Download Pintu App

3 Important Facts: Loss of Rp286 Trillion, Will Strategy Sell Bitcoin (BTC)?

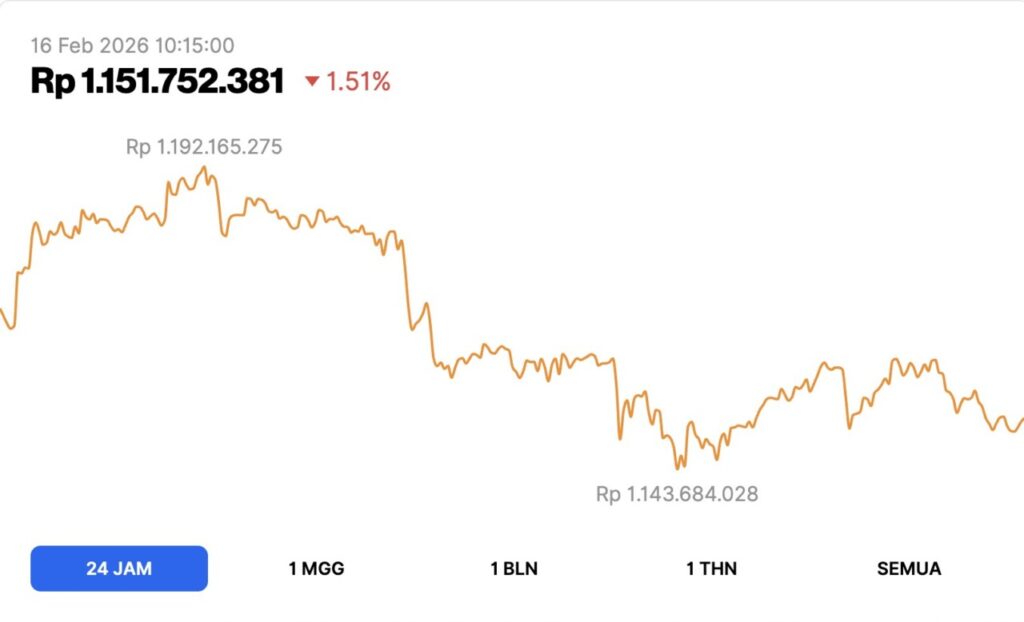

Jakarta, Pintu News – Spikes and corrections in crypto prices are back in the spotlight after the company Strategy reported an unrealized loss of US$17 billion or around Rp286.09 trillion. The figure sparked speculation whether the company would sell Bitcoin (BTC), which has been its main asset. Strategy’s CEO’s statement also caught the attention of global cryptocurrency investors.

1. Rp286 Trillion Loss: The Impact of Bitcoin (BTC) Volatility

Strategy has a large exposure to Bitcoin (BTC) as part of its treasury strategy. When the price of BTC corrected sharply, the value of these holdings was eroded, resulting in an unrealized loss of US$17 billion or around Rp286.09 trillion, assuming an exchange rate of Rp16,829 per US dollar. These losses are accounting in nature and have not actually been realized as long as the assets are not sold.

Volatility is a key characteristic of crypto and cryptocurrencies, especially Bitcoin (BTC) which still dominates the market capitalization. Price fluctuations can occur due to macroeconomic sentiment, interest rate policies, and institutional fund inflows and outflows. This confirms that a large exposure to a single crypto asset carries both the potential for profit and significant risk.

Also Read: 7 Crypto in the Spotlight Ahead of Chinese New Year 2026, Seasonal Momentum or Just a Trend?

2. When Will Strategy Sell BTC?

Strategy’s CEO emphasized that the company has no plans to sell Bitcoin (BTC) in the near future. However, he explained that discussions about selling could become relevant in certain extreme circumstances, for example if liquidity needs are urgent or there is a change in corporate strategy. This statement shows an approach that remains open to various scenarios.

In practice, public companies holding crypto as cash reserves must consider accounting factors, shareholder pressure, as well as balance sheet stability. If BTC prices experience a prolonged decline, the pressure to make strategy adjustments may increase. However, as long as companies still have access to other funding, a massive sale is not yet a priority.

3. What Does It Mean for Crypto Investors and Beginners?

For cryptocurrency investors, this case confirms the importance of understanding the difference between unrealized losses and realized losses. As long as Bitcoin (BTC) is not sold, price fluctuations only affect the value on paper. However, volatility still has an impact on risk perception and overall market sentiment.

Novice investors also need to realize that a “buy and hold” strategy in crypto requires a high risk tolerance. Portfolio diversification, risk management, and understanding market cycles are key factors in dealing with price volatility. While the movements of large institutions like Strategy are influential, investment decisions should be tailored to each individual’s risk profile.

Amid the dynamics of the cryptocurrency market, transparency of communication from companies holding digital assets is an important element in maintaining public trust. Open statements regarding possible sale scenarios help the market understand that investment strategies are adaptive. It also reflects that crypto adoption by large corporations is still in an evolving phase of evolution.

Follow us on Google News to stay up to date with the latest crypto and blockchain technology. Check Bitcoin price, USDT to IDR and Nvidia stock price tokenized via Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading the Pintu crypto app via Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- Jamie Redman/Bitcoin.com News. Will Strategy Sell Bitcoin? CEO Outlines Scenario When Talks Turn Real Amid $17B Loss. Accessed February 16, 2026.

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.