Download Pintu App

3 Meme Coins That Stole the Spotlight in the First Week of February 2026

Jakarta, Pintu News – Meme coins started February with renewed vigor as speculative appetite returned to the market. Recent launches, strong community growth, and aggressive price movements put several tokens in the spotlight.

Here is an analysis of three meme coins worthy of attention by investors in the first week of February, according to BeInCrypto analysis.

Buttcoin (BUTTCOIN)

BUTTCOIN emerged as one of the best performing meme coins this week, attracting high speculative interest. The newly launched token has already managed to attract more than 10,000 holders. As of February 2, BUTTCOIN was trading around $0.0213, reflecting its rapid adoption and growing short-term demand.

Read also: 3 Meme Coins Worth Monitoring Based on Recent Performance, Potential to Soar or Plummet?

The meme coin surged by 259% in the last seven days, setting a new record high of $0.0292. As the price is still in the price discovery phase, BUTTCOIN faces minimal technical barriers. This structure favors further upside potential, as momentum traders typically push prices higher during the initial phase of expansion.

However, there is a risk of correction from profit-taking. Early investors may choose to secure profits after this sharp surge. If selling pressure increases, BUTTCOIN could drop below the $0.0187 support level. A deeper correction towards $0.0125 would invalidate the bullish scenario and signal a weakening of momentum.

The White Whale (WHITEWHALE)

WHITEWHALE has emerged as a standout small-cap meme coin, with a 114% gain over the past week, despite the controversy. Currently, the token is in a consolidation phase after a sharp surge, moving in a price range between $0.099 and $0.070. This phase reflects slowing momentum after aggressive speculative flows.

This consolidation could be a “recharging” process, not a sign of trend exhaustion. The Money Flow Index is still high, indicating that buying pressure remains strong. If demand continues, WHITEWHALE has the potential to break the $0.099 level.

In case of a confirmed breakout, the next target is $0.123 and could go even higher.

However, there is a downside risk if market sentiment changes. If buying pressure weakens and selling pressure increases, WHITEWHALE could fall through the $0.070 support. If that happens, the next downside target is in the range of $0.048 or even $0.038. This scenario would invalidate the bullish outlook and extend the price correction phase.

Read also: Crypto Market Under Pressure: When Can Crypto Prices Recover from the Bearish Trend?

EGL1 (EGL1)

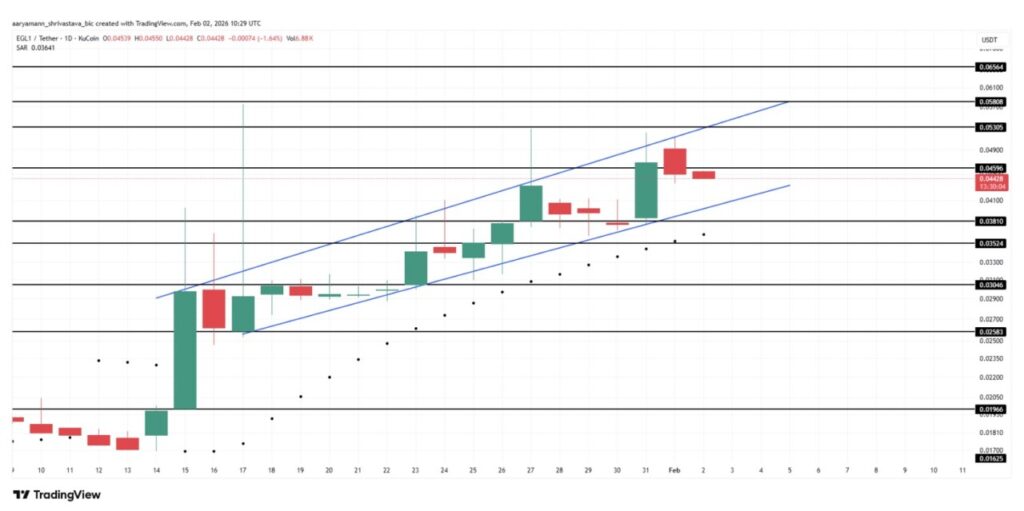

Over the past three weeks, EGL1 has continued to show a steady upward trend and was briefly trading around $0.044 (2/2). The meme coin has the support of more than 55,000 token holders, which helps sustain demand and strengthen the upward momentum of the EGL1 price.

The trend indicators are now signaling continued upside potential. The Parabolic SAR is below the price, signaling that the uptrend is still ongoing. This signal indicates that the bullish momentum still has room to continue. If buying pressure remains strong, EGL1 has a chance to rise further and test the $0.053 level in the near future.

However, caution is still required even if the market structure appears favorable. Currently, a rising wedge pattern is forming on the chart, which is often a sign of reversal.

If EGL1 breaks the support at $0.038, selling pressure could increase. A drop towards $0.030 will confirm the bearish scenario and invalidate the bullish projections.

Follow us on Google News to stay up to date with the latest in crypto and blockchain technology. Check Bitcoin price, usdt to idr and tokenized nvidia stock price through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading the Pintu crypto app via Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. 3 Meme Coins To Watch In The First Week Of February 2026. Accessed on February 6, 2026

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.