Download Pintu App

Bitcoin Slips to $67,000 as Long-Term Holders Stand Firm

Jakarta, Pintu News – Bitcoin (BTC) has struggled to regain upward momentum in recent sessions. Its price is still moving in a limited range amid uncertain macroeconomic conditions. Volatility in the stock market as well as expectations on interest rates are also holding back recovery efforts.

With short-term signals still mixed, attention now turns to the Long-Term Holders (LTH). This group has historically often been the arbiters of major Bitcoin reversals. Their current behavior provides important insight into whether BTC is approaching a turning point.

Bitcoin Price Drops 2.35% in 24 Hours

On February 18, 2026, Bitcoin was trading at $67,272, or about IDR 1,131,041,159, after posting a 2.35% correction over the past 24 hours. Throughout the session, BTC dipped to a low of IDR 1,122,076,141 and climbed as high as IDR 1,161,746,317.

At the time of writing, Bitcoin’s market capitalization is hovering around IDR 22,731 trillion, while 24-hour trading volume has inched up 2% to IDR 636.07 trillion.

Read also: Crypto Analysts Highlight Top Altcoins with Strong Growth Potential Driven

Bitcoin Long-Term Holders (LTH) Now Have a Crucial Support Level

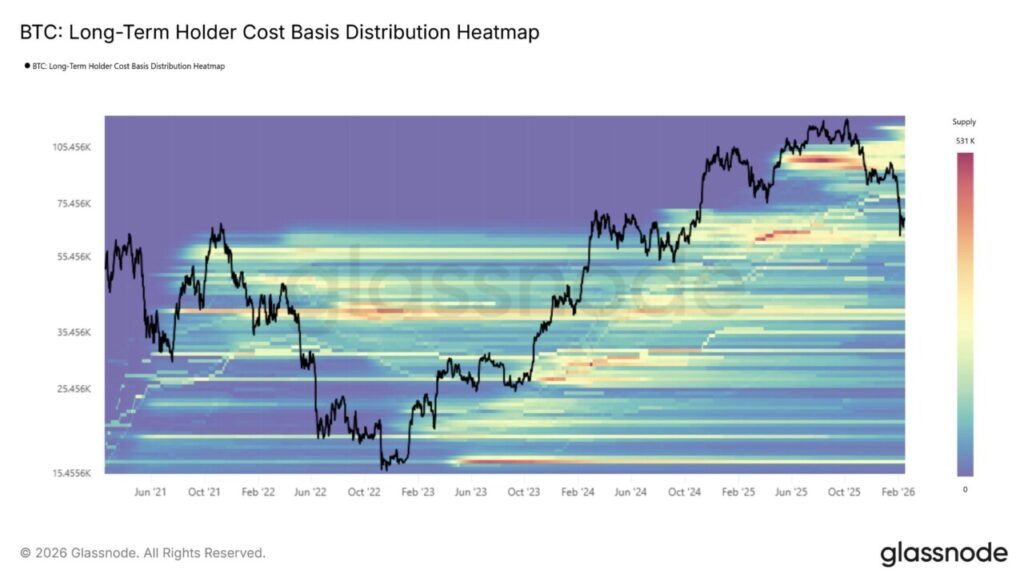

The LTH CBD heatmap shows a significant concentration of supply above the $65,000 level. This cluster was formed from the accumulation phase in the first half of 2024. The area has repeatedly been able to absorb selling pressure in recent times. The strong demand in this zone reflects the high confidence of experienced Bitcoin holders.

This support band has served as a buffer during price corrections. The capital accumulated during the previous consolidation phase remains largely immobilized. As long as this structure remains in place, a massive distribution seems unlikely.

However, in the event of a decisive break below that range, the market narrative could change. That could potentially pave the way towards Bitcoin’s Realized Price which currently stands at around $54,000. Even so, that scenario looks less likely as long as LTH supply remains stable. Data shows holders are not yet showing signs of preparing for capitulation.

How did LTH respond?

