Download Pintu App

Gold Price Today in Padang [2026]

Jakarta, Pintu News – Today’s gold price in Padang 2026 is around IDR 2,947,210 per gram for the buying price and IDR 2,878,000 per gram for the selling price of 99.99% precious metal. This level reflects a significant upward trend in recent years, in line with the strengthening of global gold prices and movements in the rupiah exchange rate.

How much is 24 Karat Gold today in Padang?

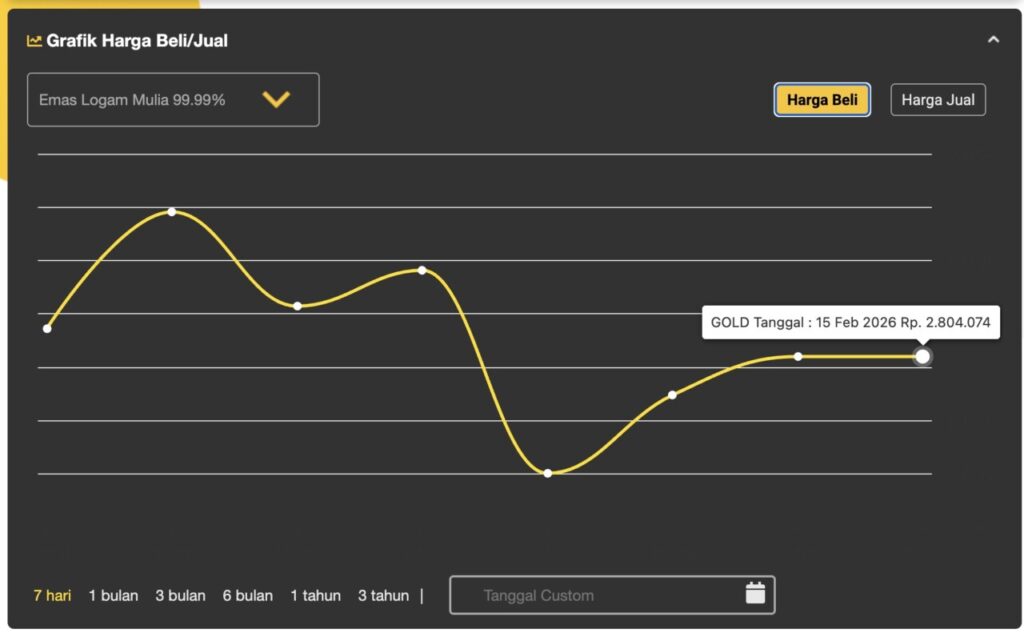

The buying price chart shows a similar pattern to the selling price, but at a higher nominal level as it reflects the purchase price by consumers. The movement begins with a rise, then corrects sharply, and rebounds again towards the end of the period.

On February 15, 2026, the buying price of gold today in Padang was recorded at IDR 2,804,074 per gram. The upward trend at the end of the period indicates a rebound after the correction phase, as well as showing the spread between the buying price and selling price, which is a common characteristic in physical gold transactions.

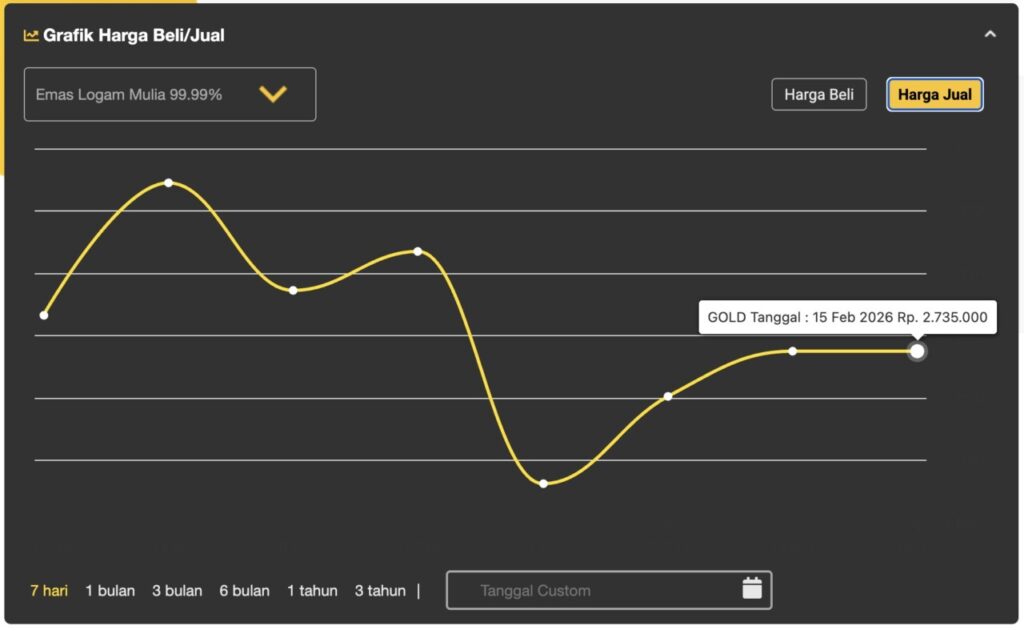

The selling price chart shows the movement of 99.99% precious metal gold in the last 7 days which tends to fluctuate. At the beginning of the period, the price rose and reached a weekly high, then experienced a sharp correction in the middle of the week before stabilizing at the end of the period.

