Download Pintu App

Will Bitcoin (BTC) Hit Zero? Google Searches Surge Amid Peaking Investor Fears

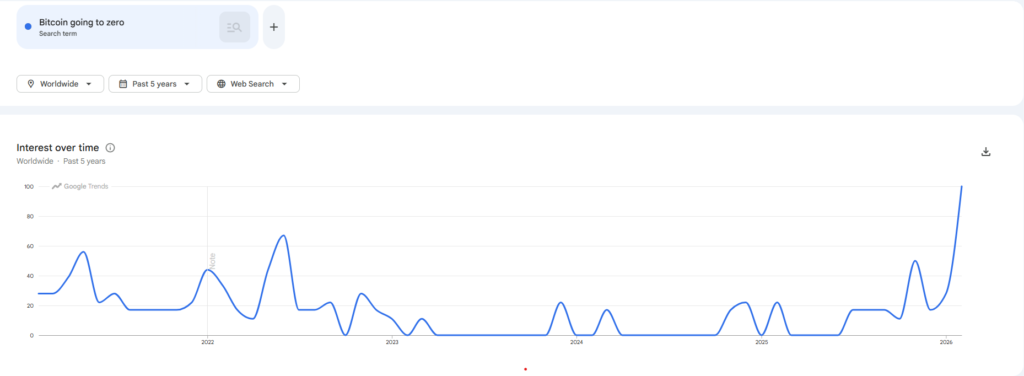

Jakarta, Pintu News – A spike in Google searches with the keyword “Bitcoin going to zero” signals a new wave of concern among crypto investors. This phenomenon comes amid a sharp decline in the price of Bitcoin (BTC), even as large institutions continue to add to their holdings. Global macroeconomic uncertainty and pessimistic narratives from the media are amplifying the negative sentiment in the market.

“Bitcoin Going to Zero” Search Spike and Mass Fear

Google searches for the phrase “Bitcoin going to zero” hit their highest peak since November 2022, just after the FTX collapse that rocked the crypto market. The last five years of Google Trends data shows that global interest in the possibility of Bitcoin (BTC) going to zero has surged again as the price has fallen from a record high of $126,000 on October 6, 2025 to around $66,500.

The nearly 50% drop from the peak triggered panic, reflected by the Bitcoin Fear and Greed Index plummeting to an extreme level of 9, on par with dark times like the Terra and FTX ecosystem crashes. This situation shows how market sentiment is easily affected by price movements and negative news.

This phenomenon is not only happening among retail investors, but has also caught the attention of the media and financial analysts. When FTX froze withdrawals and Bitcoin (BTC) plunged to $15,000 in 2022, similar searches surged. Now, despite the stronger fundamentals of Bitcoin (BTC), mass fear still dominates the public narrative. This shows that crypto market psychology is highly susceptible to rumors and negative sentiment, even when on-chain data and institutional accumulation suggest otherwise.

The difference between ‘Fear’ in 2022 and 2025

According to analysis by crypto intelligence platform Perception, fear in 2022 is driven by internal failures such as the collapse of centralized lenders and major exchanges. However, by 2025, fear is fueled more by macroeconomic factors and amplified by one very vocal pessimistic voice.

Bloomberg’s Mike McGlone has been the central figure constantly voicing gloomy predictions, such as Bitcoin (BTC) will drop to $10,000 and the market will experience a 2008-like crisis. This narrative has been repeated and amplified by various crypto media outlets, creating a snowball effect of fear among investors. Perception notes that McGlone has been the main source of bearish quotes for the past three weeks, further influencing public perception.

Read also: Silver Bar Price 1 Kg Today, Friday, February 20, 2026

The crypto media consistently cited his negative predictions, making the “Bitcoin (BTC) is going to zero” narrative even more massive. As a result, the spike in Google searches reflects not only retail concerns, but also the amplification effect of media coverage. This proves that one dominant voice can shape broad market sentiment, even if it doesn’t always align with fundamental data.

Institutions Accumulate, Retail Panic: Market Sentiment Imbalance

While searches for “Bitcoin going to zero” soar, data shows large institutions continue to add to their Bitcoin (BTC) holdings. Perception highlights that sovereign wealth funds such as Abu Dhabi and large corporations such as Strategy have been consistently buying Bitcoin (BTC) through exchange-traded fund (ETF) products.

This phenomenon indicates a sharp difference between the behavior of institutional and retail investors. When retail was struck by fear, institutions seized the moment for asset accumulation. Perception also found that professional media sentiment has started to recover since February 5, while fear among retailers only peaked in mid-February.

This means that retail fears usually lag 10-14 days behind changes in sentiment in the professional media. While the public is still panicking, the institutional and media narratives have begun to stabilize. This shows that retail and institutional behavior often move in opposite directions, creating opportunities for large investors to take strategic positions.

Follow us on Google News to stay up to date with the latest in crypto and blockchain technology. Check Bitcoin price, usdt to idr and tokenized nvidia stock price through Pintu Market.

Enjoy an easy and secure crypto trading and crypto gold investment experience by downloading the Pintu crypto app via Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- Cointelegraph. ‘Bitcoin going to zero’ searches spike as extreme fear grips crypto market. Accessed on February 20, 2026

- Featured Image: Generated by AI

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.