Download Pintu App

Bitcoin Price Prediction 2026: Is it the Right Time to Invest?

Jakarta, Pintu News – Bitcoin (BTC) price predictions for 2026 are increasingly showing an optimistic trend as the second half of 2025 comes to an end, with a new record high reaching $125,000 in that year. A strong wave of bullish sentiment is sweeping the market, drawing investors’ and traders’ attention to the next direction.

Market enthusiasm is at its peak. Investors are asking the questions: “Can Bitcoin sustain this dramatic surge?” and “Will it redefine the financial landscape in the next five years?”

This 2026 Bitcoin price prediction will take an in-depth look at the trends driving this historic rally. Read on for the full review.

Bitcoin Price Prediction February 2026

Since the end of November 2025, Bitcoin’s price movements have mostly consolidated within a narrow range between $84,800 to $94,500. However, this consolidation phase appears to be a large accumulation phase occurring near the long-term support trend line – this gives optimistic signals, but also creates tension as this price range creates a lot of speculation in the market.

Read also: Pi Network 2026 Price Prediction: Will Pi Coin Bounce Back or Fall Further?

Fears of a potential decline were finally confirmed in early February, when prices plummeted to $74,420. This level is now considered quite vulnerable – if the bearish pressure continues, then a deeper drop could be possible.

Conversely, if the price manages to reverse, then the $85,000 level will be the first important resistance, followed by the next resistance in the $89,000 range.

Bitcoin Price Prediction 2026

In early February, Bitcoin price broke the support of the ascending wedge pattern and fell to $74,420. This drop confirms the break of the pattern and opens up the possibility of further declines if the price fails to hold above $74,420.

However, if the price is able to bounce back from this point, the two major dynamic resistance areas to break are the 200-day and 50-day EMA bands. If both are successfully passed, the uptrend still has a chance of continuing.

Conversely, failure to break out of this area could mark the end of the bull cycle and open up space for a deeper downtrend.

Bitcoin Price On-Chain Overview

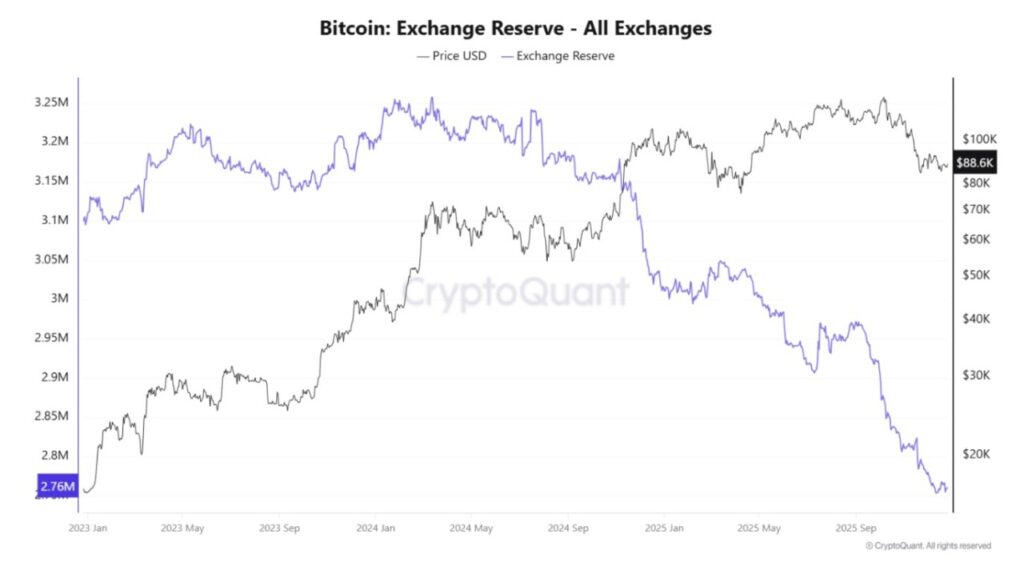

On-chain data through 2025 shows a strong accumulation and sustained decline in Bitcoin reserves on exchanges. This is an indicator of high institutional commitment, which is also reflected in spot Bitcoin ETF data in the US.

Read also: Bitcoin Falls Sharply: Crypto Winter Threat or Just a Cyclical Change?

Corporate adoption has also reinforced this trend, with public companies’ holdings of BTC nearly doubling since the beginning of the year.

Overall, Bitcoin’s price prediction for 2026 depends heavily on sustained buying demand, geopolitical stability, and regulatory clarity. If market sentiment remains bullish, the highest price target in this cycle is expected to reach $150,000.

However, if global uncertainty increases and market sentiment deteriorates, downside risks are expected to find strong support around the $70,000 level.

Follow us on Google News to stay up to date with the latest in crypto and blockchain technology. Check Bitcoin price, usdt to idr and tokenized nvidia stock price through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading the Pintu crypto app via Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Coinpedia. Bitcoin Price Prediction 2026, 2027 – 2030: How High Will BTC Price Go? Accessed on February 6, 2026

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.