Download Pintu App

Bitcoin Plunges to $64,000 — Is a Drop to $55,000 Coming Next?

Jakarta, Pintu News – The price of Bitcoin (BTC) fell below the $70,000 mark today, recording a daily low of $64,00. This is the first time BTC has traded at that level since November 2024, which shows how serious the ongoing market correction is.

This decline was triggered by a combination of macroeconomic pressures and aggressive deleveraging in the derivatives market, which further magnified downward pressure on prices.

Bitcoin Price Drops 9.28% in 24 Hours

On February 6, 2026, Bitcoin was trading at $64,673, equivalent to IDR 1,094,508,529 — marking a 9.28% drop over the past 24 hours. During that time, BTC hit a low of IDR 1,016,788,694 and reached a high of IDR 1,213,308,545.

At the time of writing, Bitcoin’s market capitalization is approximately IDR 21,892 trillion, while its 24-hour trading volume has surged by 101% to IDR 2,769 trillion.

Read also: Crypto Market Keeps Falling — Is 2026 on Track to Be the Worst Year Yet?

Bitcoin Miners at Risk

Bitcoin’s price movement towards the $70,000 mark puts the price action in a critical zone, where the economic factors of mining start to matter more than the psychology of traders.

With the current grid difficulty and average electricity costs of around $0.08 per kWh, the data shows that many Antminer S21 series miners are approaching the point of no return in the price range of $69,000-$74,000. Above this range, mining activities are still considered quite viable.

However, if prices fall below this range, profits can only be made by the most efficient operators. This adds to the financial pressure on the mining sector. While the price level that triggers a mining shutdown is not always the price floor, it is often the moment when market behavior changes significantly.

If the price stays below $70,000 for too long, weaker miners could be forced to sell their BTC reserves or shut down equipment.

Such actions can lower hashrate and simultaneously add selling pressure in the market. These risks exacerbate existing headwinds such as tight liquidity, low risk appetite, outflows from ETFs and continued derivative liquidations.

The combination of miner pressure and market weakness could increase the volatility of the drop without indicating a fundamental breakdown in Bitcoin’s long-term network security.

Analysts Highlight Downside Risks

Bitcoin slumped to $73,000 on February 3, extending a downward trend that has erased around 41% of its peak above $126,000 in October 2025. This decline comes at a time of rising geopolitical and macroeconomic uncertainty, including renewed tensions between the US and Iran.

This situation pushed the VIX volatility index up by about 10% and shifted the Crypto Fear & Greed Index into the zone of “extreme fear.”

With declining interest in risky assets, investors began to turn to traditional hedge assets. Gold prices rose 6.8%, while silver surged 10%. On the other hand, Bitcoin failed to attract defensive fund flows during the period.

Analysts believe that this divergence has weakened Bitcoin’s short-term narrative as asafe haven asset, thus amplifying selling pressure.

Read also: Bitwise CIO Claims Crypto Winter Has Started Since 2025: The Question, When Will It End?

The market view is currently very divided. Bearish analysts warn that the correction could go deeper, pointing to historical declines of 78% to 86% in previous cycles. If that pattern repeats, Bitcoin price could drop to the $35,000 range.

Technically, Bitcoin is now trading near $74,400, which is the average buying price range reported by MicroStrategy.

If the price continues to fall and breaks the $70,000 barrier, then the potential weakness could take the price to the $55,700-$58,200 range, close to the long-term average. On the contrary, on-chain data shows that the supply of BTC that is still in favorable conditions has decreased from 19.8 million to 11.1 million BTC-a condition that is historically often associated with the stabilization phase of the market.

Michael Burry Warns of Potential Bitcoin Crash

Michael Burry, known for The Big Short, highlights the similarities between Bitcoin’s current market structure and past market peaks. Macro-wise, Bitcoin formed a double top pattern in 2021, followed by a sharp decline in early 2022. According to Burry, a similar pattern appears to reappear from the fourth quarter of 2025.

From this point of view, Bitcoin is currently near a tipping point. In case of breakdown confirmation, a deeper correction could occur. Although historical analogies do not guarantee the same outcome, this pattern reinforces a cautious attitude among investors who are already facing high volatility and weakened momentum in the crypto market.

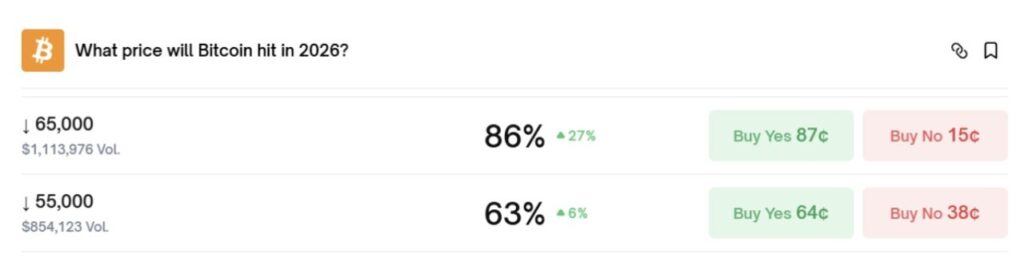

Polymarket Estimates 63% Chance of Bitcoin Falling to $55,000

The prediction market is also showing increasing bearish conviction. Traders at Polymarket are currently predicting an 86% chance that Bitcoin price will drop to $65,000. In fact, there is a 63% chance that the price will fall to $55,000.

On Tuesday, Bitcoin price fell below $70,000, hitting a daily low of $69,922 – the first time BTC has reached this level since November 2024, confirming the intensity of the ongoing correction.

The decline was triggered by a combination of bearish macroeconomic signals and aggressive deleveraging in the derivatives market. As of February 5, 2026, chain liquidations reached approximately $451 million, which amplified selling pressure and accelerated the price decline.

Technically, Bitcoin seems to be forming a Head and Shoulders pattern which indicates a potential 37% drop towards $51,511. Confirmation of this pattern occurs if the price breaks decisively below $63,000. In that scenario, the bottom is likely to be between $65,000 (psychological limit) and $63,000 (technical support), making the next trading session crucial.

With a major psychological barrier having been breached, Bitcoin price is now increasingly vulnerable to further declines, with $65,000 being the next important level to watch if selling pressure continues.

Follow us on Google News to stay up to date with the latest in crypto and blockchain technology. Check Bitcoin price, usdt to idr and tokenized nvidia stock price through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading the Pintu crypto app via Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. Bitcoin Price Falls Below $70,000 After Crashing 21% This Week. Accessed on February 6, 2026

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.