Download Pintu App

CME Group Ready to Shake Up the Market, 24/7 Crypto Derivatives Trading Coming Soon!

Jakarta, Pintu News – A revolutionary step is being taken by CME Group, the world’s largest derivatives exchange, by announcing the launch of 24/7 crypto derivatives trading. The innovation is scheduled to go into effect on May 29, pending regulatory approval, and is predicted to change the digital asset trading landscape globally.

US Regulators Push Market Transformation Toward Nonstop Trading

US financial authorities, such as the Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC), are currently examining the possibility of implementing unlimited trading hours in the capital market. This move is in response to the reality of an increasingly connected global economy that demands open market access.

Several major exchanges, including Nasdaq and the New York Stock Exchange (NYSE), have also announced plans to expand their trading hours. Nasdaq, for example, will expand trading hours to 24 hours for five days a week, while NYSE is developing a stock and ETF tokenization platform with 24/7 trading features.

This transformation is expected to align the US market with global markets that have already implemented non-stop trading, such as the foreign exchange, gold, and cryptocurrency markets. This will allow market participants to respond to price movements and global news in real-time without having to wait for traditional markets to open.

In addition, the integration of blockchain technology on the NYSE’s new platform will enable multichain settlement and more efficient custody. All these initiatives show that the US capital market is gearing up for the era of rapid digitization and globalization.

Bitcoin to Solana Ready to Trade

CME Group announced that futures and options contracts for digital assets such as Bitcoin (BTC), Ethereum (ETH), Ripple (XRP), and Solana (SOL) will be available for trading non-stop. All trading activity will take place on the CME Globex platform, with only a two-hour weekly maintenance break on weekends.

For transactions that occur on holidays or weekends, the clearing, settlement, and regulatory reporting processes will be carried out on the next business day. This step is also expected to eliminate the “CME gap” phenomenon that has often occurred due to market closures on weekends.

Read also: Bitcoin (BTC) at Zero? Google searches skyrocket, investor fears peak

In addition to these four major digital assets, CME Group has also launched futures contracts for Cardano (ADA), Chainlink (LINK), and Stellar Lumens (XLM) this month. With 24/7 trading, institutional investors can now manage their exposure and risk to various digital assets at any time.

CME Group emphasized that these innovations are in response to a surge in institutional demand. In doing so, CME Group further strengthens its position as a leading derivatives exchange in providing regulated and transparent crypto products.

Institutional Demand Surges

Tim McCourt, Global Head of Equities, FX, and Alternative Products at CME Group, stated that client demand for risk management in the crypto market has reached an all-time high. This is reflected in the notional volume that reached $3,000 trillion last year for crypto derivatives at CME Group.

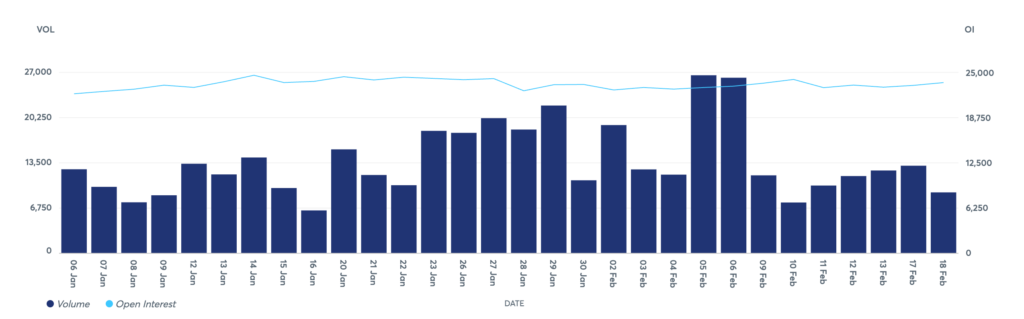

The average daily volume (ADV) for crypto contracts this year reached 407,200 contracts, a 46% increase over the previous year. In addition, average daily open interest also rose 7% to 335,400 contracts, while ADV for futures contracts jumped 47% to 403,900 contracts.

This increase in volume shows that market participants are gaining confidence in regulated and transparent crypto derivatives products. CME Group emphasized that 24/7 access will give investors more flexibility in managing their portfolios and risks.

Market analyst Shaun Edmondson calls CME Group’s move a major breakthrough that will eliminate price gaps on weekends. As such, the crypto market is expected to become more efficient and responsive to global dynamics.

Follow us on Google News to stay up to date with the latest in crypto and blockchain technology. Check Bitcoin price, usdt to idr and tokenized nvidia stock price through Pintu Market.

Enjoy an easy and secure crypto trading and crypto gold investment experience by downloading the Pintu crypto app via Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- Cointelegraph. CME Group may soon offer 24/7 crypto derivatives trading: Report. Accessed on February 20, 2026

- Coingape. CME Group To Launch 24/7 BTC, ETH, XRP, SOL Futures Trading On May 29. Accessed on February 20, 2026.

- Featured Image: Blockworks

Berita Terbaru

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

Kegiatan perdagangan aset crypto dilakukan oleh PT Pintu Kemana Saja, suatu perusahaan Pedagang Aset Keuangan Digital yang berizin dan diawasi oleh Otoritas Jasa Keuangan serta merupakan anggota PT Central Finansial X (CFX) dan PT Kliring Komoditi Indonesia (KKI). Kegiatan perdagangan aset crypto adalah kegiatan berisiko tinggi. PT Pintu Kemana Saja tidak memberikan rekomendasi apa pun mengenai investasi dan/atau produk aset crypto. Pengguna wajib mempelajari secara hati-hati setiap hal yang berkaitan dengan perdagangan aset crypto (termasuk risiko terkait) dan penggunaan aplikasi. Semua keputusan perdagangan aset crypto dan/atau kontrak berjangka atas aset crypto merupakan keputusan mandiri pengguna.