Download Pintu App

5 Important Facts about Solana (SOL) Staying in $100 Zone and Crypto Trend Situation

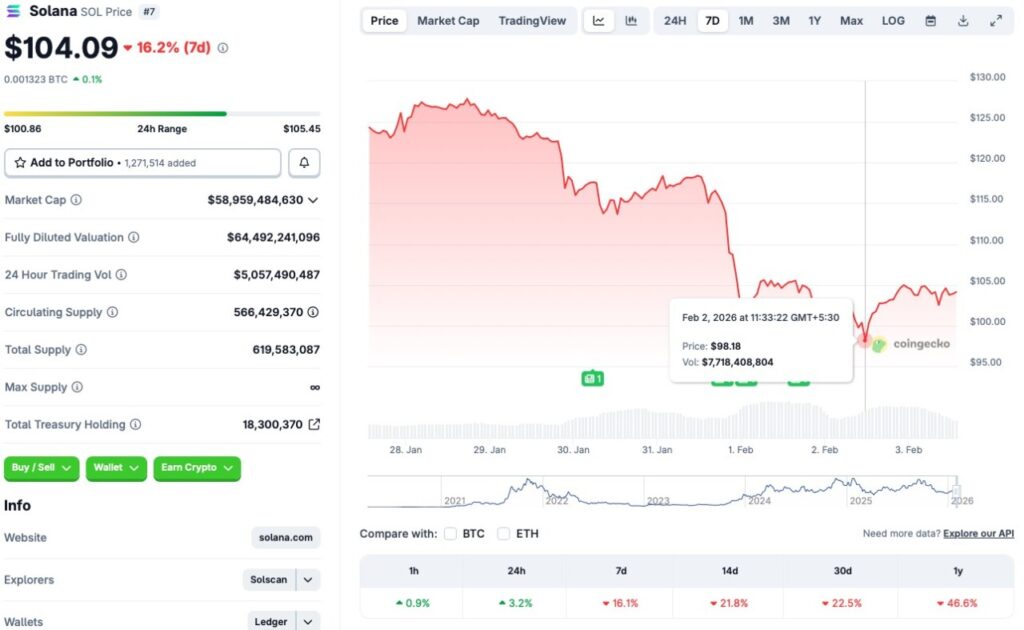

Jakarta, Pintu News – Solana (SOL), one of the largest cryptocurrencies in the digital market, has caught the attention of investors once again after the price of the asset fell sharply and then found support around the psychologically important level of USD 100.

This price movement provides a technical signal that must be considered in the context of a crypto market that is still experiencing bearish pressure. Here are five key points from the latest SOL developments that are relevant for both investors and beginners.

1. SOL Finds Support Around $100 After Decline

Solana (SOL) briefly fell below the USD 100 level in early February 2026 as part of a broader market correction, including pressure on Bitcoin (BTC). Following the drop, SOL prices rebounded and showed steady support in the range of around USD 102-104, signaling that the area around USD 100 is an important zone for buyers to enter.

Support at that level is not just a psychological number; it also reflects that buyers are starting to take opportunities at low prices after bearish pressure has temporarily subsided. Monitoring this zone is important as it could determine the direction of the next trend.

Also Read: 7 Shocking Bitcoin & Crypto Facts in Epstein Files: Crypto’s Early Traces Revealed!

2. Prices Still Under Pressure in the Medium Term

While SOL is showing stability near the USD 100 level, the medium-term trend still shows strong selling pressure. Price data shows that SOL fell by more than 16 percent in one week, about 22 percent in 14 days, and about 22.5 percent in the past month. This illustrates that this rally is taking place in a weaker market overall.

Investors should note that an upward move from support does not automatically mean the bearish trend is over; it could be a technical rebound within a broader correction.

3. Momentum Indicator Indicates Oversold Condition

Independent technical analysis shows that SOL’s relative strength index(RSI) has entered oversold territory, which is often the basis for a relief bounce. A very low RSI can indicate that the extreme selling pressure is starting to ease and the first batch of buyers are stepping in.

However, oversold levels are only one technical signal; a steady rebound usually requires stronger volume support and market structure changes.

4. Next Resistance Still Awaits

If SOL prices continue to rally from the USD 100 support, the next various technical resistance levels could hold the upside. Important resistance areas include the USD 113-115, USD 125-130, and USD 140-160 ranges. A strong breakout above these zones would be required to confirm a medium-term trend reversal or towards a new bullish direction.

Without a daily close above these levels, the rebound may still be technical or corrective in nature, not the start of a deep bullish trend.

5. Broader Crypto Market Context Is Still Tough

SOL’s condition is not happening in isolation – the crypto market as a whole is facing a phase of selling pressure and high risk sentiment, reflected by broad market indicators as well as Bitcoin’s price decline. When Bitcoin drops, selling pressure on altcoins like Solana tends to increase as capital flows shift to lower risk assets or stablecoins.

This means that the SOL rally in the USD 100 zone could be part of a larger market correction, so investors need to consider macro and technical factors simultaneously before making long-term decisions.

Also Read: 4 Shocking Facts about Bitcoin Breaking Rp1.42 Billion: Similar to BTC April 2025 Technical Signal!

Follow us on Google News to stay up to date with the latest crypto and blockchain technology. Check Bitcoin price, USDT to IDR and Nvidia stock price tokenized via Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading the Pintu crypto app via Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Watcher Guru. Solana Finds Support At $100: Is This The Best Time To Buy? Accessed February 4, 2026.

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.