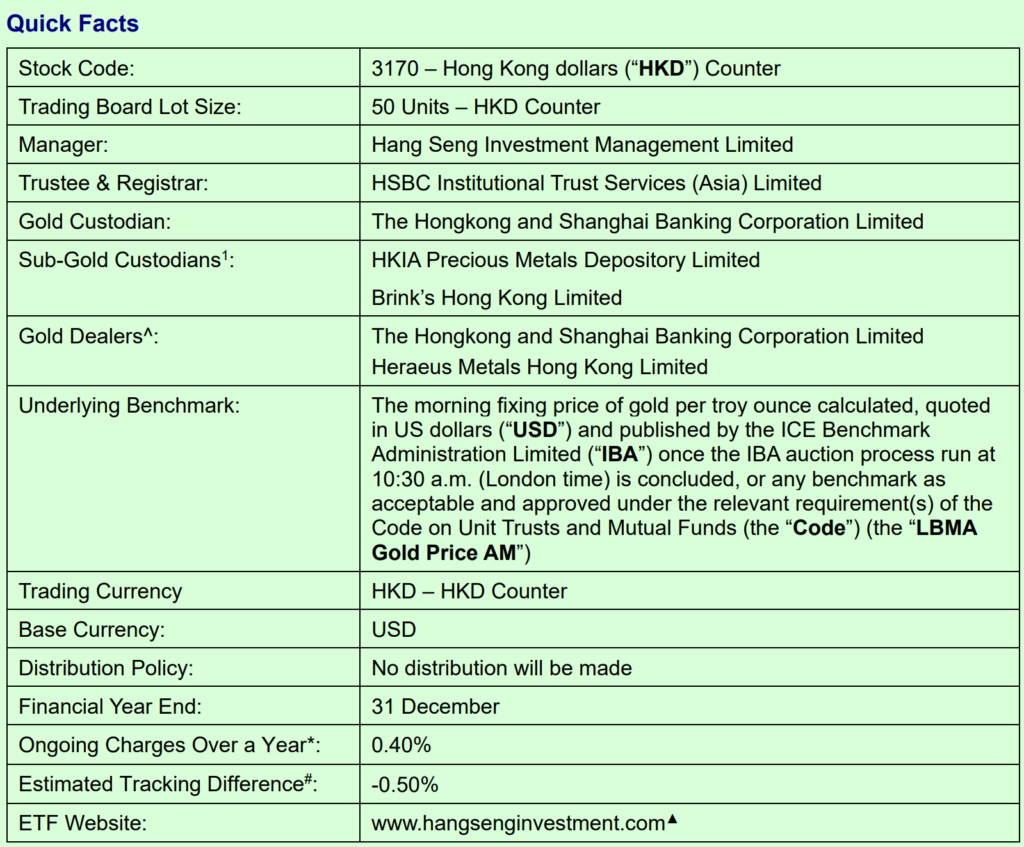

The Hang Seng Gold ETF began trading on the Hong Kong Stock Exchange under stock code 3170. The ETF is designed to track the movements of the LBMA Gold Price AM, which is a global gold price benchmark from London. The product is a passive ETF and is fully backed by physical gold in the form of London Bullion Market Association standardized gold bars. All gold is held in Hong Kong vaults with HSBC as the official custodian.

The ETF is traded in Hong Kong dollars with a lot size of 50 units per transaction. The annual management fee is estimated at 0.40 percent with a tracking spread of approximately minus 0.50 percent per year. Hang Seng emphasizes that this ETF will not distribute dividends to investors. As such, potential returns are entirely dependent on the movement of global gold prices.

Blockchain-based Gold Tokenization Plan

In addition to exchange-listed ETF units, Hang Seng also announced plans to present gold ETF units in the form of digital tokens. These tokenized units will represent ownership of the same ETF, but recorded through blockchain technology. However, the tokenized product is not yet available and is still awaiting regulatory approval. Hang Seng sees this move as part of long-term innovation.

HSBC is appointed as the tokenization agent that will issue digital tokens as proof of ownership of ETF units. Each token will represent one unit or part of a physical gold ETF unit. The blockchain infrastructure to be used in the initial stage is Ethereum (ETH), with possible expansion to other public networks in the future. Although crypto-based, these tokenized units can only be subscripted and redeemed through authorized distributors without trading on the secondary market.

Read also: Sony Injects Rp218 Billion into Startale, Soneium Projected to Become Global Crypto Engine

Gold Price Surge and Global Tokenization Trend

The launch of this ETF coincides with a surge in global gold prices that are getting stronger. Spot gold prices reportedly rose about 4 percent and broke through the level of US$5,530 per ounce. This increase was triggered by increasing global economic and geopolitical uncertainty. Gold has again become the top choice of investors as a hedge against financial market volatility.

On the other hand, tokenization of financial assets is also gaining attention from major institutions. The New York Stock Exchange and the Intercontinental Exchange are developing a blockchain-based tokenized stock and ETF trading platform. Meanwhile, industry reports predict tokenization will go mainstream by 2026, with up to 10 percent of new bond issuances potentially coming directly in tokenized form. This trend shows the convergence between traditional finance and the cryptocurrency ecosystem.

Follow us on Google News to stay up to date with the latest in crypto and blockchain technology. Check Bitcoin price, usdt to idr and tokenized nvidia stock price through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading the Pintu crypto app via Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- crypto.news. Hang Seng launches physical gold ETF with tokenization option. Accessed January 30, 2026.

- Featured Image: Finance Feeds

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.