Download Pintu App

5 facts that DOGE is still an investor’s choice in 2026

Jakarta, Pintu News – Investor demand to understand Dogecoin’s (DOGE) position in crypto portfolios is back on the rise after its recent rally and debates about its long-term value. It’s a classic meme coin that continues to attract market attention despite facing criticism about its utility. Here are five key points from recent analysis that are relevant for both investors and novices.

1. DOGE Supply Still Inflationary

Dogecoin has a supply mechanism that continues to grow every year because it has no maximum supply limit. This means that every year the amount of DOGE in circulation increases and can put pressure on price growth if demand is not matched.

As supply continues to grow, the rise in value of DOGE has become more dependent on market sentiment than the underlying utility of the crypto. This data points to structural challenges that investors need to understand before valuing DOGE as a long-term asset.

In addition to supply pressure, this makes DOGE’s long-term price target generally lower than some other altcoins that have a “deflationary” mechanism. As a result, DOGE’s long-term growth potential will be heavily influenced by the momentum of investor demand.

Also Read: 7 Shocking Bitcoin & Crypto Facts in Epstein Files: Crypto’s Early Traces Revealed!

2. Institutional Access Begins to Grow

One notable change in the Dogecoin narrative is the widening institutional access through DOGE-related products such as exchange-traded products in the United States. This opening up of access gives professional investors an organized way to get in touch with the meme coin without having to directly hold the asset. This is seen as adding legitimacy to DOGE in the eyes of some market participants, although it does not change its basic economic logic.

Such access could help increase the liquidity of DOGE as institutions tend to carry more capital. However, increased legitimacy does not necessarily mean that the fundamentals of DOGE will change drastically, especially if the utility of use does not evolve with it.

3. New Rally Volume and Market Sentiment

Several news stories have pointed to a rally in DOGE in recent periods, although price movements are often influenced by overall crypto market volatility and speculative action. Rallies often coincide with market momentum of other meme coins and positive sentiment on social media.

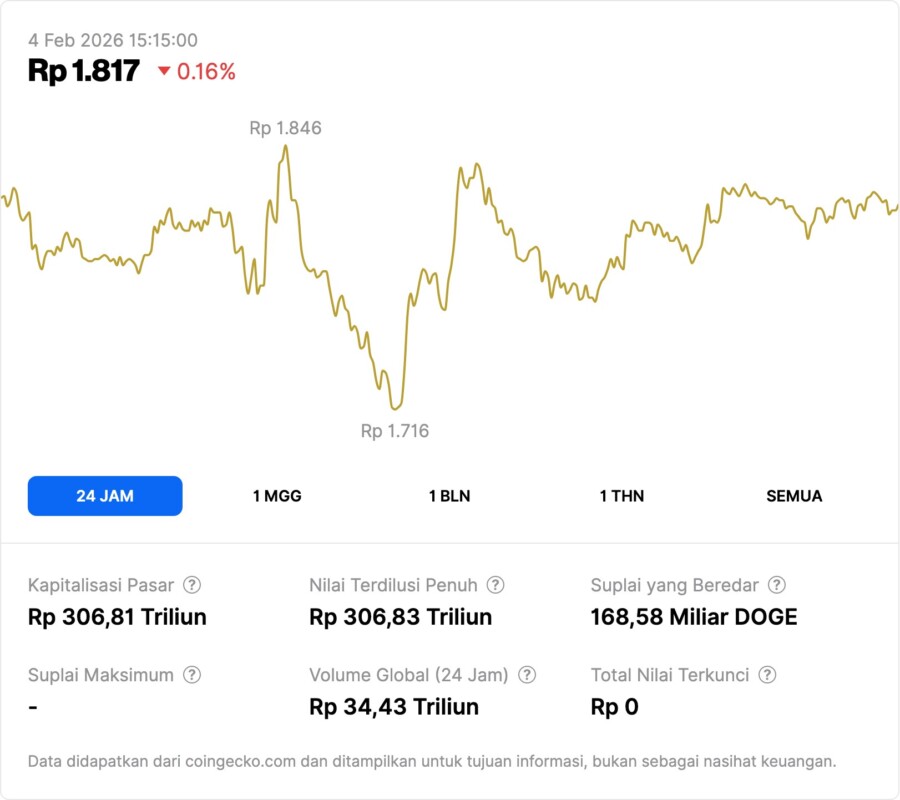

DOGE’s price data shows an up-and-down trend that is not necessarily driven by the utility of the technology, but rather the market’s reaction to news or hype sentiment.

This kind of behavior exposes the nature of DOGE, which tends to follow the broad sentiment of memecoins. This means that the price of DOGE is very sensitive to investor opinions and media buzz, which can make it very volatile and less stable than strong utility-based crypto assets.

4. Risk Diversification in Crypto Portfolio

Due to its unique characteristics – inflationary supply levels and highly sentiment-driven market action – Dogecoin is often viewed as part of a speculative portfolio rather than the main foundation of a long-term investment.

Many analysts suggest that investors consider diversifying by including assets that have real utility such as Bitcoin (BTC) or other altcoins with different functions, rather than relying solely on Dogecoin. This diversification can help balance risk if the crypto market experiences sharp volatility.

Historical data shows that meme coins often experience a phase of rapid spikes followed by sharp corrections, so a risk approach is important before making a large investment in DOGE. This diversification strategy reflects a moderate outlook that helps investors reduce dependence on a single asset whose fluctuations are influenced by hype.

5. The Long-Term Perspective is Still Debatable

The main debate about Dogecoin is its long-term fundamental value. On the one hand, DOGE’s strong community and brand awareness remain high, which could support liquidity. On the other hand, without clear technical utility and with inflationary supply, the long-term growth prospects are not as strong as some other advanced technology altcoins.

As such, the decision to include DOGE as part of a long-term investment strategy should take into account volatility risk and the role of DOGE in the overall portfolio. Long-term analysis often shows that DOGE is less competitive than other crypto assets that have stronger technology or utility functions.

Also Read: 4 Shocking Facts about Bitcoin Breaking Rp1.42 Billion: Similar to BTC April 2025 Technical Signal!

Follow us on Google News to stay up to date with the latest crypto and blockchain technology. Check Bitcoin price, USDT to IDR and Nvidia stock price tokenized via Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading the Pintu crypto app via Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- NewsBTC. Is Dogecoin Still Worth Investing In?DOGE Rally Sparks Debate Over Long-Term Value. Accessed February 4, 2026.

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.