Download Pintu App

Pi Network February 2026 Price Outlook: Reversal Ahead or Fresh All-Time Low?

Jakarta, Pintu News – Pi Coin is back in the spotlight after the downward price trend continued in recent days. This weakness deepens market losses and brings the asset closer to what could potentially be a new low.

Amidst weakening demand, investor support appears to be waning so selling pressure still dominates. This has left market confidence fragile, while also giving rise to speculation about the direction of Pi Coin in February 2026.

Negative Fund Flows Suppress Pi Coin Accumulation Interest

The flow of funds from Pi Coin holders has shown less encouraging signals in recent days. Withdrawal activity has increased, which is often read as an indication of capital exiting the asset.

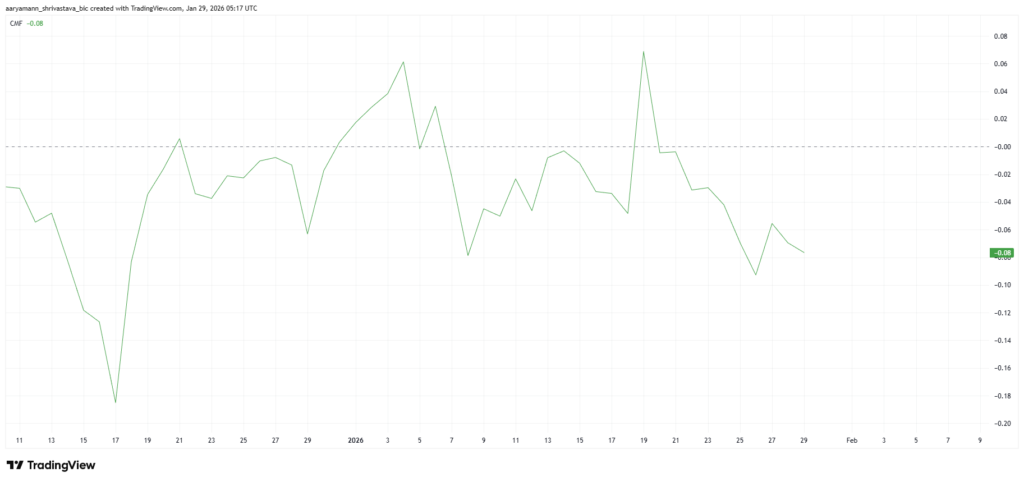

The Chaikin Money Flow (CMF) fell below the zero line and touched a six-week low. This pattern confirms that outflows are greater than inflows, so accumulation interest appears to be waning. Low CMF usually reflects weakened investor confidence and a tendency to wait on the sidelines.

Market participants appear reluctant to add to positions at current prices as downside risks remain open. Without a new buying push, price stability becomes difficult to maintain in the short term. The situation reinforces the narrative that a quick recovery still needs a stronger catalyst.

Also read: 3 Analyst Predictions on the Next Direction of Bitcoin, XRP, and Ethereum

Momentum Indicators Still Under Selling Pressure

Selling pressure is also reflected in the Money Flow Index (MFI), which is in negative territory. This indicator combines price and volume, thus illustrating the dominance of distribution over accumulation. When the MFI stays low, the chances of a sustained rally are usually slim as buyers tend to be passive.

In this context, Pi Coin is still in a momentum phase that does not yet favor a trend reversal. Historically, crypto assets often struggle to bounce back when the MFI is depressed for a long time.

Buyers generally wait for confirmation of improved volume flow before getting aggressive again. As long as the indicators have not moved up, price movements are potentially restrained and easily hit by negative sentiment. Broader market conditions, including Bitcoin (BTC) and Ethereum (ETH) dynamics, may also affect risk appetite towards altcoins.

Also read: 3 XRPL On-Chain Data Points to Potential XRP Recovery

Critical Support Level $0.166 to Determine Price Direction

From a technical perspective, Pi Coin is very close to the $0.166 level which acts as important support. This area is aligned with the 23.6% Fibonacci retracement which is often considered a “floor” in bearish phases. Staying in this zone is key to prevent a deeper decline. If this level is broken convincingly, the pressure could push the price towards an all-time low of $0.150.

However, recovery opportunities remain in case of a bounce off the Fibonacci support. The optimistic scenario targets a price return to $0.176 as a first step to improve the structure.

If $0.180 is successfully converted into support, the bearish outlook could lose ground and open up room for further gains. The psychological factor of the first anniversary in February 2026 could potentially trigger retail interest, although the 222% rally in February 2025 is no guarantee of a repeat.

Follow us on Google News to stay up to date with the latest in crypto and blockchain technology. Check Bitcoin price, usdt to idr and tokenized nvidia stock price via Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading the Pintu crypto app via Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- BeInCrypto. Pi Coin Price Prediction February 2026. Accessed on February 1, 2026

- Featured image: Coin Central

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.