Download Pintu App

Price of 1 Pi Network (PI) in Indonesia Today (2/5/26)

Jakarta, Pintu News – The price of 1 Pi Network (PI) in Indonesia today, February 5, 2026, is of concern to crypto market participants amid increased volatility and information flow from the project’s internals.

PI’s price movements were influenced not only by general cryptocurrency market conditions, but also by a large transfer of 500 million Pi Coin that sparked investor speculation, as well as significant updates regarding Mainnet migration and know-your-customer (KYC) processes.

This combination of on-chain factors and fundamental developments makes the direction of Pi Network’s price movements more dynamic and under close market scrutiny.

How much is 1 PI in Indonesia today?

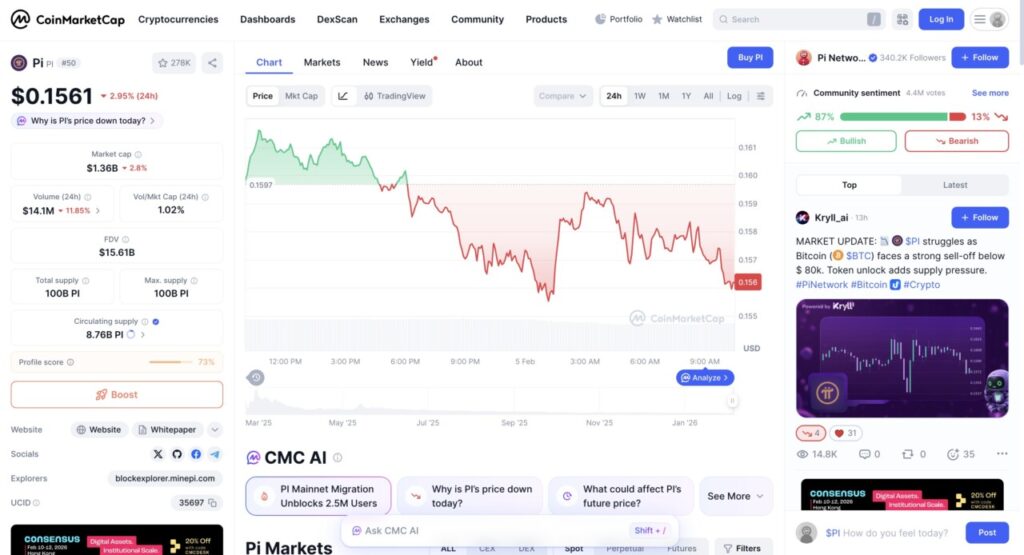

The Pi Network (PI) price chart on the 24-hour timeframe shows a relatively consistent downward trend with fairly high intraday volatility. The PI price opened in the area around USD 0.159-0.160, had moved up in the early session, then turned gradually weaker until it broke the USD 0.156 level. Selling pressure appeared to be increasingly dominant after the middle of the period, characterized by a series of lower highs and lower lows indicating a continuation of the short-term bearish trend.

This price drop is in line with the general weakening of market sentiment, reflected by the decline in daily trading volume and correction in market capitalization. Although the community still shows high bullish sentiment, chart movements indicate continued supply pressure. Technically, PI price is currently near the intraday support area, so its further movement will largely depend on the market’s response to the selling pressure and the macro sentiment of cryptocurrencies in the near term.

Read also: 3 Token Unlock in Early February 2026, Red Market Alert?

Huge 500 Million Pi Coin Movement Sparks Speculation

The latest on-chain data shows the wallet labeled PI Foundation 1 has transferred around 500 million Pi Coin in several large transactions in early February. The transfer value is equivalent to more than USD 80 million or around IDR 1.34 trillion at an exchange rate of IDR 16,812 per dollar. The scale of these transactions immediately caught the attention of cryptocurrency market participants because they were carried out when the price of Pi Coin was weakening.

However, data from Pi Scan reveals that the funds did not flow to crypto exchanges. All Pi Coin was instead moved to another internal wallet that still bears the PI Foundation 1 label. This pattern indicates that the move was likely an internal restructuring, not a sell-off on the open market.

Read also: 6 Important Facts Behind the MSCI Stock Market Warning that Shook the Indonesian Stock Exchange

Mainnet Update and KYC are the Background of Transfer

This large Pi Coin transfer occurred shortly after the Pi Network Core Team released an important update regarding network development. The team confirmed that over 16 million Pioneers have now successfully completed migration to the Mainnet. This figure demonstrates the accelerated adoption and readiness of the network for the next phase.

In addition, around 2.5 million users who were previously held back due to security processes have now passed verification. They are now eligible to continue migrating to the Pi Network Mainnet. This move has the potential to increase the amount of Pi Coin actively circulating on the network.

Going forward, Pi Network also plans to open up know-your-customer (KYC) access to over 700k additional users. The core team is currently testing a new reward distribution system for KYC validators. If the trial goes well, the system is targeted to be widely implemented before the end of March 2026.

Follow us on Google News to stay up to date with the latest in crypto and blockchain technology. Check Bitcoin price, usdt to idr and tokenized nvidia stock price through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading the Pintu crypto app via Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Coinspeaker. Pi Network Core Team Moves 500 Million Pi Coins, What’s Happening?. Accessed February 5, 2026

- Featured Image: Coinlaw

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.