Download Pintu App

Could Bitcoin Collapse in 2026? Rising Market Volatility Raises the Stakes

Jakarta, Pintu News – Bitcoin’s (BTC) recent price drop to a 2026 low of $81,000 has sparked discussion about how far the major cryptocurrency could fall this year and whether there will be another major crash.

This comes amid increased market volatility influenced by macro factors such as Trump’s tariffs, uncertainty from Fed policy, concerns over the health of the global economy, and rising inflation in the United States.

Bitcoin price threatens to fall further this year

In a post on platform X, on-chain analytics firm Glassnode stated that Bitcoin price is still at risk of further decline, despite having dropped to the $81,000 mark.

Read also: Bitcoin Plunges to $74,000, Falling Below Its Fair Value for the First Time!

Glassnode highlighted a $1.25 billion “short gamma pocket” around the $80,000 level, saying that if the price breaks this zone on net, then the risk of Bitcoin returning to the $70,000 range increases. They also added that this could be due to hedging activities by dealers that could accelerate downward pressure.

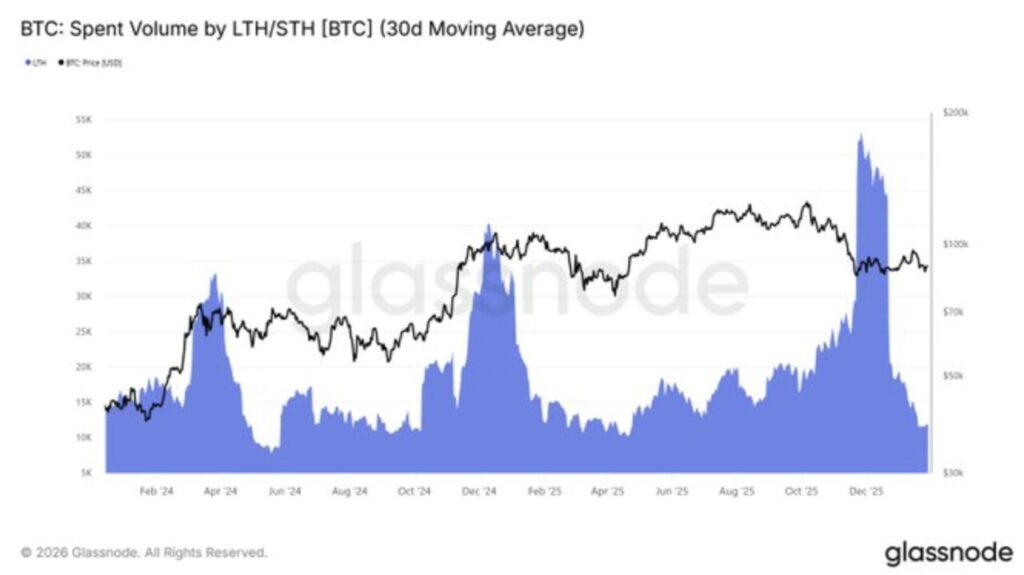

In another post, Glassnode also explained a number of factors that continue to put selling pressure on Bitcoin prices. One of the factors is long-term holders who are still actively selling.

In the past 30 days, long-term holders have distributed an average of 12,000 BTC per day, totaling 370,000 BTC in a month. “This indicates a large amount of distribution, which adds to the continued selling pressure,” Glassnode said.