As of February 15, 2026, today’s gold selling price in Padang stands at around IDR 2,735,000 per gram. After a significant drop in the middle of the week, prices showed a gradual recovery to flat on the last two days, indicating a short-term stabilization in the local gold market.

Gold-Based Crypto: When Physical Assets Meet Crypto Technology

As blockchain technology develops, gold can now be owned not only in physical form such as jewelry or bars, but also in digital form through gold-based crypto assets.

One of the most popular is Tether Gold (XAUt), a physical gold-backed ERC-20-based stablecoin, where 1 token represents 1 troy ounce of pure gold. The gold is stored in vaults in Switzerland and each token is directly linked to certified gold bullion. The system uses automated algorithms to efficiently manage the allocation of gold and Ethereum addresses.

XAUt tokens are available and traded on various crypto exchanges. XAUt is also an attractive alternative for those looking to hedge against inflation or global economic uncertainty, while remaining within the digital asset ecosystem.

History of 24 Karat Gold Price in Padang

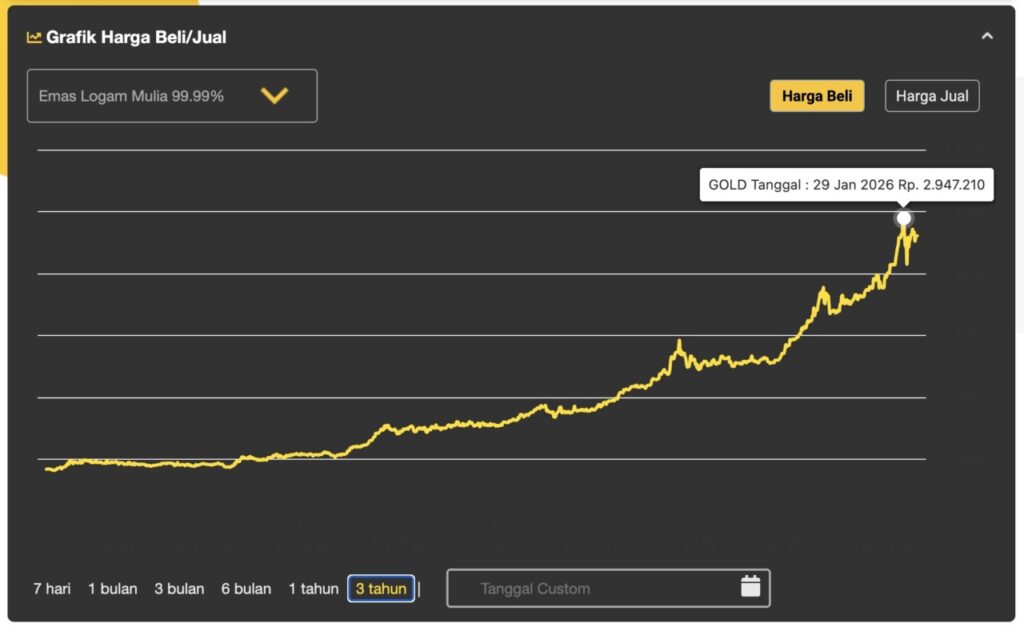

The graph of gold buying prices in Padang for 99.99% precious metals over the past 3 years shows a consistent upward trend. At the beginning of the period, prices were still below IDR 2,000,000 per gram, then moved up gradually with several phases of consolidation before finally experiencing a significant spike towards the end of the period.

On January 29, 2026, the purchase price of gold was recorded at approximately IDR 2,947,210 per gram. The sharp increase in the last year reflects the increasing demand for safe haven assets, as well as the influence of global gold prices and the rupiah exchange rate. In general, this trend shows that gold prices in Padang for the buy-side are experiencing strong appreciation in the medium to long term.

