Download Pintu App

Raydium Price Today IDR11,610, Up 1.35% amid DeFi Solana Dynamics

Jakarta, Pintu News – The price of the Raydium (RAY) crypto has recorded a gain in today’s trading amid fluctuations in the cryptocurrency market. Based on market data, RAY is trading at Rp11,610 per token, up about 1.35% in the last 24 hours. This increase has brought Raydium back to the attention of investors, especially those monitoring the DeFi sector on the Solana network.

1. Raydium Price Today and 24 Hour Movement

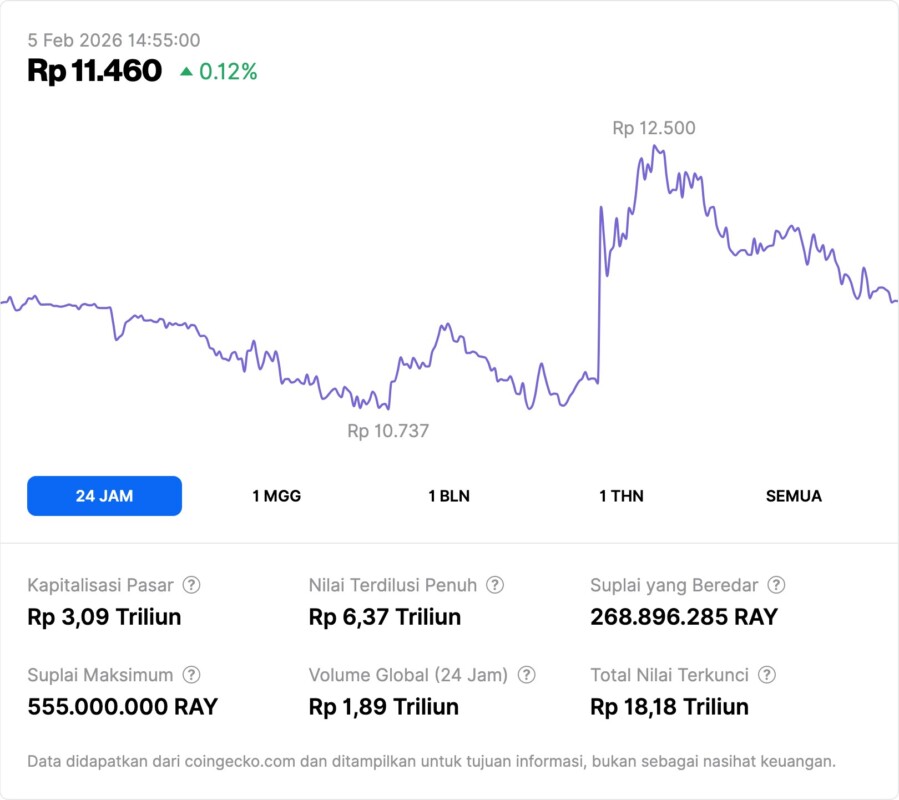

Raydium’s price today was recorded at IDR 11,610 on February 5, 2026 at 14:05 WIB. In the last 24 hours, the price had moved down to the area of IDR 10,737 before recovering. This movement shows that short-term volatility is still quite high.

The daily increase of 1.35% indicates buying interest after the correction phase. However, the price is still below the short-term peak area around IDR12,500. This reflects the consolidation phase common to DeFi assets.

Also Read: 7 Shocking Bitcoin & Crypto Facts in Epstein Files: Crypto’s Early Traces Revealed!

2. Market Capitalization and Valuation of Raydium

Raydium’s market capitalization currently stands at around IDR3.11 trillion. This figure places RAY as one of the middle DeFi tokens in the Solana ecosystem. Although not as large as major DeFi platforms on other networks, this position shows Raydium is still relevant in the market.

RAY’s fully diluted valuation (FDV) is recorded at around IDR6.42 trillion. The sizable difference between market capitalization and FDV reflects the fact that there is still a supply of tokens that have not fully circulated. This factor is often a concern for investors in assessing medium-term supply pressure.

3. Trading Volume and Market Activity

Raydium’s global trading volume in the last 24 hours reached approximately IDR1.83 trillion. This high volume indicates strong liquidity despite volatile prices. The busy market activity is an indicator that RAY is still actively traded by traders and investors.

Large volume also indicates that the current price movement is influenced by short-term activity. In the context of cryptocurrencies, this is often an adjustment phase before a clearer trend direction is established. However, high volume doesn’t necessarily mean the uptrend will continue.

4. Token Supply and Total Locked Value

The current circulating supply of Raydium is around 268,896,285 RAY out of a maximum supply of 555,000,000 RAY. This means that there is still a portion of tokens that have not fully entered the market. This supply structure may affect price dynamics in the long run.

Raydium’s total value locked (TVL) is in the range of IDR 18.17 trillion. The relatively large TVL shows that the Raydium ecosystem is still actively used by DeFi users. This factor is one of the fundamental indicators that distinguish RAY from pure speculative assets.

5. Raydium’s position in the DeFi Solana Ecosystem

Raydium is known as one of the main decentralized exchanges in the Solana network. Unlike the meme coin, RAY has clear utilities in the DeFi ecosystem, such as liquidity provision and yield farming. This makes its price movements more related to network activity and DeFi sentiment.

In the context of the 2026 crypto and cryptocurrency market, today’s rise in Raydium’s price reflects the market’s response to Solana’s ecosystem activities. For novice investors, understanding the relationship between token price and platform utility is important in assessing the future movement of RAY.

Also Read: 4 Shocking Facts about Bitcoin Breaking Rp1.42 Billion: Similar to BTC April 2025 Technical Signal!

Follow us on Google News to stay up to date with the latest crypto and blockchain technology. Check Bitcoin price, USDT to IDR and Nvidia stock price tokenized via Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading the Pintu crypto app via Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Door. Raydium (RAY) Price Today. Accessed February 5, 2026.

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.