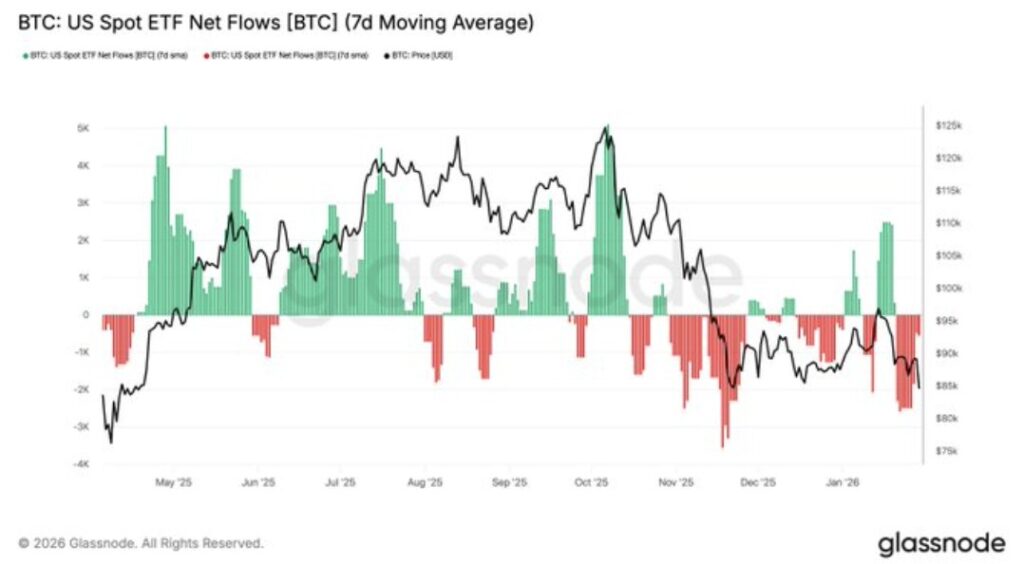

In addition, spot Bitcoin ETFs in the US have also shown net outflows recently, which Glassnode says reduces one of the main sources of spot demand. Without inflows from ETFs that could absorb supply, the downward pressure on Bitcoin price becomes stronger.

According to a report on the CoinGape website, the Bitcoin ETF recorded a daily net outflow of $818 million on January 29-the largest since November 20. Throughout January, net outflows totaled $1.61 billion, despite a strong start to the year.

Glassnode also revealed that Bitcoin miners are driving the price down, as they consistently send coins to exchanges, causing a net outflow.

“This distribution by miners creates structural selling pressure, which contributes to weakening prices in a sustainable manner,” they explained.

How far can Bitcoin go down?

Veteran trader Peter Brandt recently shared a chart showing that Bitcoin could potentially drop to $66,800. He noted that another sell signal has emerged, with a bear channel pattern now completed.

According to Brandt, to invalidate this downside prediction, the price of BTC needs to rise again and break the $93,000 level.

Read also: Ethereum Price Tumbles to $2,100 Today: Will ETH Rise or Continue to Crash?

Meanwhile, crypto analyst Ted attributed Bitcoin’s current price movement to patterns from previous cycles, suggesting that Bitcoin could potentially fall as deep as $30,000. However, he also stated that in his personal opinion, a drop that low is unlikely.

Analyst Michaël van de Poppe argues that the price of BTC has already hit all the major liquidity levels, so there is no need to drop below $80,000 to gather enough liquidity for abullish reversal.

He added that Bitcoin needs to break the $87,000 level, which could then pave the way to the psychological target of $100,000.

However, van de Poppe warns of two important factors to watch out for:

- Gold price – If the gold price corrects further in the coming week, then the Bitcoin price is also likely to fall.

- Geopolitical tensions – If former US President Donald Trump attacks Iran, there could be a surprising market reaction. Previously, Trump threatened Iran with an attack that would be “much worse” than last year, if they are not willing to negotiate.

This May Be the Lowest Point of Bitcoin Price

In a post on Substack, Bitwise advisor Jeff Park stated that the latest drop may have marked a low point for Bitcoin’s price. This statement comes after Bitcoin briefly fell to $82,000, following the announcement that Kevin Warsh was Trump’s preferred candidate to replace current Fed Chair Jerome Powell.

There are concerns that Warsh’s nomination will have a negative impact on Bitcoin, as he is known to be inflation hawkish (tending to favor tight monetary policy).

However, Park highlighted an alternative scenario, where Warsh’s policy of reducing the Fed’s balance sheet and rejecting further rate cuts could actually be a positive sentiment for Bitcoin.

In the scenario, Park predicted that the foundation of the financial system could be shaken by Warsh’s monetary policy. Long-duration assets would drastically decline in value, leading to cash flow outflows from them.

He argues that under these conditions, Bitcoin could actually benefit, as the crypto is not tied to any standardized benchmarks like traditional financial assets.

As long as Bitcoin remains scarce and in short supply, and other assets lose their reliability, it could become an increasingly attractive alternative to market volatility.

Follow us on Google News to stay up to date with the latest in crypto and blockchain technology. Check Bitcoin price, usdt to idr and tokenized nvidia stock price through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading the Pintu crypto app via Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- CoinGape. Will Bitcoin Price Crash in 2026 as Market Volatility Rises? Accessed on February 2, 2026

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.