Download Pintu App

5 Facts Coin PEPE Meme Volume Explodes 283% – Is Memecoin Hype Back?

Jakarta, Pintu News – The trading volume of Pepe (PEPE), one of the most popular memecoins in the cryptocurrency market, experienced a remarkable surge of 283 percent in the last 24 hours on February 15, 2026, making it one of the main drivers of the recent memecoin market movement. This surge in volume was accompanied by significant price increases and enhanced PEPE’s role as a sentiment indicator in the high-risk crypto asset segment. This pace is fueling the debate whether the memecoin mania is back after a period of bearish pressure on the global crypto market.

1. Volume 283 %: Significance and Impact

PEPE recorded a 283 percent surge in volume in 24 hours, with total daily trading reaching over US$1.07 billion, indicating a significant increase in trader and investor participation. This explosive volume far surpassed the previous daily average and confirms that market activity towards these memecoins has suddenly increased sharply.

An increase in volume is usually considered a strong signal that the price movement is supported by real liquidity, making the price rally more technically valid than a mere price spike. This increase in PEPE also helps lift the overall sentiment of the memecoin market.

Also Read: 7 Crypto in the Spotlight Ahead of Chinese New Year 2026, Seasonal Momentum or Just a Trend?

2. Price Rise and Bullish Momentum

As volumes surged, PEPE also recorded price gains of over 20 – 30 percent over the same period, making it one of the best performing assets among the memecoin segment on the day. This price action reflects that market demand is increasing beyond mere statistical volume, indicating active trader engagement in the momentum.

This trend shows that PEPE’s price movement is more than just a short-lived reaction; the market response suggests there is potential for a short-term rally if high volumes are sustained. However, like all memecoin rallies, the risk of short-term volatility remains high.

3. The Role of Whale Accumulation

On-chain data shows that “whales”, or large token holders, have also been involved in PEPE’s price movements by accumulating in recent weeks, including an accumulation of more than 23 trillion tokens during the previous price drop period. This activity suggests that some large investors see long-term upside potential amid weaker market conditions.

Whale accumulation is often a technical signal that there is less supply available in the market, which in turn can support demand pressure if the market continues to rally. However, this is not a guarantee that the rally will continue in the absence of other fundamental catalysts.

