Download Pintu App

Gold, Silver, or Bitcoin: Which Will Lead by the End of the Q1 of 2026?

Jakarta, Pintu News – Gold, silver and Bitcoin (BTC) showed different price movements in the first quarter of 2026 as macroeconomic conditions changed. The recent rise in precious metals prices, accompanied by Bitcoin’s weakness, reflects a change in investors’ strategies.

Policy signals, liquidity trends and market flows are expected to be key determinants in asset leadership until the end of the quarter.

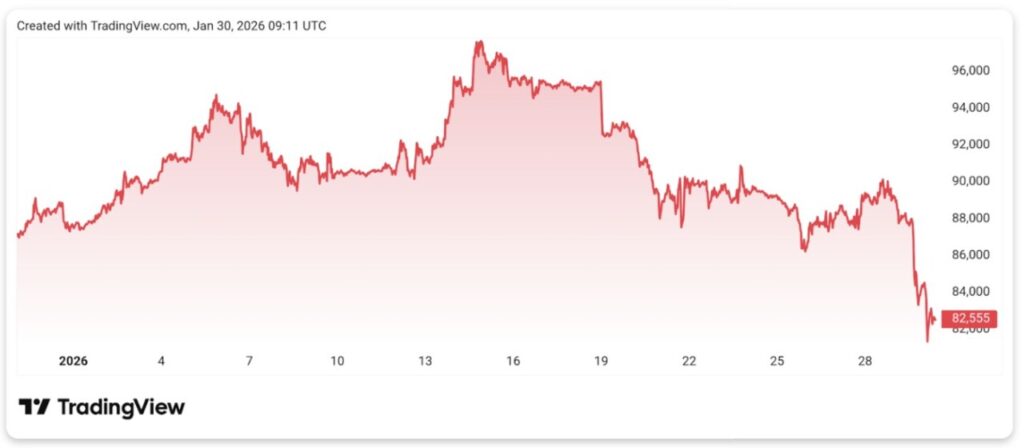

Bitcoin Weakens Amid Risk-Off Sentiment

At the end of January 2026, Bitcoin was briefly trading at $82,078, down 6.9% in a day and 7.1% in the past month, according to market data. This drop puts Bitcoin about 35% below its record high that exceeded $126,000 last October. This reflects declining interest in risky assets and reduced speculative activity in the digital asset market.

Read also: Nvidia in the Spotlight: Wall Street Analysts Reveal 2026 Stock Price Forecast for NVDA

Despite the correction, general macroeconomic conditions are still favorable for Bitcoin. The Federal Reserve has cut interest rates three times last year, bringing the benchmark rate down to a range of 3.50%-3.75%, and the market expects further easing by the end of 2026.

In addition, global liquidity, as reflected by the size of M2, remains high – a trend that has historically favored risky assets like Bitcoin.

However, institutional demand appears to be weakening. The spot Bitcoin ETF recorded net outflows of $4.57 billion during November and December 2025 – the largest since the ETF was launched. Annual net inflows also fell 39% on an annualized basis, from $35.2 billion to $21.4 billion.

Specifically, yesterday alone saw outflows of $817 million, as the Bitcoin price hit a two-month low.

This drop comes after a period of price consolidation earlier this month. Analysts from Glassnode noted a slowdown in on-chain activity, with transaction volumes declining and short-term holder participation also weakening. Inflows to the exchange increased during the sell-off, indicating profit-taking and risk reduction by traders.

Despite this, Bitcoin is still holding above the psychologically important $80,000 level. Analysts from CoinShares stated that macro liquidity conditions are still quite favorable in the medium term, but short-term price movements are likely to be affected by investor sentiment and global stock market trends.

Separately, analyst Benjamin Cowen said that Bitcoin is likely to continue to lag stock market performance, adding that expectations of a massive rotation from precious metals to cryptocurrencies are premature.

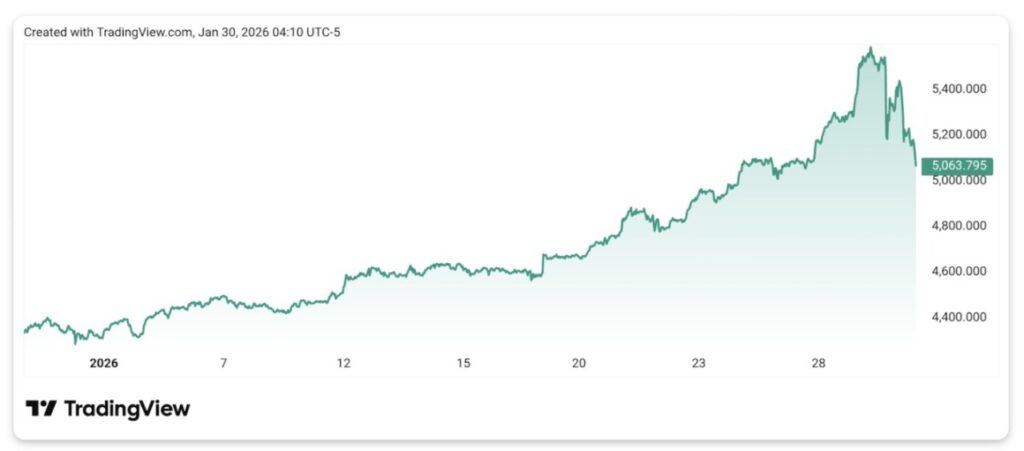

Gold prices fall after sharp gains in January

Gold prices stood at $5,171.12 per ounce at the end of January 2026, down 3.89% on the day, after profit-taking following a significant price surge earlier.