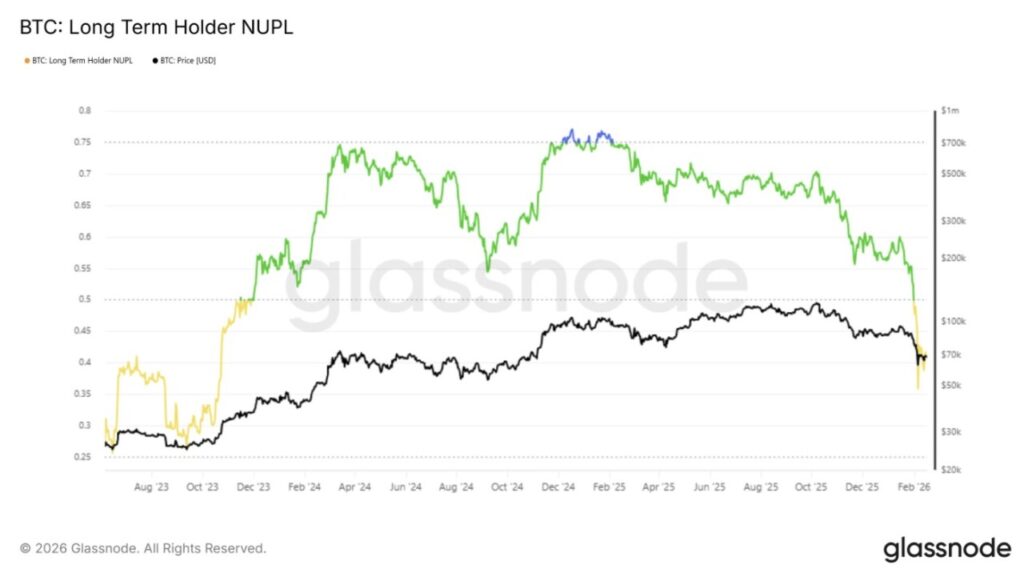

The Long-Term Holder Net Unrealized Profit and Loss (NUPL) method has recently been on the decline. This indicator measures the total unrealized profits in the wallets of long-term holders. When NUPL falls, it means that the profitability level of the LTH group is shrinking.

Historically, long-lasting NUPL declines often go hand-in-hand with deeper price corrections. Similar patterns were seen in February 2020 and June 2022. In those periods, weakening profitability triggered broader capitulation in the market.

However, this cycle looks different. Institutional fund flows and support from spot Bitcoin ETFs strengthen structural demand. The consistent inflow of regulated products has a stabilizing effect. As a result, LTHs may be less compelled to unwind positions even if their profit margins shrink.

Read also: Where Will Crypto Go This Week? Check out the Important Agenda to Watch!

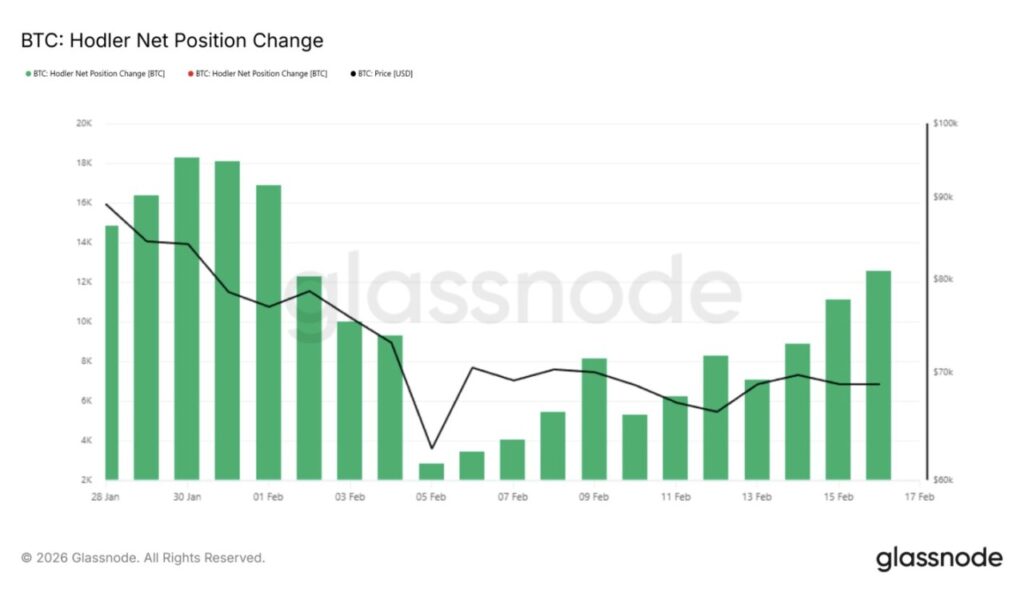

The HODLer Net Position Change data shows that Bitcoin LTH is accumulating, not distributing. The increasing green bars on this indicator indicate that more coins are moving into long-term storage. This is a positive signal, as LTH accumulation is usually long-lasting – unlike STH (short-term holders) who tend to sell quickly once they see a profit opportunity.

The continued influx of coins into LTH wallets further confirms this trend. Accumulation amid uncertainty could slow down the downward pressure, and if this pattern continues, it could potentially establish a foothold for a broader Bitcoin price recovery.

BTC Price Still Held at Resistance Area

Bitcoin was trading around $68,282 on February 17. The main target in the short term is still the same, which is to be able to reclaim the $70,000 level. This area has been a psychological barrier that has held the bulls up for the past ten days or so.

On the downside, the support level of $68,342 is a crucial point in the near future. If this zone is strongly defended, BTC has a chance to test the $70,610 resistance. In case of a confirmed breakout, the rise could continue towards $73,499 and even higher if the momentum strengthens further.

However, downside risks remain, especially if macro conditions worsen. If the price drops through $65,158, the current movement structure will weaken. Losing that support could open up opportunities for a deeper correction. In this scenario, the price could potentially move closer to the Realized Price around $58,000.

Follow us on Google News to stay up to date with the latest in crypto and blockchain technology. Check Bitcoin price, usdt to idr and tokenized nvidia stock price through Pintu Market.

Enjoy an easy and secure crypto trading and crypto gold investment experience by downloading the Pintu crypto app via Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. Bitcoin Hits the Brakes Near $68,000-But Long-Term Holders Aren’t Flinching. Accessed on February 18, 2026

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.