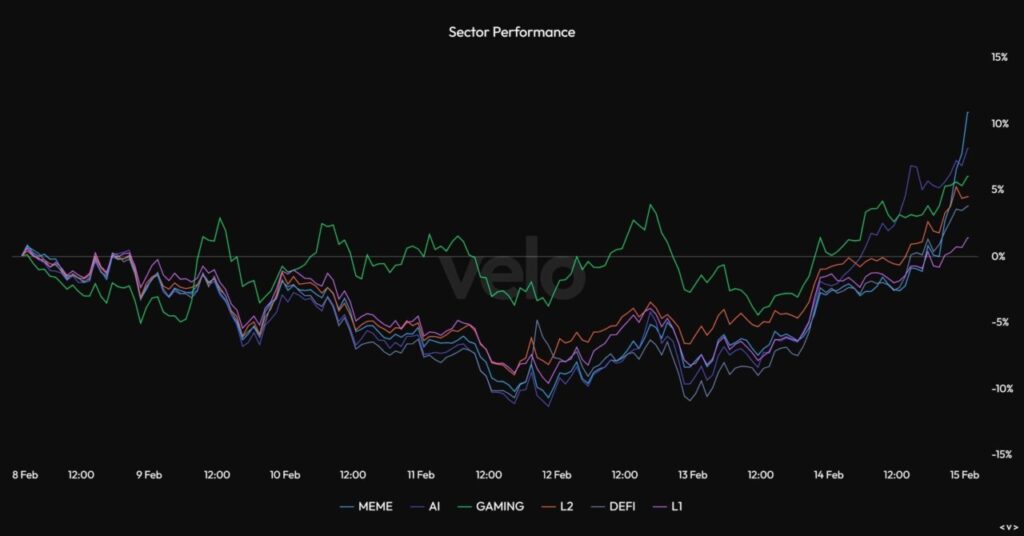

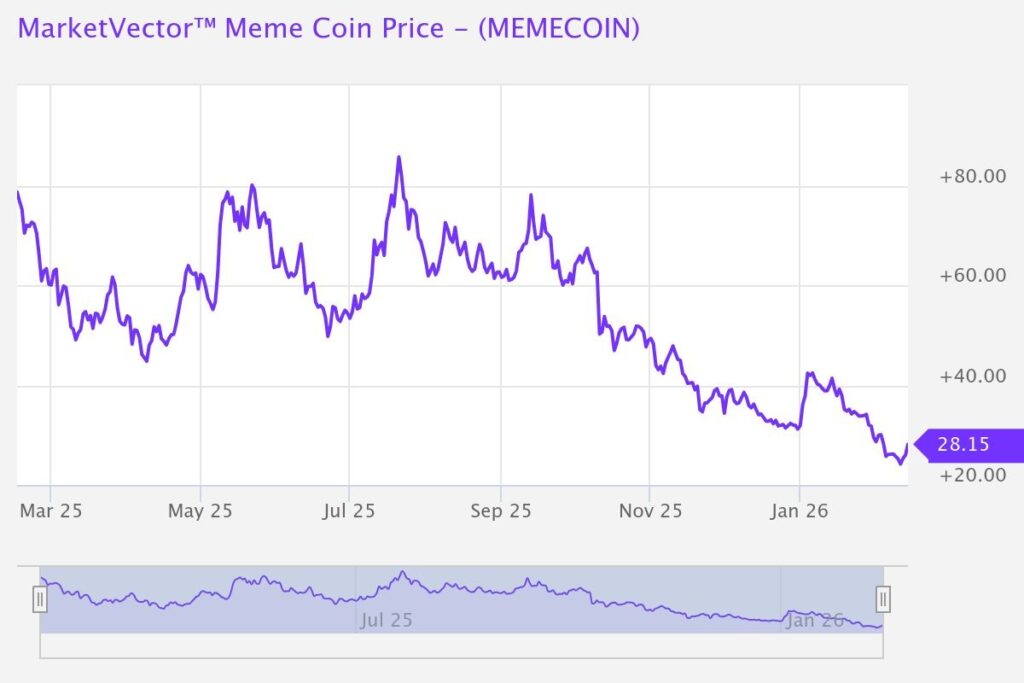

4. Current Context of the Meme-Coin Market

Broad market data shows that the market capitalization of memecoin has experienced significant declines and investor sentiment was extremely bearish. This spike in PEPE volume occurring in the middle of a period of extreme bearishness often acts as a short-term reversal point due to market overcapitalization.

However, despite the sharp rise in volume and price, the memecoin sector as a whole is still in a volatile and speculative phase, as many tokens have yet to recover from the prolonged price drop. This reflects that despite signs of a rebound, the long-term bullish phase is still uncertain.

5. Implications for Cryptocurrency Investors

For crypto investors, the 283% spike in PEPE trading volume signals that trader interest in memecoin is still strong and could again be a major catalyst in short-term market movements. However, rallies like this are usually speculative in nature and could end quickly if volumes drop or traders start realizing profits.

Investors need to combine technical analysis such as volume and price patterns with a strict understanding of risk management, especially since memecoins often exhibit extreme volatility compared to more fundamental crypto assets such as Bitcoin (BTC) or Ethereum (ETH).

Follow us on Google News to stay up to date with the latest crypto and blockchain technology. Check Bitcoin price, USDT to IDR and Nvidia stock price tokenized via Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading the Pintu crypto app via Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- AMBCrypto. PEPE volume erupts 283% in 24 hours! Is memecoin mania back? Accessed February 16, 2026.

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.