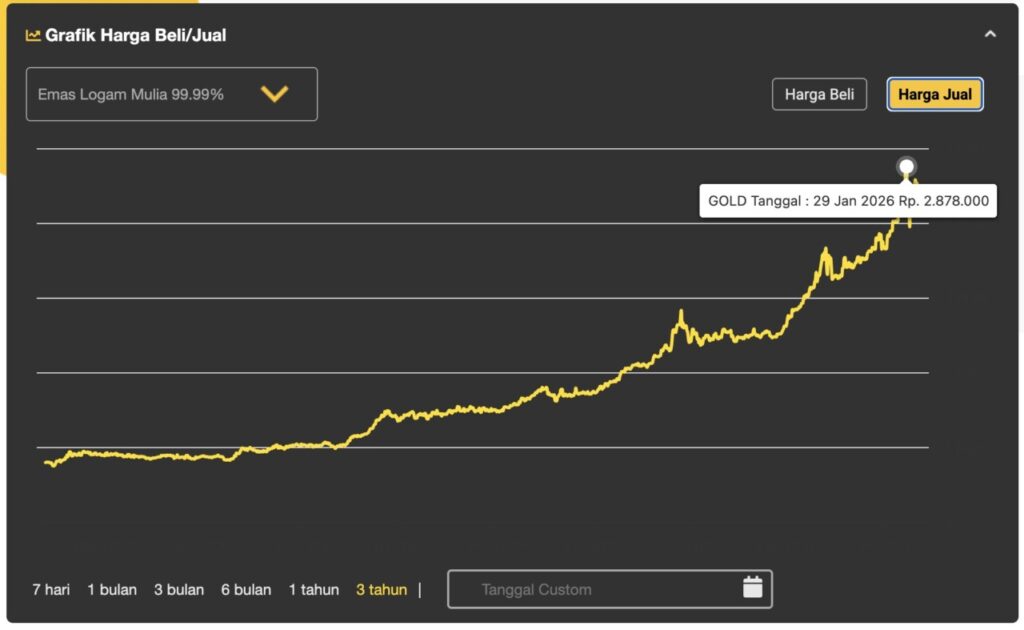

Meanwhile, the graph of the selling price of gold in Padang also shows a movement pattern in line with the buying price, but at a slightly lower level due to the spread. Over the 3-year period, the selling price gradually increased before entering a sharp acceleration phase in the last year.

As of January 29, 2026, the selling price of gold is around IDR 2,878,000 per gram. The difference between the buying price and selling price reflects the fair market margin in physical gold transactions. Overall, this data shows that the gold price in Padang is still in a long-term bullish trend, although it still has the potential to experience short-term fluctuations following global market dynamics.

Price of Various Types of Gold in Padang

The following is an update of the gold price range in Padang with reference to the latest market/jewelry data and 99.99% gold bullion benchmark. Please note, real prices in Padang gold shops may vary slightly due to spreads, stock and production costs.

- 24 karat gold bar (99.99%)

- Benchmark range per gram (buy): IDR 2,804,074

- Benchmark range per gram (sell/buyback): IDR 2,735,000

- Generally the reference for gold bullion/precious metals (highest grade), so it is at the highest price level compared to jewelry.

- 24 karat gold (jewelry, near pure)

- Price range: IDR 2,470,000 – IDR 2,568,000 per gram

- Usually used as a reference for the jewelry version of “pure gold”; may vary between stores due to design costs.

- 22 karat gold (premium jewelry)

- Price range: IDR 2,065,000 – IDR 2,160,000 per gram

- Common for high-end jewelry due to its high grade yet stronger than 24K.

- 75% gold (±18K) and 70% gold (±17K)

- 18K: Rp1,688,000 – Rp1,784,000 per gram

- 17K: IDR 1,593,000 – IDR 1,688,000 per gram

- This grade is popular for daily use due to its compromise between color, strength, and price.

- Gold grade 50% (±12K)

- Price range: Rp1,120,000 – Rp1,216,000 per gram

- More economical due to lower gold content; often chosen for jewelry with a limited budget.

- Gold jewelry (generally 12K-22K)

- The price follows the grade (e.g. 12K/17K/22K), then adds manufacturing costs (model, details, stone, finishing).

- At resale, the value received is usually lower than the purchase price of the jewelry due to store discounts and cost components.

- Estimation of 1 mayam of gold (±3.3 grams) in PadangPolylang

placeholder do not modify

Is the Gold Price in Padang the Same as the General Gold Price?

Gold prices in Padang generally refer to the national gold price which follows the movement of world gold prices and the rupiah exchange rate. As of today at the beginning of 2026, the national 24-karat gold price is in the range of IDR 2.80 million-Rp2.95 million per gram for 99.99% precious metal, matching the upward trend in recent weeks. However, at the retail level, prices may vary slightly depending on the policies of individual gold shops.

As an illustration, several gold shops in Padang set the price of 24-carat gold at around IDR 2.85 million-Rp2.95 million per gram for purchase transactions, while the buyback price is slightly lower. The difference is influenced by the seller’s margin, operational costs, as well as the level of local demand. As such, gold prices in Padang are not always identical to national gold prices, although they continue to move along the same trend.

While generally following official precious metal prices, gold shops in Padang may set prices slightly higher due to distribution factors, shipping costs from the center, stock availability and profit margins. In addition, fluctuations in the exchange rate of the rupiah against the US dollar also influence price formation in the region.

These price differences are usually not significant, ranging from a few thousand to tens of thousands of rupiah per gram. Variations are also influenced by the type of gold being sold (bars or jewelry), karat content, the presence of official certificates, manufacturing costs, as well as potential additional taxes or administrative fees at each store.

Details about today’s latest gold prices can be checked on the IndoGold website .

Follow us on Google News to stay up to date with the latest in crypto and blockchain technology. Check Bitcoin price, usdt to idr and tokenized nvidia stock price via Pintu Market.

Enjoy an easy and secure crypto trading and crypto gold investment experience by downloading the Pintu crypto app via Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- IndoGold

- Featured Image: Issuer News

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.