Download Pintu App

FOMC Release Soon: Is the Crypto Market Ready to Explode or Take a Hit from the Fed Surprise?

Jakarta, Pintu News – This week, crypto market participants’ attention is focused on the release of the minutes of the January Federal Open Market Committee (FOMC) meeting scheduled for February 18, 2026. These minutes are predicted to be the main trigger of volatility in digital asset prices, especially as the market is waiting for signals on the direction of the Fed’s interest rate policy.

Against the backdrop of flagging inflation and still-strong employment data, analysts expect the crypto market’s reaction to depend heavily on the tone taken by policymakers. Whether the market will welcome the good news or face selling pressure will be answered once the minutes are released.

FOMC: Determinants of Crypto Market Direction

The release of the FOMC minutes is always a crucial moment for financial markets, including crypto. In the context of digital assets such as Bitcoin (BTC), Ethereum (ETH) and Ripple (XRP), changes in expectations for benchmark interest rates greatly affect price movements.

If the minutes show the Fed’s inclination to cut interest rates soon, then the positive sentiment could push crypto prices up significantly. Conversely, if the Fed still emphasizes caution and inflation risks, selling pressure is likely to dominate the market.

A prominent analyst, MANI, via the X platform, revealed two main possible scenarios. In the first scenario, if the tone of the minutes is hawkish and signals that high interest rates will last longer, then the selloff in the crypto market could increase sharply.

The second scenario, if the Fed gives dovish signals and opens up opportunities for interest rate cuts, the prices of digital assets such as Solana (SOL), Pepe Coin (PEPE), and Dogecoin (DOGE) have the potential to recover. MANI also warns that high volatility is very likely to occur, so market participants need to be extra vigilant in managing risks.

Read also: Selling Price of 9 Karat to 23 Karat Gold Jewelry Today, Wednesday, February 18, 2026

Low Inflation

The latest inflation data provided a breath of fresh air for financial markets, including crypto. The Consumer Price Index (CPI) in January rose 2.4% on an annualized basis, lower than expectations of 2.5% and the lowest level in four years.

This condition strengthens the belief that inflation is starting to approach the Fed’s target of 2%. With inflation leveling off, the opportunity for future interest rate cuts is wide open.

According to analyst Liz Thomas, the market now expects total rate cuts of around 2.5% for 2026, the highest since December 2025. This projection holds even though the employment data is still solid and core (supercore) inflation has not fully declined. Thomas added that if economic growth and employment remain strong, the market’s overly dovish expectations may be corrected.

Read also: 23 Karat Gold Selling Price Today, Wednesday, February 18, 2026

Employment Data and Market Expectations

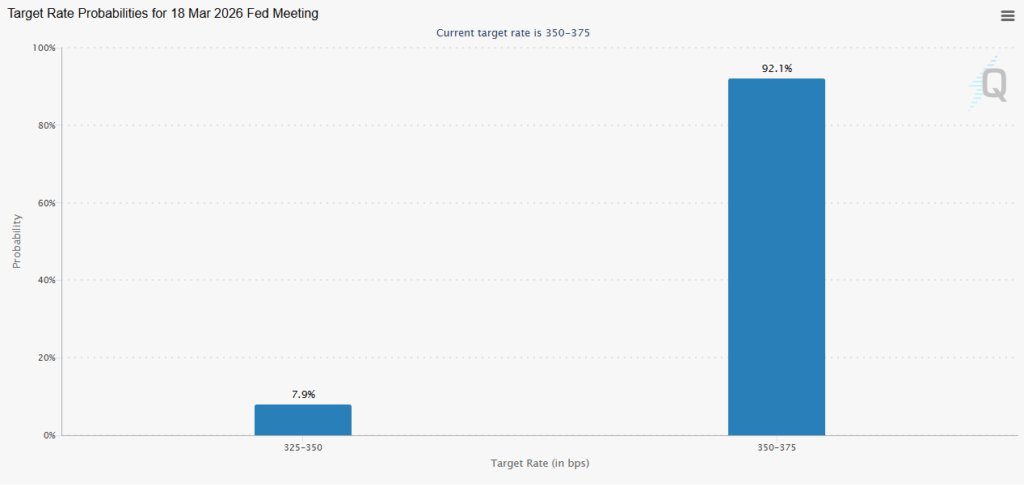

Changes in market expectations of Fed policy are heavily influenced by the latest employment data. Before the January jobs report was released, the probability of a 25 basis point rate cut at the March meeting was estimated to be around 40%.

However, after the nonfarm payrolls data showed an increase of 130,000, the chances of the Fed holding rates jumped to over 92%. This shows how sensitive the market is to every major economic data release.

This change in sentiment is also reflected in the CME FedWatch monitoring tool, which market participants use to monitor interest rate expectations. A report from Fortune quoted Schwartz as stating that the latest employment data has changed the market narrative from “no hiring/no firing” to more optimistic.

Follow us on Google News to stay up to date with the latest in crypto and blockchain technology. Check Bitcoin price, usdt to idr and tokenized nvidia stock price through Pintu Market.

Enjoy an easy and secure crypto trading and crypto gold investment experience by downloading the Pintu crypto app via Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- Coingape. FOMC Minutes Drop Tomorrow: Will Crypto Markets Rally Or Face Fed Shock? Accessed on February 18, 2026

- Featured Image: Generated by Ai

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.