Download Pintu App

Google’s Earnings Are Coming—Is the Stock Still Worth It?

Jakarta, Pintu News – Despite the decline in the Dow Jones Industrial Average (DJIA) index on Tuesday, Google (GOOGLX) shares showed a fairly strong position ahead of its earnings report scheduled for February 4.

GOOGL shares have been trending positively with an 8.94% increase since the beginning of the year (YTD) and are now at $341.85. In addition, news from Alphabet’s business side in general also shows encouraging developments.

However, this optimism may mask a number of systemic risks that are slowly starting to emerge in the financial markets in 2026. Therefore, the question of whether Google shares are worth buying before the earnings report still remains open for debate.

Why Google Stock is Worth Buying Ahead of Earnings Report

According to a recent report, Alphabet is showing growth in most of its business lines. One example is Google’s artificial intelligence (AI) platform Gemini, which despite a slow start, is now starting to eat into ChatGPT’s web traffic. Currently, Gemini’s market share is estimated to have reached around 20%.

Read also: What is a Black Card? How to get it and its benefits!

Google’s core sector, the ‘Search’ business, also seems to have stabilized.

The changes made in 2024 and 2025 had made Google lose some market share, as many users were disappointed with search performance, coupled with the decline in traffic to third-party sites due to the ‘AI Overview’ feature. However, Google’s dominance in search has now settled at around 90% as of February 2026.

On the legal front, Google is also close to resolving its long-running antitrust conflict with Epic Games-the company behind the popular game Fortnite-and has even agreed an $800 million Unreal Engine deal with another major tech company.

In addition, Waymo, Alphabet’s autonomous car company, also showed solid performance with a successful $16 billion funding round on February 2.

All these factors strengthen the argument that Google shares are worth considering buying ahead of the earnings report.

Wall Street remains optimistic about Google stock

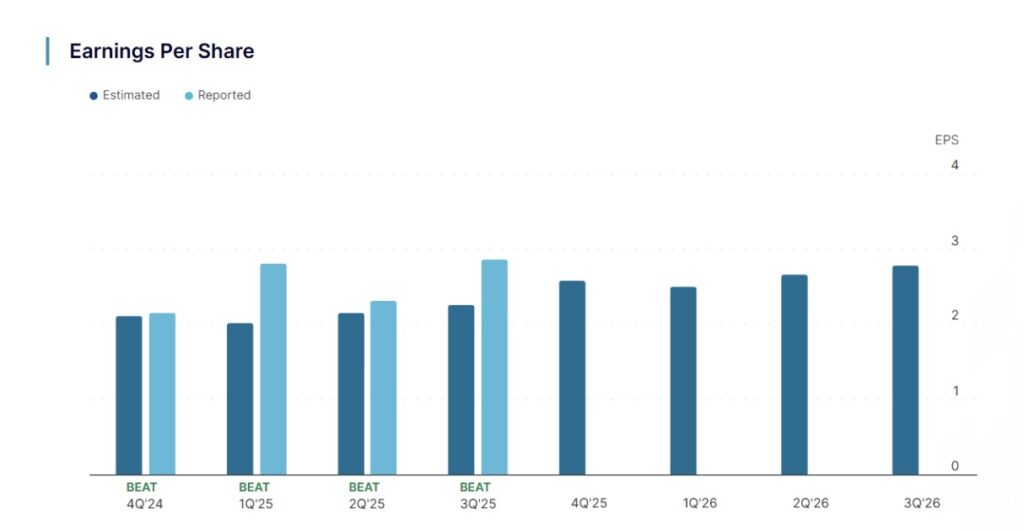

Looking at the general situation and the steady upward trend of Google shares in the past 12 months, it is not surprising that Wall Street predicts that Alphabet’s earnings per share (EPS) for the fourth quarter (Q4) will rise to $2.58. These results are scheduled to be announced after market close on February 4.

The EPS prediction is 14.2% higher than the previous Q3 projection of $2.26, indicating strong optimism from analysts. However, investors need to be cautious, as GOOGL stock may react negatively if the results only meet expectations or only slightly exceed targets.

For the record, the surprise in the previous quarter’s report was quite large, at 27%, with actual EPS reaching $2.87. This means that in order to keep getting a positive boost, Google will have to at least surpass the current consensus by more than 11%.

Furthermore, to warrant a stock rally, Alphabet must post an EPS of at least $3.28, to be comparable to the Q3 surprise.

Read also: Bitwise CIO Claims Crypto Winter Has Started Since 2025: The Question, When Will It End?

While Google has historically managed to beat projections-and has even outperformed in every report since Q4 of 2024-high expectations and the company’s soaring valuation remain a risk for investors.

Why Google Stock May Not Be Worth Buying in 2026

On the other hand, the explosion of AI technology-which is now the main focus of Alphabet and other big tech companies-could be a potential threat to Google’s stock performance.

Lately, much of the news around artificial intelligence (AI) has taken on a cautious tone, as there are more and more signals that the sector is starting to come under pressure.

One glaring example is the revelation that about 45% of Microsoft’s (MSFTON) backlog is heavily dependent on OpenAI. This dependency, coupled with shrinking profit margins, led to a share price crash after Microsoft’s earnings report was released.

OpenAI itself is also considered a systemic risk for large technology companies.

- On the one hand, the company’s plan to start displaying ads on its chatbots sparked speculation that OpenAI is starting to run short of funds, especially considering that its CEO, Sam Altman, was previously strongly against such practices.

- On the other hand, news that Nvidia (NVDAX) may cancel its commitment to invest $100 billion into OpenAI also eroded market confidence.

Another potentially disruptive issue-especially regarding Google’s cloud business-is the recent concern about production limitations and the energy crisis, which could lead to many new data centers going unused.

To illustrate, popular data center power consumption targets since 2025-such as 10 gigawatts-are considered unsustainable, both for environmental reasons, construction time, and the fact that they exceed even the power needed to illuminate the entire New York City.

Finally, the ambitious promises made by tech giants-which previously drove sky-high market valuations-are starting to prove to be overblown, as evidenced by the growing number of canceled data center projects.

All of this is a serious warning that Google stock, while promising, is not without risk in 2026.

Trading US Stock Tokens on the Door

Imagine being able to buy shares of big companies like Google, Amazon (AMZNX), and Meta (METAX) in token form for as little as a few thousand dollars. The good news is that you can now buy/sell tokenized US stocks from xStocks and Ondo at Pintu.

By leveraging blockchain technology, you can now enjoy a faster settlement process for tokenized US stocks, more affordable start-up capital, and a more global investment experience.

Trade on the Door Now!

Follow us on Google News to stay up to date with the latest in crypto and blockchain technology. Check Bitcoin price, usdt to idr and tokenized nvidia stock price through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading the Pintu crypto app via Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Finbold. Is Google stock a buy before next earnings? Accessed on February 5, 2026

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.