Download Pintu App

7 Strategic Impacts of Tether’s US$150 Million (Rp2.53 T) Investment in Crypto & Gold!

Jakarta, Pintu News – A major investment by one of the major players in the cryptocurrency market, Tether, has caught the attention of the global crypto market and tokenized assets. The company announced the purchase of a US$150 million minority stake in the Gold.com platform to expand the distribution of blockchain-based gold tokens, while strengthening the link between crypto assets and digital gold in the portfolios of long-term investors.

1. Tether Buys 12 % of Gold.com Shares

Tether announced the acquisition of approximately 12% stake in Gold.com through an investment of US$150 million in shares. The partnership is a strategic move to expand the distribution of blockchain-based gold tokens. Gold.com is a platform that provides retail and institutional investors with access to both physical precious metals and tokenized gold.

The investment also strengthens the relationship between Gold.com and Tether’s largest stablecoin, providing deeper integration into the digital asset ecosystem. This integration is expected to strengthen infrastructure readiness for digital gold trading in various regions. This is an important signal to the market that cryptocurrencies and real-world asset tokens are becoming increasingly connected.

Also Read: 5 Crypto that Whale is Eyeing in February 2026, Quietly Accumulating Amid Volatility

2. XAUT is the focus of distribution integration

With this investment, Tether plans to integrate its gold token, Tether Gold (XAUT), into Gold.com ‘s infrastructure to expand the market coverage of gold tokens. XAU₮ is a stablecoin that is 1:1 backed by physical gold stored in secure vaults. The token entitles its holders to gold ownership via the blockchain.

The integration allows Gold.com users to access digital gold directly through Tether’s network. It also means Gold.com can tap into Tether’s extensive distribution network, particularly in the global stablecoin sector. For investors, this is a signal that physical-backed gold tokens can be part of a broader digital asset diversification strategy.

3. Access Physical Gold Through Stablecoins

The Tether and Gold.com partnership is exploring the possibility of allowing direct physical gold purchases using stablecoins such as USDT and USAT. These stablecoins are digital assets whose value is pegged to the US dollar, making it easier to transact across blockchains and digital payment systems.

The option allows crypto investors who previously focused on volatile assets such as Bitcoin (BTC) or Ethereum (ETH) to switch to more stable assets with physical gold exposure. This practice could strengthen the role of stablecoins as a bridge between the traditional financial system and digital assets.

4. Tokenized Gold Assets Are Growing in Popularity

The tokenized gold market, including XAUT, has experienced significant growth in recent years. The combined market value of gold tokens has increased to over US$5 billion, with XAUT holding over 60% of that market share.

The popularity of gold tokens increased especially when the price of physical gold experienced a strong rally, attracting investors looking for safe-haven assets amid economic uncertainty. Integrations like Tether’s demonstrate the growing demand for crypto products backed by real assets.

5. Expand Global Investor Reach

This strategic investment also demonstrates Tether’s efforts to expand its global market reach, including reaching investors who may not directly participate in classic crypto markets. By becoming a shareholder of Gold.com, Tether strengthens its position in the digital precious metals market while increasing exposure to stablecoins such as USDT and USAT.

This indicates that digital assets and real-world assets such as gold can reinforce each other in the future digital investment ecosystem. Institutional investors are also increasingly paying attention to the role of tokenized assets in long-term allocation strategies.

6. Hedge Strategy and Asset Diversification

Tether’s CEO stated that gold investment is not just a speculative move, but part of a long-term hedge strategy to protect the value of users’ portfolios from macroeconomic pressures. Traditional gold has a long history as a hedge asset against inflation and market uncertainty.

Combining the advantages of physical gold with the efficiency of blockchain-based transactions can attract investors who seek stability without losing the flexibility of digital assets. It also shows the trend of diversifying investment strategies in the eyes of new assets such as cryptocurrencies and gold tokens.

7. Implications for Crypto Investors

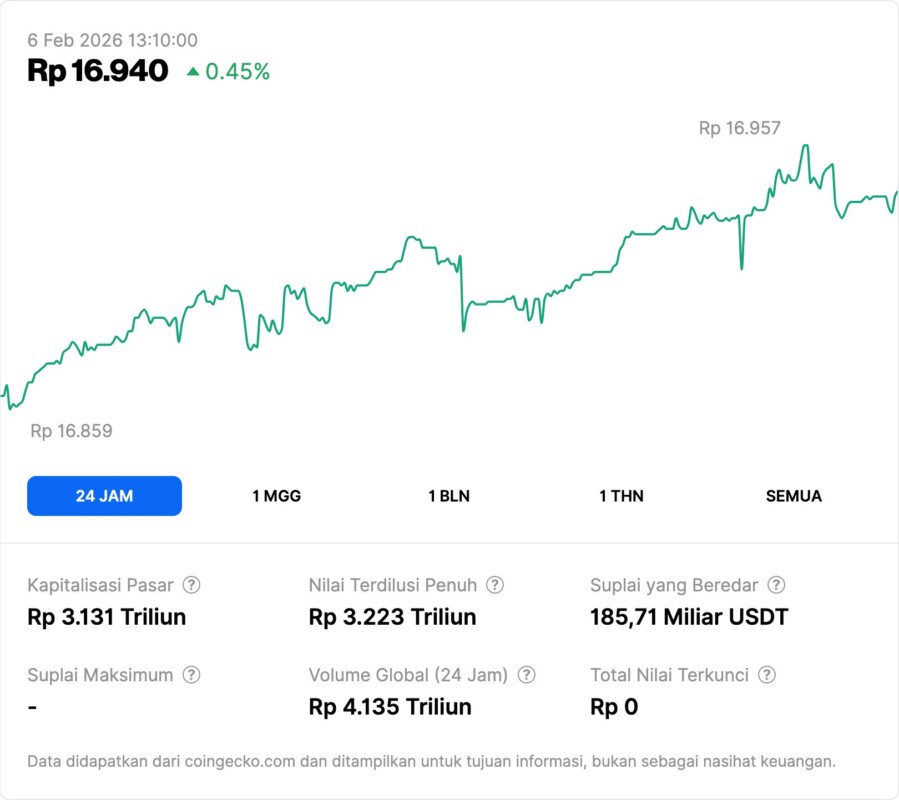

CHECK TETHER GOLD PRICE HERE!

For crypto investors, this investment means there are new opportunities beyond traditional crypto assets like BTC or other altcoins. Gold tokens can be a diversification instrument that bridges the digital and real-world asset landscapes. This development also demonstrates the adoption of blockchain technology into the broader financial sector.

However, investors still need to assess the risks of tokenized assets, including aspects of trust in the issuer and regulatory factors that are still evolving. Understanding the structure of the asset and its physical backing mechanism is important in assessing long-term prospects.

Also Read: 3 Crypto Underrated in February 2026 that Investors are Starting to Look at, Not Just Hype!

Follow us on Google News to stay up to date with the latest crypto and blockchain technology. Check Bitcoin price, USDT to IDR and Nvidia stock price tokenized via Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading the Pintu crypto app via Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

Coindesk. Tether buys USD150 million stake in Gold.com to boost tokenized gold distribution. Accessed February 6, 2026.

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.