Despite the daily decline, gold still recorded a gain of 24.68% during January-up $1,065.07 since the beginning of the month. Central bank buying and safe haven demand supported gold prices during the month, especially amid ongoing geopolitical risks and inflation concerns.

Analysts from UBS stated that gold’s performance in January reflected continued diversification by reserve managers and institutional investors. However, they cautioned that a short-term correction remains possible after the sharp price increase.

Nevertheless, the resilience of gold prices has made it one of the best performing assets in the first quarter of 2026 so far.

Read also: Silver Price Forecast: XAG/USD Today

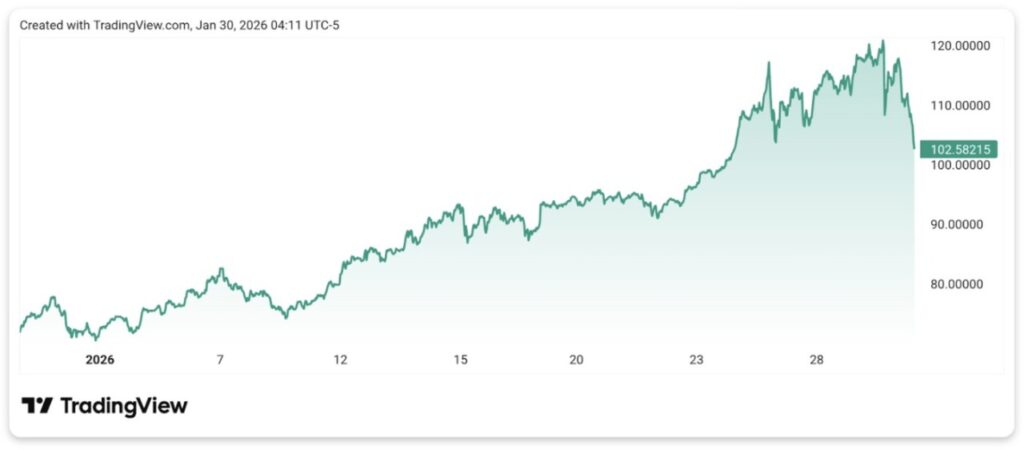

Silver Price Volatility Reflects Diverse Demand Signals

Silver prices briefly traded at $107.83 at the end of January 2026, down $6.67 or 5.83% in one day. This decline came after an earlier sharp rally, during which silver recorded a 51.95% (or $39.61) gain in the last 30 days.

Silver’s price movements reflect its dual role as a precious metal and industrial commodity. Analysts from Citi explained that expectations of increased demand from the manufacturing and clean energy sectors had driven prices higher, but profit-taking quickly triggered the latest decline.

They predict that silver prices could reach $150 per ounce, citing Chinese demand and other structural factors.

Compared to gold, silver showed much higher volatility throughout January. Despite sharper daily declines, silver’s monthly performance remains the strongest among the three assets (gold, silver, and Bitcoin).

Saxo Bank’s Ole Hansen warns that the rise in gold and silver prices has entered a higher risk phase, with heightened volatility starting to erode market liquidity.

Which Asset Led the Way as the First Quarter Progressed?

A comparison of asset performance during the first quarter shows a different pattern of leadership. Gold and silver recorded initial gains driven by safe haven demand, inflation concerns, as well as central bank buying. However, the rapid price surge has triggered profit-taking and a short-term correction.

In contrast, Bitcoin has been on the decline due to risk-off market sentiment and weakening institutional investment flows. On-chain indicators such as MVRV-Z and NUPL are currently showing neutral sentiment – neither in a state of extreme fear nor optimism.

Going forward, asset leadership until the end of the quarter will most likely be influenced by policy signals, investor portfolio rotation, and economic data to be released. If there are additional interest rate cuts, risk assets like Bitcoin could get a boost. Conversely, concerns over inflation and slowing economic growth could continue to benefit gold and silver.

Interestingly, analysis from Milk Road shows a historical pattern that Bitcoin tends to follow gold price movements with a lag of about six months. In this context, Bitcoin’s sideways movement amidst the gold rally could be more reflective of timing differences, rather than weak structural performance.

However, analyst Charlie Morris Edwards warns that the 18-month-long upward trend in gold and silver could still continue. He advises investors not to rotate capital into Bitcoin too quickly.

Follow us on Google News to stay up to date with the latest in crypto and blockchain technology. Check Bitcoin price, usdt to idr and tokenized nvidia stock price through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading the Pintu crypto app via Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- CoinEdition. Gold vs Silver vs Bitcoin: Which Asset Will Lead by the End of Q1? Accessed on February 2, 2026

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.