Download Pintu App

5 Crypto Indicators that Determine Whether the Big Altseason is Coming in 2026!

Jakarta, Pintu News – The cryptocurrency market is back in the limelight with speculations of an increasing likelihood of an altseason – a phase when altcoins outperform Bitcoin (BTC). Although a number of optimistic signals have emerged, current market conditions suggest that the big altseason has not really begun as some key indicators have yet to flip. The following article summarizes five important indicators that both investors and beginners need to understand to assess the probability of the 2026 altseason.

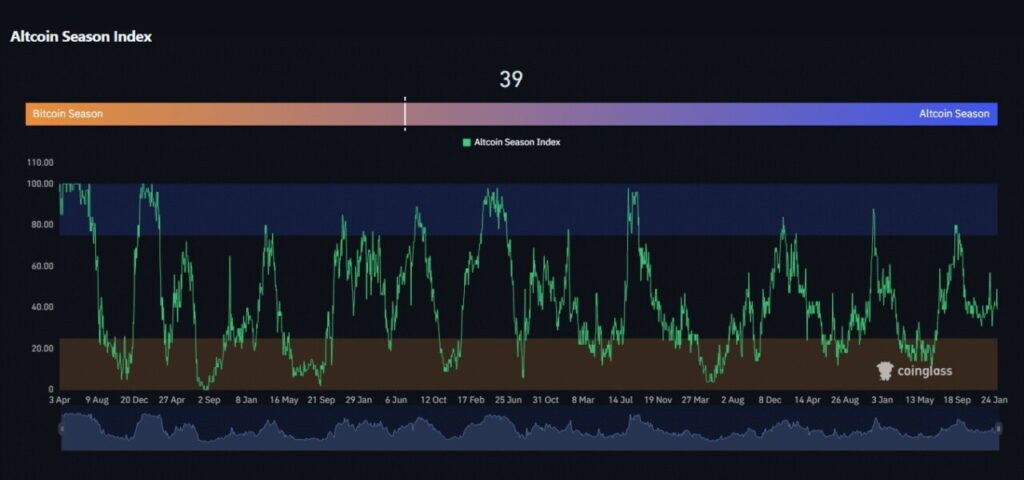

1. Altcoin Season Index Still Below Key Levels

One indicator often used to measure altseason is the Altcoin Season Index, which shows the percentage of market momentum that is outside of Bitcoin. At the beginning of February 2026, this index stood at 39, well below the threshold commonly associated with altseason (usually above 50-60).

This index value reflects that most of the market capital is still concentrated on Bitcoin rather than moving to other altcoins. In the context of crypto, we have not seen large capital flows supporting altcoins consistently. This indicates that the altseason momentum is still immature.

Also Read: 7 Shocking Bitcoin & Crypto Facts in Epstein Files: Crypto’s Early Traces Revealed!

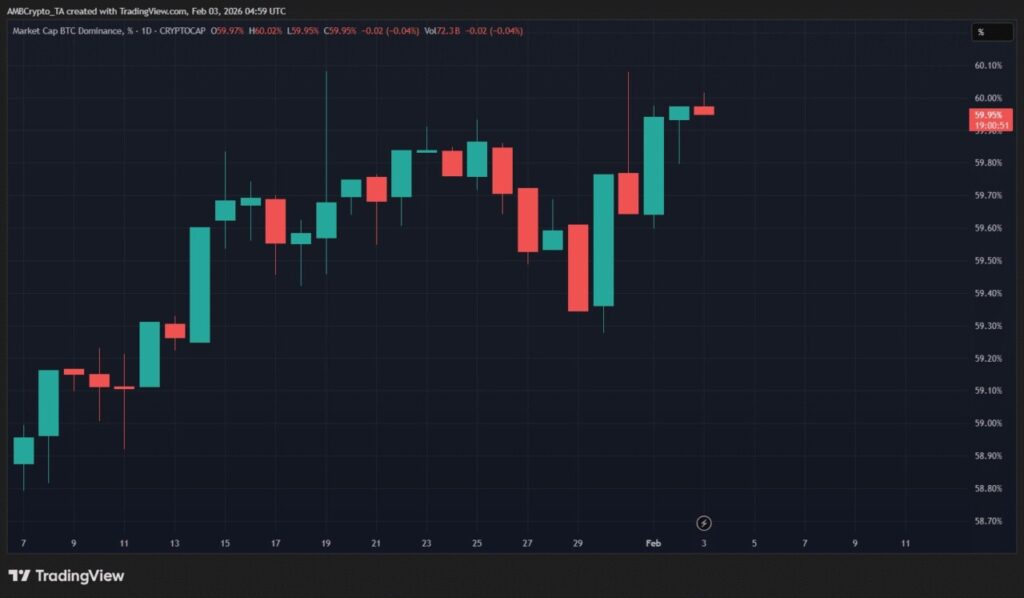

2. Bitcoin’s Dominance Remains High

Bitcoin Dominance ( BTC.D) is the percentage of Bitcoin’s market capitalization relative to the total crypto market capitalization. A high BTC.D often indicates that investors still prefer Bitcoin over rotating to altcoins. In the same period, BTC.D was still near the 60 percent level.

Historically, altseason often begins when Bitcoin dominance drops sharply towards or below the 50 percent mark, as this signals capital is starting to shift to altcoins. Still-high dominance means that selling pressure on altcoins is relatively strong and capital tends to stay in Bitcoin.

3. Ethereum (ETH) Performance Hasn’t Been Consistent

Ethereum (ETH) is often considered a leading indicator of altseason as it is the largest altcoin asset and often leads the altcoin market trend. But in the past 15 months, ETH has performed weakly with negative returns in many periods, showing an inconsistent uptrend.

ETH’s fragile performance record reduces the likelihood of a big altseason as other altcoins often follow ETH’s direction in broader market phases. Without a strong recovery from ETH, altcoin momentum forecasts remain inconclusive.

4. Macro Signals are Improving, but Not Strong Enough

Some macro indicators are showing improvement such as the manufacturing PMI in the United States returning to expansion territory, which has historically preceded the altseason. Nonetheless, the current PMI values are still below the threshold usually associated with a strong altcoin phase.

Improved macro conditions do have the potential to trigger positive market volatility for crypto in general, but not enough as a trigger for a broad alt-season. Macro indicators need to improve further or be combined with other signals.

5. Capital Rotation Has Not Occurred Significantly

For the altseason to really take off, market capital needs to move from safe-haven assets like Bitcoin to riskier altcoins. This capital rotation is usually visible through technical indicators, increased altcoin volumes, and a decrease in Bitcoin’s dominance. According to current data, capital is still concentrated in Bitcoin, while altcoins have not shown sustained growth in market capitalization.

Without clear capital rotation, the big altseason is very likely to be delayed or limited to a few specific altcoins. Investors should carefully monitor dominance movements, altcoin volumes, and advanced technical indicators.

Also Read: 4 Shocking Facts about Bitcoin Breaking Rp1.42 Billion: Similar to BTC April 2025 Technical Signal!

Follow us on Google News to stay up to date with the latest crypto and blockchain technology. Check Bitcoin price, USDT to IDR and Nvidia stock price tokenized via Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading the Pintu crypto app via Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Samyukhtha L KM/AMBCrypto. Is Altseason Finally Brewing?Only If THESE 2 Indicators Flip First. Accessed February 4, 2026.

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.