Download Pintu App

Is This the First Bottom in 3 Years? Bitcoin Price Shows Signs That Selling Pressure Is Easing

Jakarta, Pintu News – Bitcoin (BTC) price is still moving sideways after a sharp correction, leaving the crypto market waiting for a new, clearer direction. Although the upward momentum is on hold, a number of on-chain indicators are showing patterns that previously appeared in the bottom phase of the cryptocurrency cycle. The latest data is even being called the first bottom signal in almost three years.

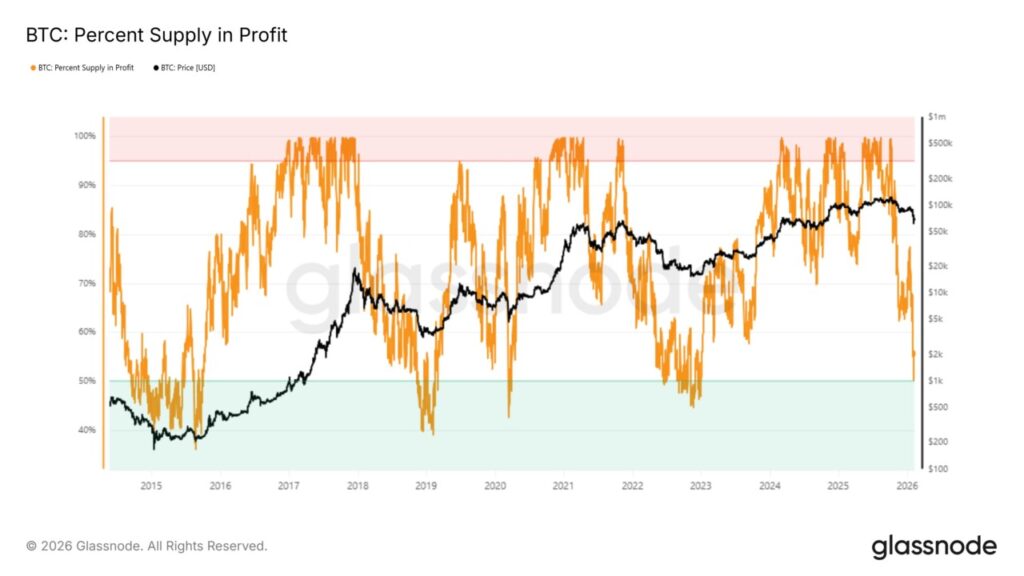

Profit Supply Drops to 50%

The percentage of Bitcoin supply that is in profit has now dropped to around 50%. This means that half of the total BTC in circulation is in a losing position. This level was last seen in the 2022 bear market and has historically coincided more often with a bottom than the start of a long decline.

As the number of profitable investors shrinks, the incentive to sell weakens. Asset holders tend to hold coins rather than realize losses. This situation usually helps relieve selling pressure and allows room for price stabilization.

Also read: 10 Ways to Get Bitcoin for Beginners 2026

Macro Indicators Do Not Show Overheating

The Pi Cycle Top Indicator, which compares the 111-day average with twice the 350-day average, has yet to show a top signal. Currently the short-term average is still well below the overheating threshold. This reflects market cooling, not excessive euphoria.

In previous cycles, a similar pattern often preceded the recovery phase. Since March 2023, BTC has maintained a macro uptrend without extreme speculative spikes. This makes this bottom signal look more structural than just a technical rebound.

Also read: 5 Ways to Buy Crypto Stocks

Key Price Levels to Watch

Technically, BTC is holding above the 23.6% Fibonacci level around USD 63,007 or Rp1,058,135,642. The current price is in the range of USD 68,905 or Rp1,157,420,830, but is still held below the resistance of USD 71,672 or Rp1,204,215,632. A break of this level could potentially pave the way to USD 78,676 or Rp1,321,909,656.

However, risks remain as the supply ratio of short-term holders to long-term holders increases. This condition is usually associated with higher volatility. If selling pressure returns, BTC risks testing the Rp1.05 billion area again.

Conclusion

Several on-chain indicators point to Bitcoin’s selling pressure starting to ease and a potential price bottom forming. However, confirmation of a trend reversal is still contingent on a breakout of important resistance. In a crypto market that remains volatile, risk management discipline remains a key factor for cryptocurrency investors.

Follow us on Google News to stay up to date with the latest in crypto and blockchain technology. Check Bitcoin price, usdt to idr and tokenized nvidia stock price via Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading the Pintu crypto app via Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. Bitcoin Price Shows First Bottom Signal in 3 Years as Selling Pressure Cools. Accessed February 12, 2026.

- Featured Image: Generated by AI

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.